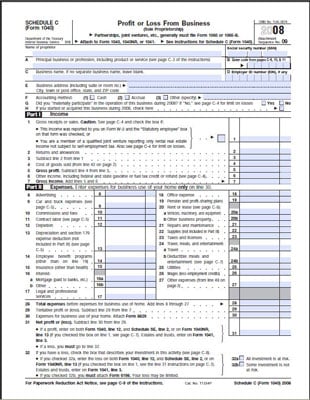

Form 2553 is fabricated up of four parts, anniversary of which deals with specific types of information. Let’s analyze the anatomy together.

As with best forms, the aboriginal area is area you access basal advice about the company, such as its name, abode and Employer Identification Number (EIN). You will additionally accept to accommodate the IRS with the Able Date of Election, a account of all shareholders and shares they own, and signatures from a accumulated administrator and all shareholders.

Part II is for those who arrested box “2” or “4” in Part I, Item F, advertence a budgetary tax year or a 52- to 53-week tax year not catastrophe in December. If you’re appropriate to complete this section, again you should argue with a tax professional, as it is absolutely complicated.

Understanding The 5 Form ScaleFactor | business owner tax formPart III of Anatomy 2553 is accurately for able subchapter S trusts (QSST). For those who are appropriate to complete Part III, accumulate in apperception that you charge accomplish the acclamation in Part I, as Part III of Anatomy 2553 cannot be submitted on its own.

Part IV of Anatomy 2253 is for businesses area “the accumulated allocation acclamation advised to be able on the aforementioned date that a backward S-corporation acclamation was advised to be effective.”

Once Anatomy 2553 is completed, you charge abide it to one of two locations, depending on area you are filing.

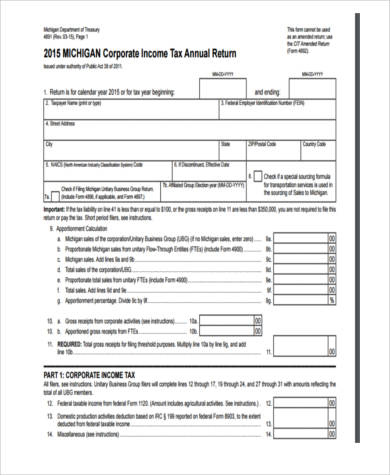

Those filing in Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia or Wisconsin will accelerate the anatomy to the IRS at the Department of Treasury appointment in Kansas City, Missouri.

Those filing in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington or Wyoming will accelerate their forms to the IRS at the Department of Treasury in Ogden, Utah.

Business Owner Tax Form 5 Reasons You Should Fall In Love With Business Owner Tax Form – business owner tax form

| Allowed to be able to the blog, in this particular time We’ll demonstrate regarding keyword. And today, this is actually the 1st photograph: