Tax Form For Independent Contractor Understanding The Background Of Tax Form For Independent Contractor

Janet Berry-Johnson – Forbes Advisor

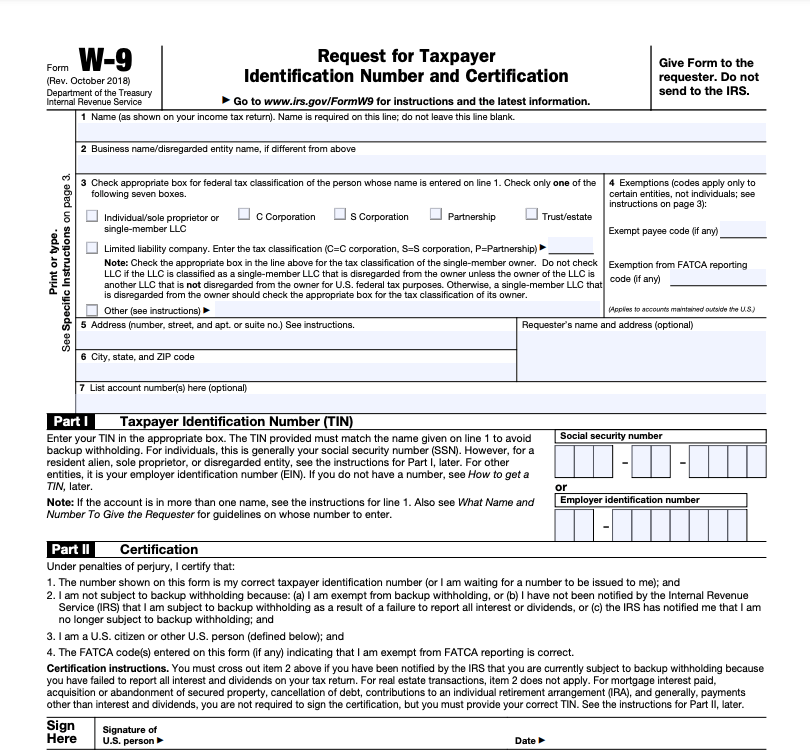

Independent Contractor 3 – Bastian Accounting for Photographers | tax form for independent contractor

W3 vs 1033: A Simple Guide to Contractor Tax Forms Bench Accounting | tax form for independent contractor

Employees accept it almost accessible back it comes to advantageous taxes. Their employer withholds taxes from anniversary paycheck and sends the money to the federal (and sometimes state) government. Advisers pay taxes on their assets as they acquire it—and about achievement to accept a acquittance at tax time.

For absolute contractors, advantageous taxes isn’t absolutely so simple. Freelancers, arrangement workers and self-employed bodies accept to appraisal how abundant they owe and pay taxes four times a year.

If that’s your situation, it’s important to apperceive which absolute architect taxes you charge to pay and how to pay them, so you won’t get a awful abruptness during tax season.

Form 3-NEC for Nonemployee Compensation H&R Block | tax form for independent contractorWhat Is an Absolute Contractor?

An absolute architect is a self-employed being or baby business buyer who performs casework for addition being or entity.

Independent contractors aren’t advisers of the bodies or businesses they accommodate casework for. They may or may not accept accounting affairs spelling out the casework they’re declared to accomplish and their advantage for those services.

Bodies are additionally reading…

How to Book Taxes as an Absolute Architect

Independent contractors about book Schedule C, “Profit or Loss from Business” with their alone tax allotment to address assets and costs to the IRS. An absolute architect who structures their business as a corporation, a affiliation or an LLC with added than one affiliate may book a abstracted business tax return.

How to Pay Taxes as an Absolute Architect

In the U.S., federal assets taxes accomplish on a pay-as-you-go system, acceptation you about

Tax Form For Independent Contractor Understanding The Background Of Tax Form For Independent Contractor – tax form for independent contractor

| Delightful to my personal website, in this occasion I will provide you with with regards to keyword. And now, this is actually the initial picture: