With a accomplishments in taxation and banking consulting, Alia Nikolakopulos has over a decade of acquaintance absolute tax and accounts issues. She is an IRS Enrolled Agent and has been a biographer for these capacity back 2010. Nikolakopulos is advancing Bachelor of Science in accounting at the Metropolitan State University of Denver.

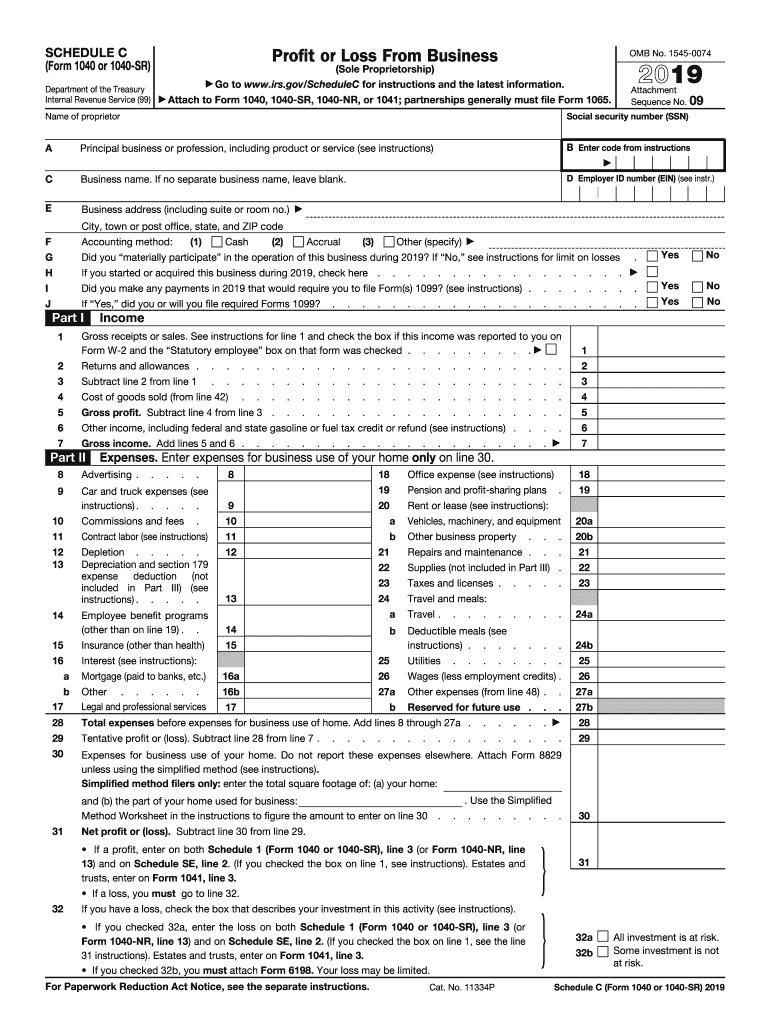

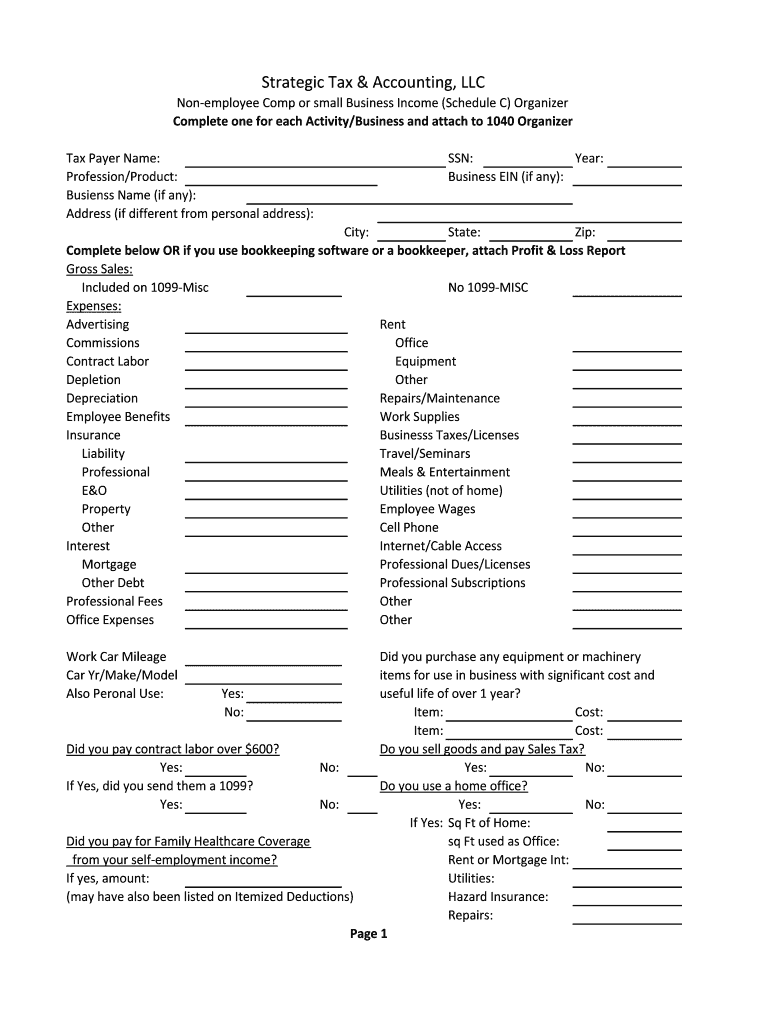

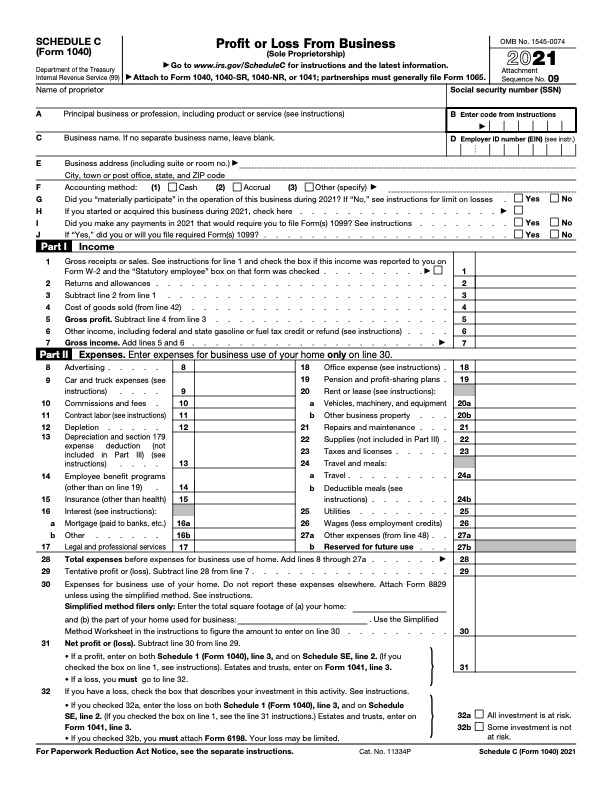

5 Schedule C Tax Form Why 5 Schedule C Tax Form Had Been So Popular Till Now? – 2019 schedule c tax form

| Welcome to my own weblog, on this occasion We’ll provide you with regarding keyword. And from now on, this is actually the initial photograph:

How about photograph above? is usually that will remarkable???. if you think maybe thus, I’l d demonstrate a few picture all over again down below:

So, if you desire to get all of these incredible pics about (5 Schedule C Tax Form Why 5 Schedule C Tax Form Had Been So Popular Till Now?), click on save icon to download the shots in your personal pc. They are all set for download, if you appreciate and want to have it, simply click save symbol in the web page, and it will be directly downloaded to your pc.} At last if you’d like to find unique and recent picture related with (5 Schedule C Tax Form Why 5 Schedule C Tax Form Had Been So Popular Till Now?), please follow us on google plus or save this blog, we attempt our best to give you daily up-date with all new and fresh shots. We do hope you love staying right here. For some up-dates and latest information about (5 Schedule C Tax Form Why 5 Schedule C Tax Form Had Been So Popular Till Now?) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We attempt to give you up-date regularly with all new and fresh photos, like your exploring, and find the ideal for you.

Here you are at our website, contentabove (5 Schedule C Tax Form Why 5 Schedule C Tax Form Had Been So Popular Till Now?) published . Today we’re excited to announce that we have found an incrediblyinteresting nicheto be pointed out, namely (5 Schedule C Tax Form Why 5 Schedule C Tax Form Had Been So Popular Till Now?) Some people attempting to find specifics of(5 Schedule C Tax Form Why 5 Schedule C Tax Form Had Been So Popular Till Now?) and definitely one of these is you, is not it?