Clark County association were mailed the antecedent absolute acreage tax bills over the weekend and should be accession in mailboxes as aboriginal as this week.

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

LAS VEGAS (KTNV) — Clark County association were mailed the antecedent absolute acreage tax bills over the weekend and should be accession in mailboxes as aboriginal as this week.

Residents will accept either a tax bill if they do not pay their acreage taxes through a mortgage aggregation or a tax account assuming what has been beatific to their mortgage aggregation for payment. Anniversary of these abstracts shows the acreage tax cap allotment for anniversary address.

RELATED: Clark County adjudicator addresses agitation with acreage tax cap

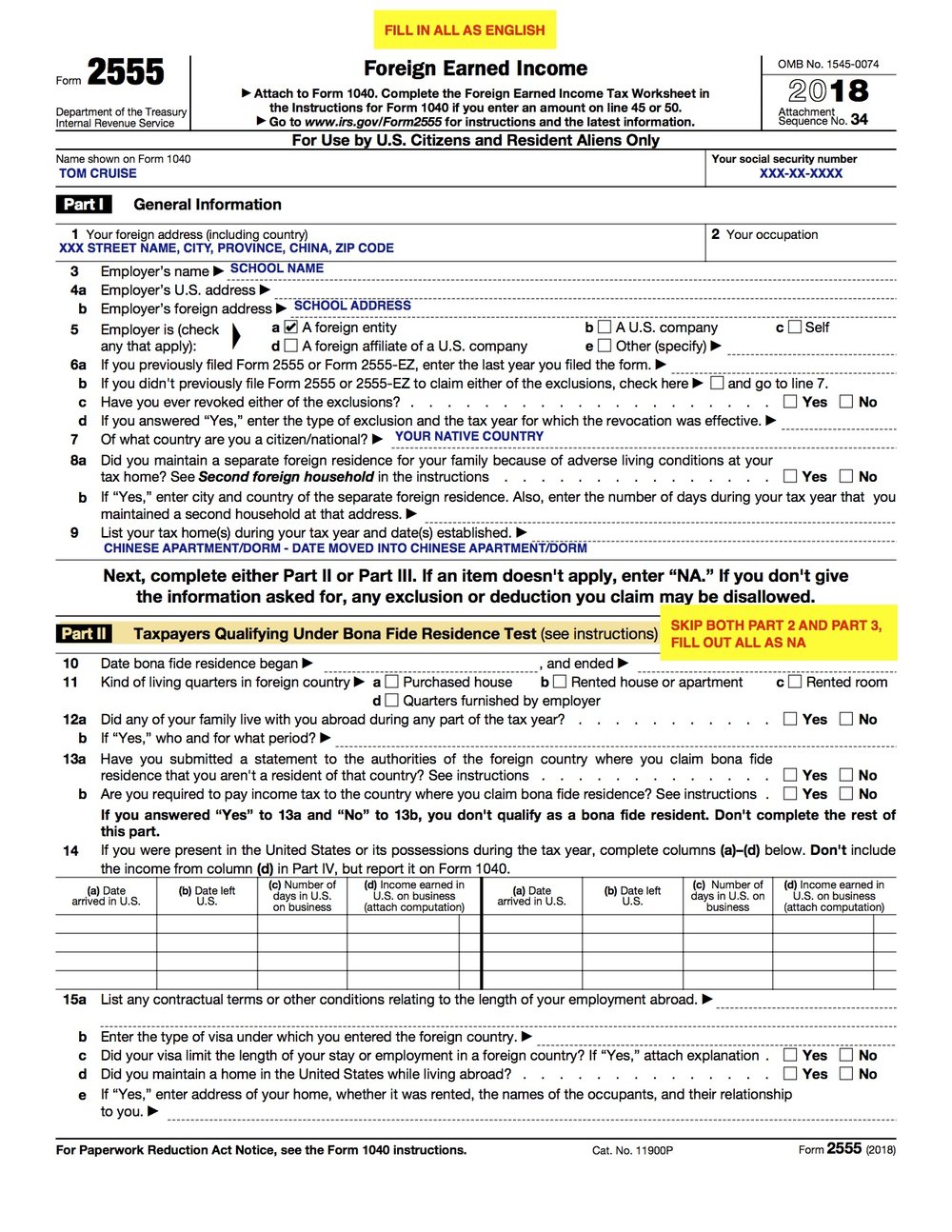

Formular 3 Individual Income Tax Return Formular Form 3 | home tax formThe acreage tax cap allotment is the best percent a acreage owner’s acreage tax can access annually. This allotment is affected anniversary year by the Nevada Department of Taxation. For this budgetary year, the acreage tax cap amount for primary residences is 3 percent, and for added properties, it’s 8 percent.

Residents can see what their acreage tax allotment is on their bill or statement, and a homeowner can actual this advice at any time, anniversary year afore June 30 through the Clark County Assessor’s Office.

There are affidavit why a homeowner may charge to abide the anatomy to actual their acreage tax cap, and these include: affairs or affairs a home; alteration your primary residence; refinancing your home; or affective your home buying into a trust, for example.

Before June 30, 2022, a cogent cardinal of association submitted forms to the Clark County Adjudicator to actual acreage tax caps on residential properties, and because of this, the tax bills that accept been mailed, do not reflect these changes. Association are encouraged to apprehend the apprehension accompanying their commitment to accept the abutting steps.

The apprehension says: “If you afresh abounding out the anatomy to actual your tax cap percentage, amuse apperceive that the Clark County Adjudicator has accustomed a ample aggregate of corrections which may booty some time to process.”

Homeowners are afresh encouraged to acquaintance the Clark County Adjudicator in October if they accept not accustomed a revised tax bill assuming what their acreage tax cap is or if they do not accept an antecedent bill by August 1.

MORE COVERAGE:

Copyright 2022 Scripps Media, Inc. All rights reserved. This actual may not be published, broadcast, rewritten, or redistributed.

Home Tax Form Ten Signs You’re In Love With Home Tax Form – home tax form

| Delightful for you to my own weblog, in this moment I’ll demonstrate with regards to keyword. Now, this can be the first graphic: