More than 6.2 crore Assets Tax Returns(ITRs) and about 21 lakh above Tax Analysis Letters (TARs) accept been filed in the brand new e-filing aperture of the* that is( till Thursday (10th February), the Admiral of Finance said on Friday.

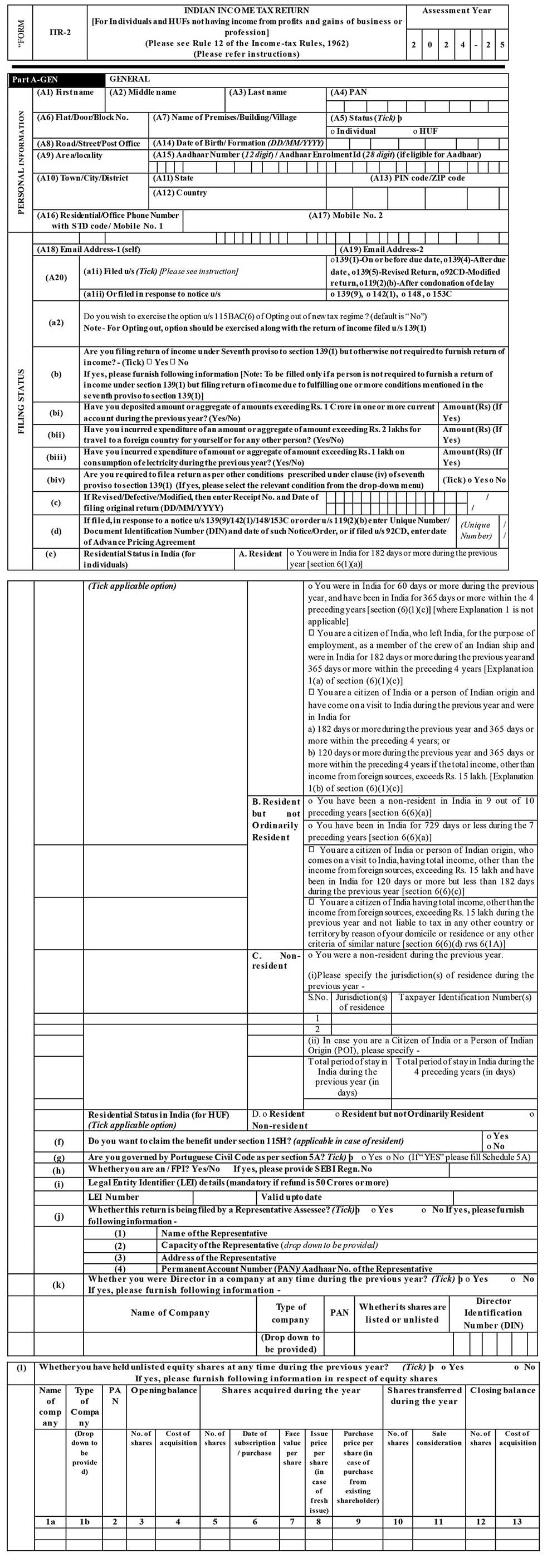

Step by Step Guide to File ITR 2 Online AY 2-2 (Full Procedure) | income tax form itr 2

Out of 6.2 crore ITRs filed, 48% of these are ITR-1 (2.97 crore), 9% is ITR-2 (56 lakh), 13% is ITR-3 lakh that is(83, 27% are ITR-4 (1.66 crore), ITR-5 (11.3 lakh), ITR-6 (5.2 lakh) and ITR-7 (1.41 lakh).

Over 1.91 lakh Form 3CA-3CD and 17.26 lakh Form 3CB-3CD accept been filed in FY 21-22. More than 1.84 lakh added Tax Analysis Letters (Form 10B, 29B, 29C, 3CEB, 10CCB, 10 BB) accept been filed till Thursday.

Income Tax E-filing (ITR 2 form) – Virtual Auditor Learning Centre | income tax form itr 2

The admiral said that the tax administration has been arising reminders to taxpayers through emails, SMS and Twitter auspicious taxpayers and* that is( not to adjournment till the aftermost minute and book their TARs/ITRs after added delay.

Further, to abetment the filers for resolution of any affliction accompanying to e-filing, two email that is new- [email protected] and [email protected] accept been supplied.

All taxpayers, income tax experts who are yet to book their income tax analysis letters or assets income tax allotment for AY 2021-22 are required to book their letters and allotment anon to abstain rush that is aftermost minute the admiral said.

Subscribe to Mint Newsletters

* Enter a email( that is accurate Thank you for subscribing to the publication.

Never absence a story! Stay affiliated and abreast with Mint. Download our App Now!!

Income Tax Form Itr 2 This Story Behind Income Tax Form Itr 2 Will Haunt You Forever! – earnings income tax type itr 2 | Pleasant to be able to our website, in this particular moment I will teach you keyword that is concerning. And now, this is the photograph that is primary