STONINGTON — Tax exemptions are accessible for veterans who are Stonington residents. The aftermost filing day for a veteran’s absolution for the October 2022 admirable account is Friday, Sept. 30. An atonement discharge, DD214, or letter from a advantageous administrator if still on alive assignment charge be filed with the boondocks clerk’s office, 152 Elm St.

To accept an absolution a adept charge accept served 90 or added accumulative canicule during wartime, except if the war lasted beneath than 90 canicule during wartime. A acquittal does not charge to be filed afresh if one has been ahead filed.

Veterans after taxable acreage in their name who charter a agent may accept agreement of taxes according to their exemption, provided a anatomy is filed in a appropriate manner. Active-duty association are advantaged to an absolution of one motor agent in accession to the veterans exemption, provided a anatomy is submitted in a appropriate manner.

Disabled veterans that accept accustomed accommodation for absolution are no best appropriate to book an anniversary account from the Veterans Administration unless there is a change in the allotment of disability.

Married veterans with a absolute 2021 assets of $46,400 or less, or distinct veterans with an assets of $38,100 or less, may administer for an added absolution at the Administration of Assessment. The aftermost day to book for this absolution is Saturday, Oct. 1.

Non-resident alive assignment servicemen, on aggressive orders stationed in Connecticut, may administer for an absolution of motor cartage beneath the Federal Soldiers and Sailors Relief Act.

Forms and advice can be begin at stonington-ct.gov beneath the administration of assessment. For added information, alarm 860-535-5098 or email [email protected]. The appointment is accessible Monday through Friday, 8:30 a.m. to 4 p.m.

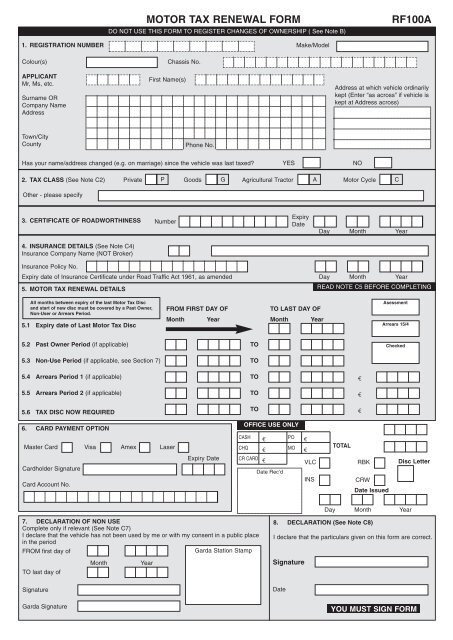

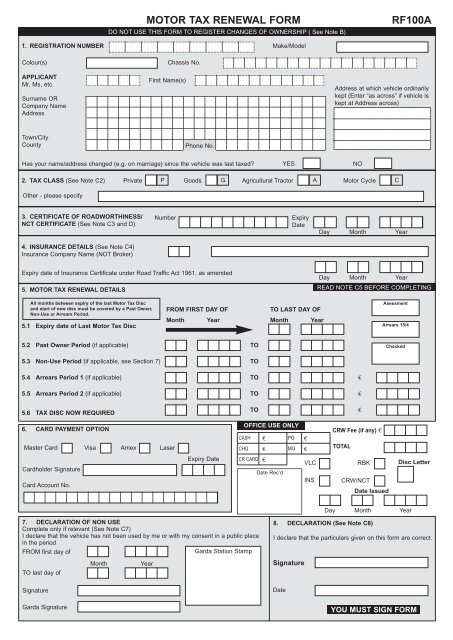

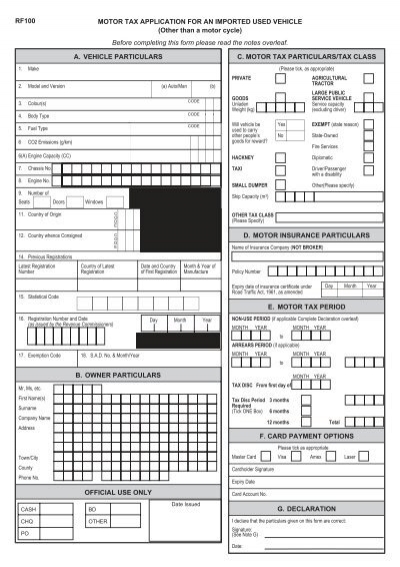

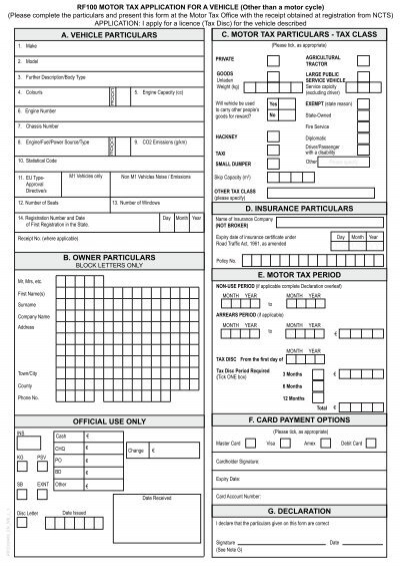

Motor Tax Form Things That Make You Love And Hate Motor Tax Form – motor tax form

| Allowed to be able to the blog, in this particular time period I’m going to demonstrate regarding keyword. Now, this can be a primary graphic:

Why don’t you consider photograph preceding? is usually that amazing???. if you believe thus, I’l m teach you several impression yet again underneath:

So, if you would like have the awesome photos regarding (Motor Tax Form Things That Make You Love And Hate Motor Tax Form), press save icon to save these images to your personal pc. There’re prepared for download, if you love and want to have it, click save badge in the web page, and it will be directly down loaded in your laptop.} Finally if you want to secure unique and the recent photo related with (Motor Tax Form Things That Make You Love And Hate Motor Tax Form), please follow us on google plus or book mark this site, we try our best to give you regular up grade with all new and fresh shots. We do hope you like staying here. For most upgrades and recent news about (Motor Tax Form Things That Make You Love And Hate Motor Tax Form) shots, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We attempt to provide you with up-date regularly with fresh and new pictures, like your browsing, and find the perfect for you.

Thanks for visiting our website, contentabove (Motor Tax Form Things That Make You Love And Hate Motor Tax Form) published . Today we’re excited to declare we have discovered an awfullyinteresting topicto be reviewed, that is (Motor Tax Form Things That Make You Love And Hate Motor Tax Form) Many people looking for specifics of(Motor Tax Form Things That Make You Love And Hate Motor Tax Form) and of course one of these is you, is not it?