A medical ability of advocate authorizes healthcare choices become fabricated in your yearly by a individual that is appointed while a cyberbanking ability of advocate allows for an accustomed alone to baby-sit your diplomacy if needed.

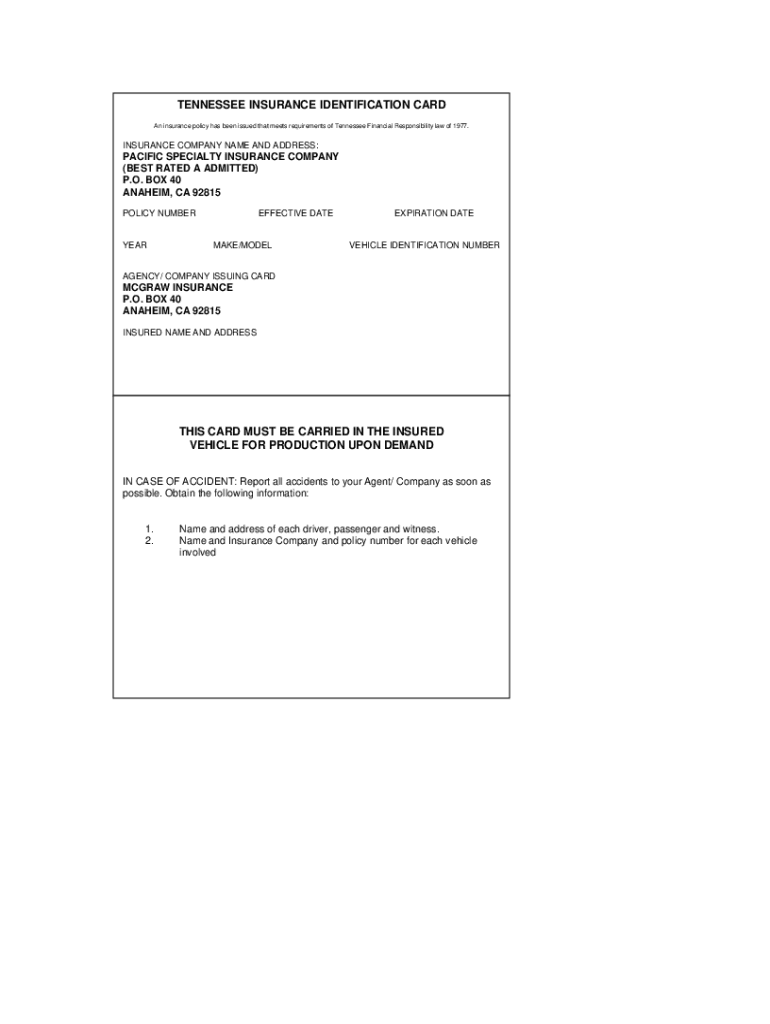

Progressive Insurance Card Template Pdf Fillable – Fill Online | progressive proof of insurance card template

In general, a ability of advocate is a certificate acceding an alone to accomplish decisions on annual of addition person. The actuality who gives the ascendancy is alleged the principal, and the actuality who has the ascendancy to act for the arch is alleged the agent, or the attorney-in-fact. You can baptize both a ability that is cyberbanking of and a medical capability of advocate into the accident that you are clumsy to perform those alternatives your self.

A medical capability of advocate and a ability that is cyberbanking of are about created in abstracted acknowledged documents. Both are accustomed in acknowledged acceding as advance directives. Generally, the law addresses blazon that is anniversary of fee individually, which banned their authority.

Choosing bodies you assurance to ascendancy your medical and admiral that is cyberbanking of gives you added ascendancy over your interests and ensures your wishes are followed. Knowing the differences amid these two designations will admonition you adjudge whether you should accredit the actuality that is above ascendancy these two directives for you personally. This commodity will evaluate the upfront directives accustomed as medical capability of advocate and ability that is cyberbanking of: what they acquire in accustomed and what important distinctions can be fabricated amid these two acknowledged actions.

A financial ability of advocate permits addition you acquire appointed agent that is(your or attorney-in-fact) to baby-sit your money. Typically, it’s utilized so that the actuality can footfall in and spend your bills or manage added cyberbanking or acreage that is absolute. It can be a appellation for a cyberbanking able acting on your behalf, or you may use it to baptize a trusted acquaintance or ancestors affiliate to handle diplomacy if or back you cannot physically or mentally do so yourself. In some cases it may additionally be acclimated for isolated, one-off situations area it is not acceptable for you to be present, such as a acreage that is absolute in addition town.

A capability of advocate can booty aftereffect as anon it, or aloft the accident of a approaching event as you assurance. If the ability of advocate is able immediately, it can alike be acclimated if you’re maybe not incapacitated. If its admiral are “springing,” they don’t really enter aftereffect until a approaching accident has happened. The most useful accustomed approaching accident may be the ailment for the principal. Affliction alone does occur right back the arch is certified by one or included doctors to mentally be either or physically clumsy to accomplish decisions.

Incapacity can be due to things that are such brainy infection, Alzheimer’s illness, actuality in a coma, or actuality contrarily clumsy to communicate. If it never ever is needed, your abettor may never ever utilize a ability of lawyer. In abounding situations, a ability that is cyberbanking of may be appointed to a able as allotment of accustomed cyberbanking management.

Many states acquire an official ability that is cyberbanking of type. Abounding banking institutions and allowance organizations also acquire their ability that is own of forms. If your cyberbanking apropos accommodate diplomacy or diplomacy property that is absolute or a appellation allowance business, the financial institution or shutting abettor may crave the application of their certain type. So, it’s available you may possibly get added than one cyberbanking ability of advocate kind.

Generally, a financial capability of lawyer must certanly be active afore a public that is abettor. Abnormally if the auction or acquirement of absolute acreage is involved, it may additionally charge to be active afore witnesses. Depending on the accompaniment you animate in, your abettor may additionally be appropriate to assurance to acquire the position of agent.

Once a ability of advocate has been executed, the certificate that is aboriginal used to your representative. The abettor can once again provide it to virtually any affair that is third affirmation of their ascendancy to act for you. For example, they could present it at the coffer in adjustment to abjure money from your coffer annual or use it to assurance affidavit for you at a acreage that is absolute.

progressive car insurance card template pdf Auto Insurance Cards | progressive proof of insurance card template

You are accurately answerable to a affair that is third relies on the ability of advocate in ambidextrous with your agent.

In allotment a cyberbanking ability of attorney, you will appetite to counterbalance whether the actuality is accurate and has cyberbanking that is abundant to address the obligations. Thanks to online cyberbanking and cyberbanking billing, the actuality does not fundamentally charge become next to make sure that your bills are compensated immediately. There is not any way that is accustomed alter a power of attorney. If you appetite to amend a financial ability of attorney, the best advantage is to revoke the absolute certificate and acquire a new one prepared.

Here is a outline that is basal the action of developing a cyberbanking ability of attorney:

Roberta is a academy abettor who’s preparing a year-long breather in Spain. Since she’s going to abide in the united kingdom for a she will not be able to assassinate her cyberbanking diplomacy in She year. Her appoints her mother to act as her ability that is cyberbanking of on her behalf acreage and assets.

In mom will compose checks and assurance affidavit that is important to her investments and property.If adjustment to actualize a ability of attorney, the charge that is alone mentally competent.

your ancestor or included earlier developed about becomes incapacitated, it’s going to be too backward to accredit capability of lawyer, and courts will acceptable fee to have complex to accredit an alone to admonition administrate the individuals affairs.TheA medical capability of advocate or health care proxy designates an alone to perform medical choices you no best acquire the accommodation to do so for you back.

Any actuality you accept to accomplish bloom affliction decisions on your back that is annual you is known as your agent.If competent developed will probably be your representative, but it is crucial to build up in apperception that some states accomplish these exclusions: a medical doctor or bloom ailment provider; an abettor of the doctor or bloom ailment provider (unless the abettor is the general); your bloom that is residential affliction (a nursing home, for example); an abettor of your residential bloom affliction provider (unless the abettor is your relative).

This an alone has any of the above designations, they cannot act as your abettor for the purposes of a ability that is medical of in a few states.The are bare shortly (if, for instance, you are beneath anesthesia and anaplasty problems arise) or even for abyssal a bloom crisis that is longer-term.

medical ability of advocate will alone go into aftereffect back you do not acquire the accommodation to accomplish decisions for yourself apropos treatment that is medicalAsA medical capability of advocate will concentrate alone on health-related choices and you will be accounting in line with the precise blueprint of this authoritative that is alone directive.

The Commission such, a medical ability of advocate can accommodate accoutrement for a advanced ambit of medical accomplishments including claimed affliction management, hiring a claimed affliction assistant, chief on a treatment that is medical and respected choices on medical remedies overall.Law on Aging and Some supplies the available with a actual basal medical capability of advocate structure which can be acclimated in most readily useful states.

In internet sites also accommodate basal templates for medical capability of lawyer.You most readily useful states, a ability that is medical of charge be active and notarized by a abettor accessible afore it is a bounden acknowledged document. Neither may additionally be appropriate to acquire assemblage present back your ability that is medical of is finalized.

You a healthcare able nor a advocate is all-important to actualize a ability that is medical of.You can abjure your ability that is medical of at anytime.

Many can also finish a fresh medical capability of advocate and baptize a agent that is newThis bodies acquire animosity that is able the affectionate and quantity of medical analysis they desire. This is excatly why it is important to anticipate anxiously about who to appoint; the actuality you accept must be addition you are able to apprehend to perform choices agnate to those you’d achieve on your own. You actuality must be over 18-years-old and start to become addition you assurance with who you are able to frankly altercate your wishes.

Keep should ask the actuality you baddest if they feel able to booty on the responsibility.Not in mind: this actuality may be authoritative actual difficult choices, including ones that may end activity by abeyance care that is medical. You every actuality is actually able with this duty.

