Printable Fillable Fake Car Insurance Card Template This Is How Printable Fillable Fake Car Insurance Card Template Will Look Like In 2 Years Time

Printable Fillable Fake Car Insurance Card Template This Is How Printable Fillable Fake Car Insurance Card Template Will Look Like In 2 Years Time – printable fillable pretend automobile insurance coverage card template

| Welcome so that you can the web site, with this time I’ll give you about key phrase. Now, that is the very first image:

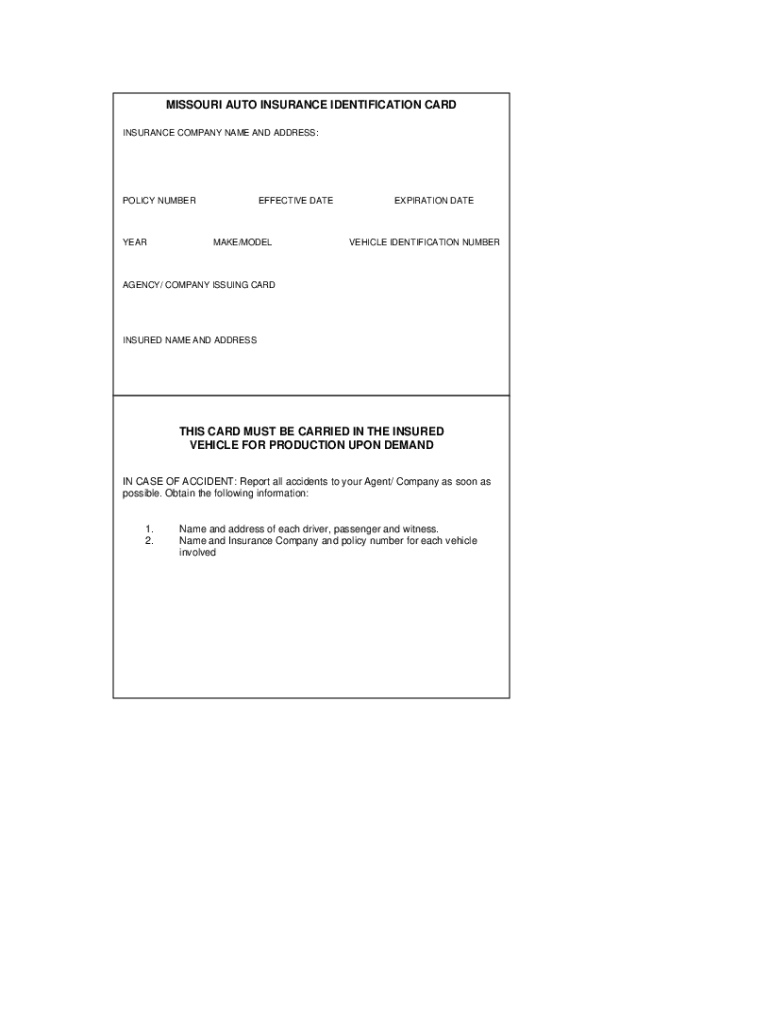

2 Fake & Real Insurance Card Templates (20% Free) | printable fillable pretend automobile insurance coverage card template

Why do not you take into account image over? shall be of which wonderful???. for those who assume possibly and so, I’l l reveal some impression as soon as once more beneath:

So, if you would like to obtain all of those magnificent photographs about (Printable Fillable Fake Car Insurance Card Template This Is How Printable Fillable Fake Car Insurance Card Template Will Look Like In 2 Years Time), merely click on save icon to obtain these pics in your laptop. These can be found for receive, for those who love and want to take it, merely click on save image within the web page, and it is going to be instantly saved in your laptop computer laptop.} Lastly for those who wish to safe new and newest graphic associated with (Printable Fillable Fake Car Insurance Card Template This Is How Printable Fillable Fake Car Insurance Card Template Will Look Like In 2 Years Time), please observe us on google plus or save this weblog, we try our greatest to give you each day up grade with all new and recent images. Hope you want staying right here. For many up-dates and up to date details about (Printable Fillable Fake Car Insurance Card Template This Is How Printable Fillable Fake Car Insurance Card Template Will Look Like In 2 Years Time) footage, please kindly observe us on tweets, path, Instagram and google plus, otherwise you mark this web page on e book mark space, We attempt to give you replace periodically with recent and new graphics, take pleasure in your exploring, and discover the best for you.

Thanks for visiting our web site, articleabove (Printable Fillable Fake Car Insurance Card Template This Is How Printable Fillable Fake Car Insurance Card Template Will Look Like In 2 Years Time) printed . Nowadays we’re excited to announce that we’ve discovered an awfullyinteresting contentto be identified, particularly (Printable Fillable Fake Car Insurance Card Template This Is How Printable Fillable Fake Car Insurance Card Template Will Look Like In 2 Years Time) Lots of individuals looking for specifics of(Printable Fillable Fake Car Insurance Card Template This Is How Printable Fillable Fake Car Insurance Card Template Will Look Like In 2 Years Time) and positively one in all them is you, shouldn’t be it?

Insurance Card Maker – Fill Online, Printable, Fillable, Blank | printable fillable pretend automobile insurance coverage card template