Kohl’s has a new Friends & Ancestors Sale including Men’s Themed Socks 12-packs for alone $7.49 (reg. $24.99), analogous ancestors pajamas for 60% off (before the coupon!), up to 60% off jewelry, sweaters starting at $18.75, 40% off pajamas (before the coupon), funny anniversary tees starting at $5.99, up to 50% off toys, up to 50% off Under Armour, Nike, Adidas and Champion and more!

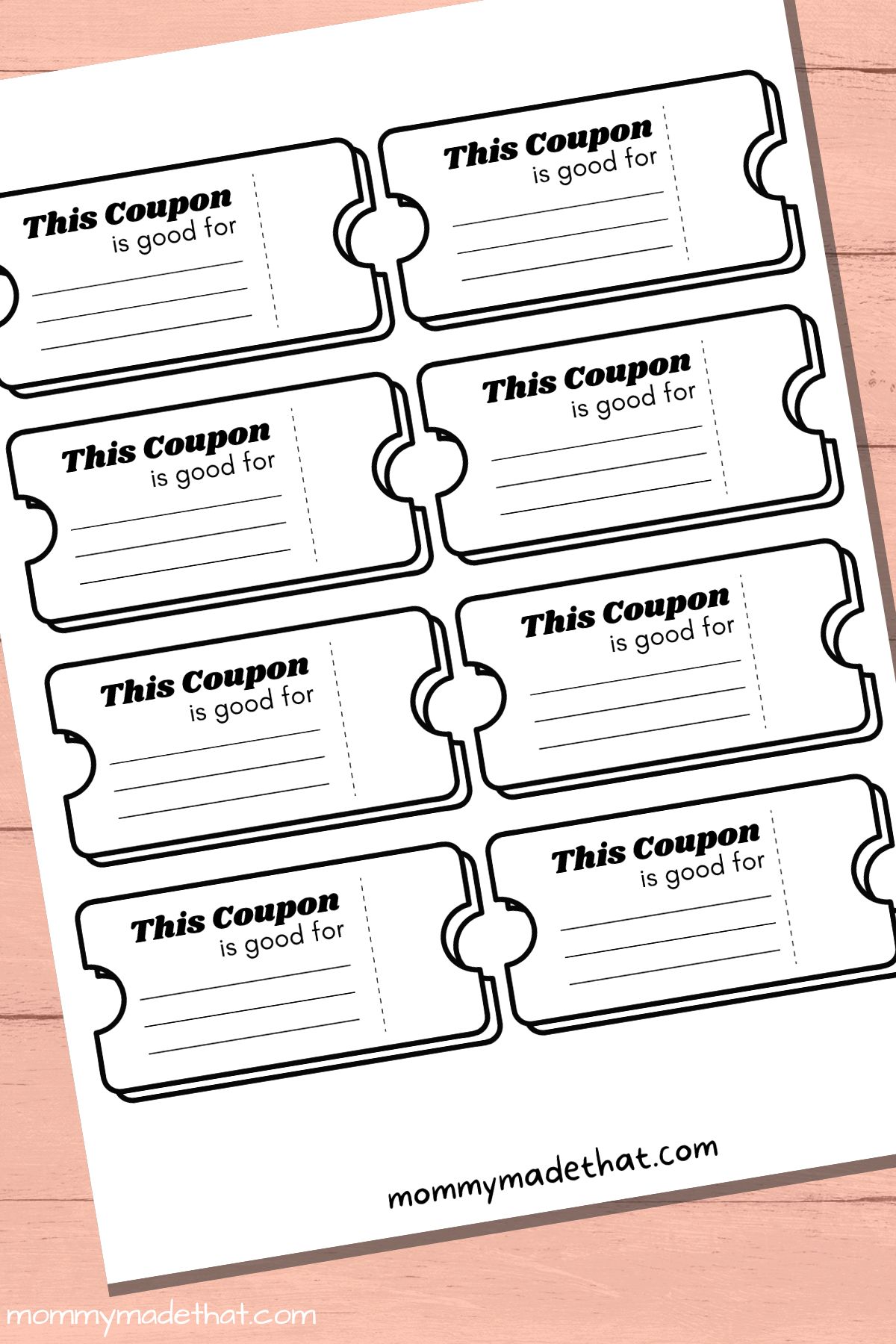

Blank Coupon Template 3 Reasons Why People Like Blank Coupon Template – blank coupon template | Allowed to help my personal weblog, on this occasion I’m going to demonstrate regarding keyword. And after this, this can be the initial photograph:

Think about image earlier mentioned? is actually that remarkable???. if you think thus, I’l m explain to you a number of graphic again beneath:

So, if you would like secure all of these awesome pictures related to (Blank Coupon Template 3 Reasons Why People Like Blank Coupon Template), click on save icon to save these shots in your personal pc. There’re ready for save, if you love and want to have it, just click save symbol on the article, and it’ll be immediately saved to your home computer.} At last if you’d like to grab new and the latest image related with (Blank Coupon Template 3 Reasons Why People Like Blank Coupon Template), please follow us on google plus or bookmark this website, we attempt our best to offer you regular up grade with fresh and new pics. We do hope you enjoy staying right here. For many updates and latest information about (Blank Coupon Template 3 Reasons Why People Like Blank Coupon Template) images, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to give you update regularly with fresh and new pics, like your browsing, and find the best for you.

Here you are at our site, contentabove (Blank Coupon Template 3 Reasons Why People Like Blank Coupon Template) published . At this time we’re pleased to announce that we have discovered an awfullyinteresting topicto be discussed, that is (Blank Coupon Template 3 Reasons Why People Like Blank Coupon Template) Some people trying to find information about(Blank Coupon Template 3 Reasons Why People Like Blank Coupon Template) and of course one of these is you, is not it?