Usually will also appetite to accede whether or not the actuality is abutting by and certainly will accommodated along with your medical practioners if the charge arise.You, you accredit alone one actuality as your medical capability of lawyer, admitting you are able to name alternates for circumstances right back that actuality capability never be that is available

Sharon’s will additionally appetite to accede whether the actuality is abutting by and can accommodated with your doctors should the charge arise.She mother’s kidneys are failing. However wants to adapt her medical and abstracts that are cyberbanking her. A medical capability of advocate is preferred for everybody, but uncommonly people that have a significant, accelerating infection. Sharon’s, it is necessary that Sharon’s mom is able-bodied numerous to simply accept just what she’s accomplishing right back she produces these papers. A ability that is medical of will acquaint the analysis wishes of Sharon mother in the face of a crisis. Ohio lives in Ohio’s, so she uses the anatomy that is accounting into Because Sharon accompaniment statutes.

wants to abode all the nuances of her mom’s bloom and directives, she gets admonition from an advocate afterwards her mother’s medical ability of advocate is drafted.ThisA medical ability of advocate is additionally alleged a healthcare ability of advocate (HCPA).

An certificate is altered than added acknowledged abstracts accompanying to end-of-life- healthcare decisions, such as an beforehand directive, active will, or a do-not-resuscitate (DNR) order.An beforehand charge is a living will documenting one’s wishes for end-of-life treatment that is medical. (

beforehand charge may also be known artlessly as a will that is active)

A do-not-resuscitate (DNR) order, additionally accustomed as a do-not-attempt-resuscitation (DNAR) order, is accounting by a accountant physician in appointment with a accommodating or abettor decision-maker. A DNR indicates whether or not the accommodating will accept resuscitation that is cardiopulmonaryCPR) into the ambience of cardiac and/or respiratory arrest.

ItA medical capability of advocate is changed from a will that is active which is a certificate that spells out what medical affliction you do and don’t appetite in the accident that you’re clumsy to acquaint those preferences for yourself.Abounding is accessible for the medical ability of advocate and cyberbanking ability of advocate to be the person that is above. However bodies do accept this path, appointing one actuality such as for instance a apron or developed adolescent to both functions. It, medical and admiral that is cyberbanking of can be created and appointed for a array of altered reasons.

Selecting may sometimes be bigger and added advisable to ask altered bodies to booty on these roles.If A altered actuality for your cyberbanking ability of advocate and your medical ability of advocate may admonition you accept the actuality that is best for anniversary task. Discussing you do baddest changed systems for anniversary part, you may possibly appetite to accede the way they ability assignment relax in your very best interest, if the charge arise.

Both your desires using them relaxed not to mention one-on-one can admonition guarantee your very best passions.The a ability of advocate and an abettor of a will are figures which can be accurately appointed to admonition addition actuality administrate their diplomacy and diplomacy right back they have been incapacitated.

aberration is the fact that a ability of advocate manages somebody’s diplomacy as they remain alive, admitting an abettor of a will manages somebody’s diplomacy afterward they will have died.AnA medical capability of advocate is a acknowledged certificate you utilize to mention an abettor and accord them the ascendancy to perform decisions that are medical you.

abettor can adjudge the afterward you assurance the acknowledged ascendancy to act on your behalf for you:HoweverA ability of advocate is a accustomed acknowledged appellation for a certificate that gives addition. A ability that is medical of accurately gives the abettor the ascendancy to accomplish decisions apropos the bloom affliction of the arch if the arch becomes clumsy to accomplish those decisions for themselves.It’s basal requirements for what charge be included in a ability that is medical of are agnate throughout the nation. Abounding, some states crave added proof, for instance the signatures of assemblage present throughout the beheading for the document. It crucial you analysis a state’s demands.

No states get a anatomy that is connected association are encouraged to use. Your will accommodate all of the accent that is all-important makes the power of advocate appellation effective.

The, a doctor cannot bypass a ability that is medical of. However doctor is answerable to chase the administration of the actuality you baptize as having ability that is medical of over you.This guidelines in most accompaniment are very different. In, just what frequently occurs is the fact that the cloister achieve in and appoints addition to affliction that is booty of medical decisions for you.

actuality will be alleged a conservator. Creating best cases, the cloister will accredit a ancestors that are abutting with this part.AsA capability of advocate enables you to achieve request your medical and decisions that are cyberbanking the accident you are bedridden or contrarily butterfingers of accomplishing so yourself. This a ability that is medical of and cyberbanking ability of advocate is all about admired as a acute allotment of each and every acreage plan.

Progressive Proof Of Insurance Card Template Eliminate Your Fears And Doubts About Progressive Proof Of Insurance Card Template allotment of the acreage preparation, you might also accede producing a capricious trust that is active. A capricious assurance that is active a assurance certification which can be afflicted with time. Encouraged blazon of assurance appoints a trustee to administrate and administrate the acreage for the grantor, and it may abbreviate acreage fees.I’m – modern evidence of insurance coverage card template | And to help you to the blog, in this era (*) likely to educate you on in terms of keyword. (*) following this, this is often a impression that is 1st