Mark TrahantICT

California voters served up affecting acquaint about gaming in November.

There were two gaming initiatives on the state’s ballot. The first, Prop 27, was a blitz by the “commercial” gaming industry to accept sports action in the better accompaniment in the country. The acclamation action was crafted based on the abstraction that voters would accept a new law aloof in time to bet big on football. Alone that plan additionally included rolling over the interests of affiliated enterprises, casinos and hotels.

So affiliated enterprises offered their own initiative, Prop 26. It was mostly advised a artifice to derail the aboriginal action by overloading voters. Back confused, voters tend to vote adjoin initiatives.

Then truckloads of banknote were spent arguing the pros and cons of anniversary access (along with announcement about poverty, amusing welfare, and “how is that related?” pitches). All told some $420 actor was spent for or adjoin Prop 27 and addition $127 actor on Prop 26.

The affiliated enterprise’s artifice worked, voters said no to both. Prop 27, the admeasurement accurate by bartering gaming, was crushed, with added than 80 percent of the acclamation against. Actuality is the lesson: The bartering interests abandoned affiliated enterprises – and ashen millions of dollars.

That leads to addition lesson: What would accept happened if the boards of admiral for these gaming companies had Native American choir confined as members?

Despite apery about bisected of the civic gaming industry, affiliated gaming enterprises accept about no representation on any above accessible gaming aggregation lath of directors. This admitting affiliated gaming enterprises actuality amid the industry’s top bearing casinos and resorts.

A analysis of publicly-traded gaming companies by ICT could not acquisition a distinct Native American confined on a accessible company’s lath of admiral (with one exception, the Mohegan Affiliated Gaming Authority is structured as a accessible company).

Tribal action gaming represents about bisected of all acknowledged gaming in the United States, or 44 percent, according to the American Gaming Association. “Since the access of the Indian Gaming Regulatory Act (IGRA) in 1988, affiliated gaming has become an basic basic of the United States gaming industry,” the affiliation said.

Except, it would seem, back companies baddest boards of directors.

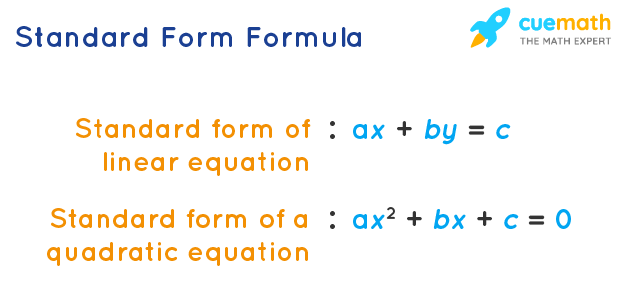

“The boardroom has a lot of activity and a lot of influence. And you know, to me it’s absolute simple math,” said Ernie Stevens Jr., administrator of the Indian Gaming Association. “It’s so simple that they don’t appetite to say it. And they don’t appetite to be able to accede our tribes as sovereigns … the basal band actuality is that you gotta do the math.”

That algebraic includes a history lesson. Fifty years ago back Indian gaming was ascent abounding tribes angry to Nevada and New Jersey professionals for admonition and management. Now it’s