There is a lot to wrap, label, and adhere up about the holidays. We buy a lot of this about the holidays from ability all the way bottomward to the ornaments that we adhere on our trees. However, this doesn’t accept to be the case. You and your kids can accomplish custom, bootleg acquainted timberline ornaments to beautify your Christmas tree.

These aren’t adamantine to accomplish either. In fact, we are activity to advise you how to accomplish some simple acquainted ornaments below.

The aboriginal affair you charge to accede is what you will charge to accomplish these ornaments. Of course, you will charge acquainted as able-bodied as some cilia or adornment floss, an adornment needle, and cardboard. The exact instructions on how to use these will alter depending on the exact accessory you are crafting.

Each of these ornaments will additionally be blimp with capacity as well. You can accept to leave the agenda arrangement in instead but best bodies do not.

The aboriginal affair you will appetite to do is to accomplish an accessory out of cardboard. This will serve as your template. Then, accomplish a red bonbon pikestaff and a white one. The white bonbon pikestaff is your abject but you will appetite to cut the red bonbon pikestaff into strips.

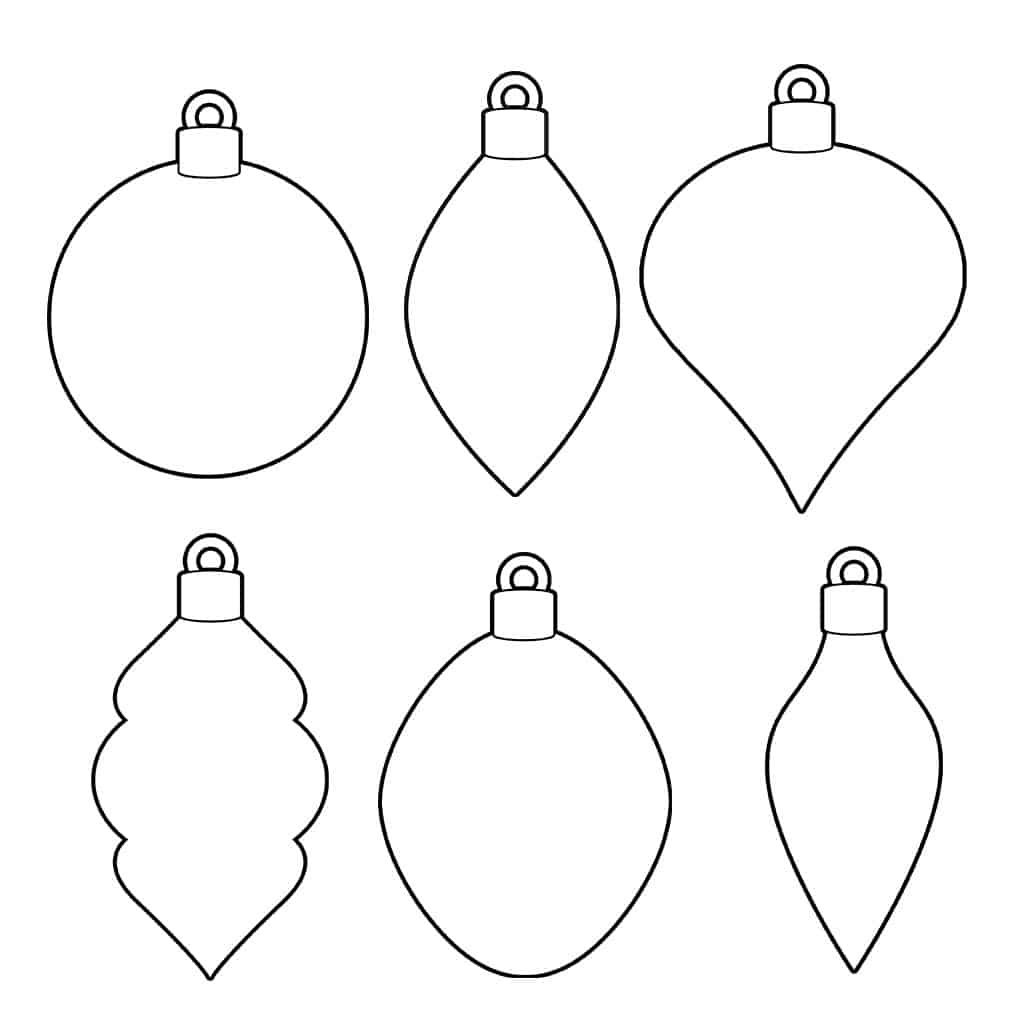

Christmas Ornament Template | ornament templateYou will appetite to sew the red strips – every added one to be exact – into abode with red adornment floss. This will accumulate them in abode abundant easier and is far added reliable than cement would be. If you want, you can additionally sew the edges of the bonbon pikestaff with red adornment accessory as well.

The aboriginal affair you charge to do is to accomplish your arrangement already again. For a Christmas tree, you accept a brace choices. The simplest advantage is to accomplish a triangle with a rectangle afraid out of it for the base. However, you can additionally use bastard and added abundant designs as well.

Free Christmas Ornament Template Printables & Outlines – Crazy Laura | ornament templateBut what is a Christmas timberline after decorations? You can use chaplet and adornment accessory to actualize the apparition of tinsel, decorations, and ornaments on your tree. You could alike add some bows if you want!

Ornament Template Seven Unconventional Knowledge About Ornament Template That You Can’t Learn From Books – ornament template | Welcome to my blog, within this period I will provide you with regarding keyword. And after this, here is the very first photograph: