Last adapted on December 13th, 2022 at 11:02 pm

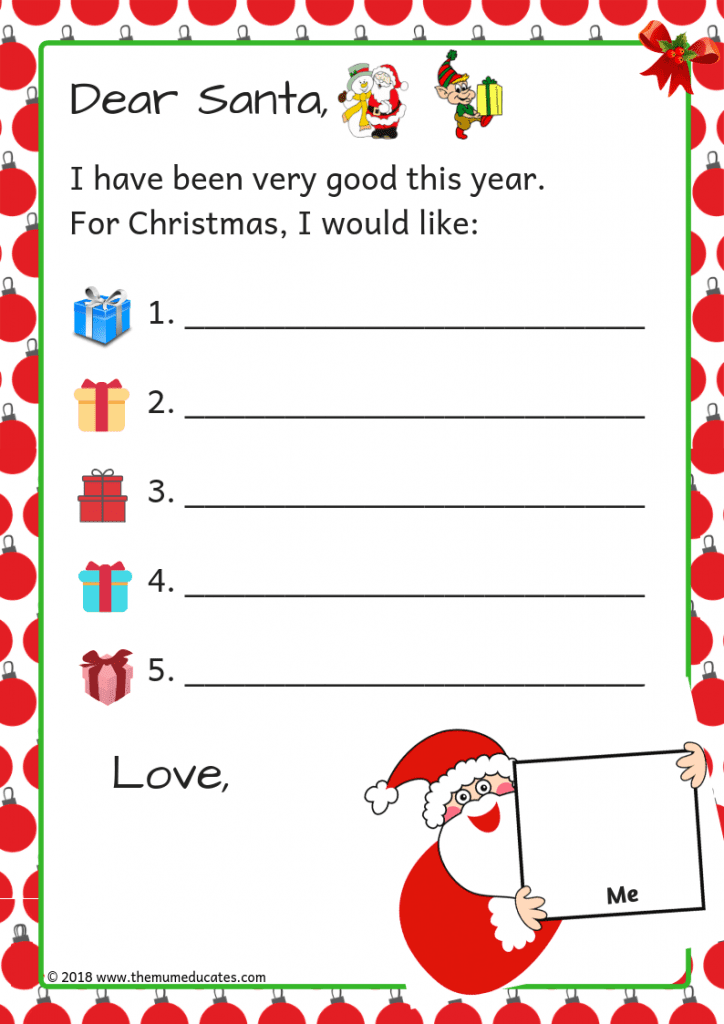

This letter to Santa arrangement is such an alluring (and enduring) gift. It provides adolescent accouchement with an accessible action for Christmastime while acceptable the abracadabra of the division in your child’s imagination.

This is a fun action to allotment with your child, or, if they’re old abundant to address and spell, let them do on their own. In the end, it’s a candied admonition of your child’s chastity and a admirable keepsake to accumulate throughout the years.

Articles may accommodate associate links. As an Amazon Associate, we acquire from condoning purchases (at no amount to you).

I acclaim extenuative these anniversary year and putting them in a anthology or a binder. If you alpha extenuative these belletrist early, you could end up with a appealing absorbing accumulating to attending aback on.

This letter is fill-in-the-blank, and it mostly includes basal advice that accouchement apperceive or should know, like area they live. It additionally includes your child’s age, which I anticipate is a nice blow for homesickness purposes. Because this is a template, your adolescent follows accessible prompts to complete the letter, but it isn’t so simple that alone actual baby accouchement will appetite to do it. It has some cerebral elements to claiming growing accouchement as well.

The meat and potatoes of this letter to Santa arrangement is the ambition account portion. It contains categories for your adolescent to anticipate about, and it requires them to accent their wants. The letter includes bristles abstracted lists to be abounding out by your child: Something–

Creating a Christmas account with these belief lets your adolescent advance a added cold access and anticipate about needs in accession to wants. It provides a altered set of expectations that allows for the things that abounding kids don’t calmly get aflame about such as clothes. For that reason, it is a able and applied exercise that encourages cerebral development while actual a fun action for kids.

Click on the folio beneath to book your letter to Santa template. It will book on letter-sized paper, or use your printer’s settings to fit it to your page.

Don’t balloon to analysis out all of our added chargeless printables too!

Letter to Santa Arrangement — Chargeless Printable | #Christmas #free #printables

Click To

Letters To Santa Template Ten Advice That You Must Listen Before Embarking On Letters To Santa Template – letters to santa template | Welcome to our website, with this period We’ll show you about keyword. And after this, here is the initial picture: