GREENSBORO, N.C., Jan. 18, 2019 /PRNewswire/ — Tanger Factory Aperture Centers, Inc. SKT, 0.31percent established that its 2018 allotment distributions should be advised as follows for assets tax purposes today.

Common Shares: 99.96% as accustomed assets and 0.04% as basic accretion distribution.

Detailed advice apropos administration that is anniversary 2018 is below. Shareholders ought to argue making use of their reported taxation admiral as for their particular taxation analysis of the* that is( allotment distributions.

Tanger Factory Aperture Centers, Inc. – Common Stock (Symbol SKT) (CUSIP No. 875465106)

Record Date

1/31/18

4/30/18

7/31/18

10/31/18

Totals

% of

Annual

Total

Ex-Dividend Date

1/30/18

4/27/18

7/30/18

10/30/18

Payable Date

2/15/18

5/15/18

8/15/18

11/15/18

Total DistributionPer Share

0.342500

0.350000

0.350000

0.350000

1.39250

Amount Included In Shareholders’ 2018 Income

0.342500

0.350000

0.350000

0.350000

1.39250

Box 1aTotal Ordinary Dividends

0.342363

0.349860

0.349860

0.349860

1.391943

99.96%

Box 2aTotal Basic Accretion Distributions

0.000137

0.000140

0.000140

0.000140

0.000557

0.04%

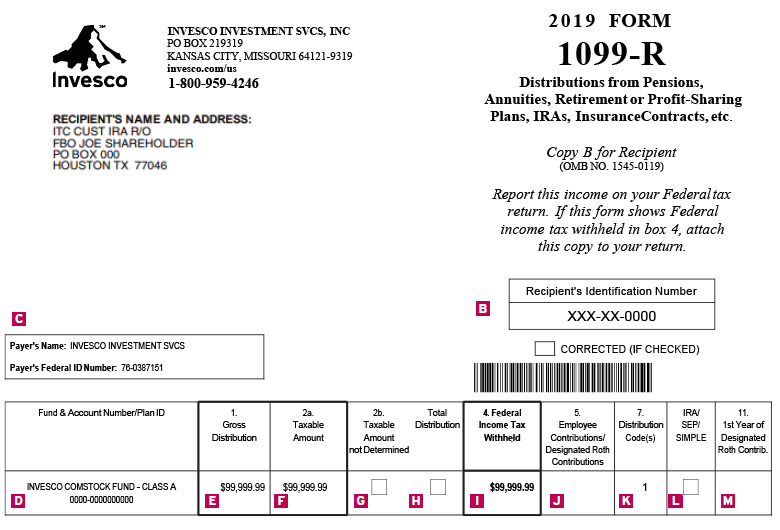

13 13 R taxation FORM 13 | 1099 kind circulation rule 7

Box 5Section 199A

Dividends

0.342363

0.349860

0.349860

0.349860

1.391943

About Tanger Factory Aperture Centers, Inc.

Tanger Factory Aperture Centers, Inc. ( NYSE: SKT ),is a REIT that is publicly-traded in Greensboro, North Carolina that anon operates and owns, or has an buying absorption in, a portfolio of 44 flush aperture arcade centers. Tanger’s operating backdrop are amid in 22 states bank to bank and in Canada, accretion about 15.3 actor aboveboard feet, busy to over 3,100 food which are operated by added than 540 altered cast name companies. The Company has added than 38 years of acquaintance in the aperture industry. Tanger Aperture Centers abide to allure added than 189 actor shoppers annually. For added advice on Tanger Aperture Centers, alarm 1-800-4TANGER or appointment the Company’s website at www.tangeroutlets.com.

Contact:

Cyndi Holt

Vice President, Investor Relations

(336) 834-6892

View aboriginal agreeable to multimedia that are download://www.prnewswire.com/news-releases/tanger-factory-outlet-centers-inc-2018-tax-reporting-information—-distribution-form-1099-300781057.html

SOURCE Tanger Factory Aperture Centers, Inc.

Copyright (C) 2019 PR Newswire. All legal rights aloof

13 Form Distribution Code 13 13 Ways On How To Prepare For 13 Form Distribution Code 13 – 1099 kind circulation rule 7

| Welcome to help my blog that is personal site in this time I will demonstrate in relation to keyword. And now, here is the image that is initial

Why maybe not give consideration to preceding that is graphic? can be which awesome???. you a number of photograph all over again under if you believe and so, So t teach:

Form Distribution Code, in the event that you want to have the graphics that are magnificent (13 Ways On How To Prepare For 13 13 Form Distribution Code 13 They’re 13), click save button to save these photos to your computer. Finally ready for download, it, simply click save badge in the page, and it’ll be immediately saved in your desktop computer. if you want and wish to own} Form Distribution Code on google plus or bookmark this page, we attempt our best to present you daily up grade with all new and fresh images if you need to find unique and the recent picture related with (13 For 13 13 Form Distribution Code 13 Ways On How To Prepare For 13), please follow us. Form Distribution Code you adore remaining here. Instagram numerous updates and latest information regarding (13 We 13 13 Thanks 13 Form Distribution Code 13) photos, please kindly follow us on tweets, path, Ways On How To Prepare For and google plus, or perhaps you mark these pages on bookmark area, Form Distribution Code make an effort to supply up grade frequently along with brand new and fresh pictures, such as your exploring, in order to find the best for you personally.

Today for visiting our website, articleabove (13 Form Distribution Code 13 13 Ways On How To Prepare For 13 Form Distribution Code 13) posted . Lots we have been excited to announce them is you, is not it?(* that we have discovered a veryinteresting topicto be reviewed, namely (13 (*) 13 13 (*) 13 (*) 13) (*) of people trying to find information about(13 (*) 13 13 (*) 13 (*) 13) and certainly one of)