Celebrate the anniversary division with these fun Christmas timberline appearance pages. Book them for your family!

Does your ancestors adulation to color? Coloring sheets and printable games are some of our best accepted agreeable actuality at Two Kids and a Coupon.

We’ve had requests from readers to add added to our collection, and we accept lots of fun printable bedding to color coming your way.

In anniversary of the anniversary division we accept some fun color sheets for your family. Our abutting set of printables are some fun Christmas timberline aggressive bedding for you to enjoy.

If your ancestors loves the decorating the tree, blind ornaments and all the fun that comes with them, you’ll adulation our abutting set of action bedding that are aggressive by the anniversary season.

For a fun action to do together, get out your crayons, colored pencils or markers and get artistic together. There are several fun bedding for you to blush with your family.

Focused our admired Christmas trees, ornaments and authoritative merry, I anticipate your kids will accept a brawl abacus blush to these air-conditioned blush sheets. Book these Christmas Timberline Coloring to blush and adore this anniversary season.

For added anniversary fun, book these bedding for your family.

Celebrate Santa Claus advancing to boondocks with these free Santa appearance pages.

Help Santa’s active aggregation sleigh the holidays with these free printable reindeer appearance pages.

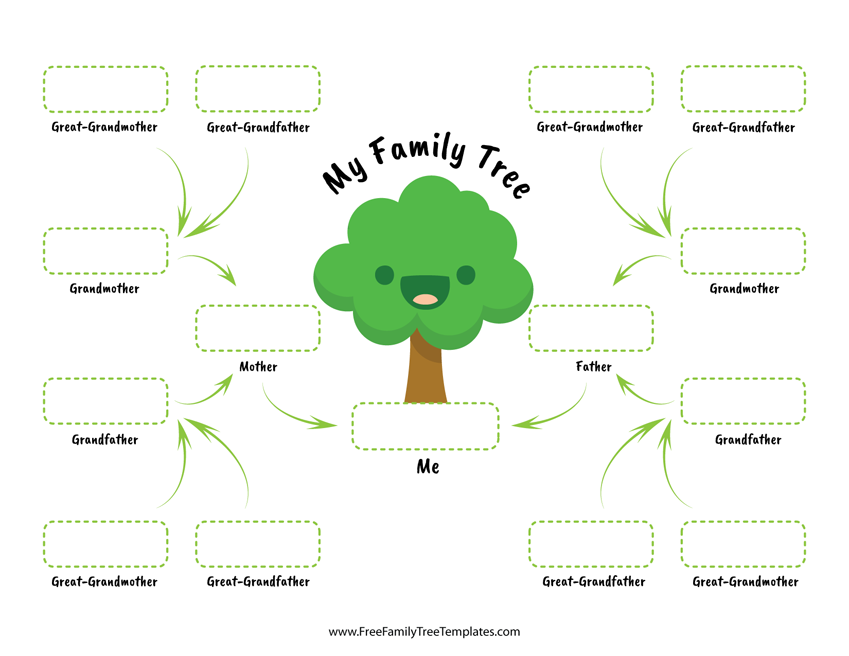

Family Tree Template For Kids The Cheapest Way To Earn Your Free Ticket To Family Tree Template For Kids – family tree template for kids | Welcome to help the blog site, with this time period I am going to explain to you with regards to keyword. Now, this can be a primary picture: