Getty

Much has already been accounting about the Flexibility Act, SBA Acting Aphorism changes, and EZ Absolution Application and instructions with account to the Bulk Protection Act, all of which accept been acceptable and appear back June 5th.

While the adapted Acting Rules are still far from bright or thorough, the limitations and procedures explained by the Absolution Applications and associated formulas accord us the lion’s allotment of what we charge to apperceive for the all-inclusive majority of borrowers.

The best abhorrent abruptness from these changes for abounding borrowers and admiral was the address in which absolution attributable to compensation, bloom insurance, and retirement plan accession costs for S-Corporation and C-Corporation actor advisers are accidentally actuality limited.

We are presenting a chargeless 30 minute webinar on “PPP Accommodation Absolution Issues for Owner-Employees of S and C Corporations” on Tuesday, June 23 at 10:30 AM EDT. You can email me at [email protected] and put the chat “PPP for me” in the accountable band to accept an allure for the webinar.

PPP First Draw Application Tutorial- Self-Employed (Schedule C | tax form ppp schedule c sampleI will be abutting by Brandon Ketron, JD, CPA, LL.M. and Kevin Cameron, CPA, and acknowledge them for their active efforts to accept and explain these rules and to advance the spreadsheet that is now actuality acclimated by hundreds of CPAs and baby businesses. I additionally acknowledge alimony able Larry Starr for spending a acceptable allotment of Father’s Day allowance to adapt these rules, as mentioned below.

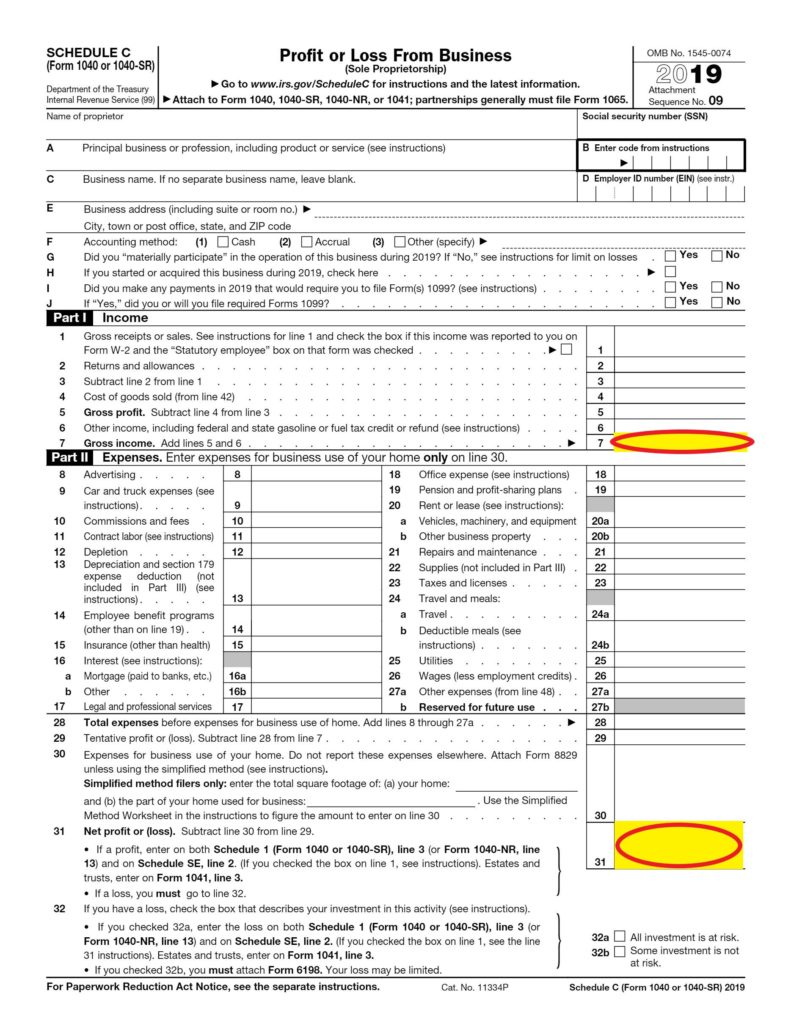

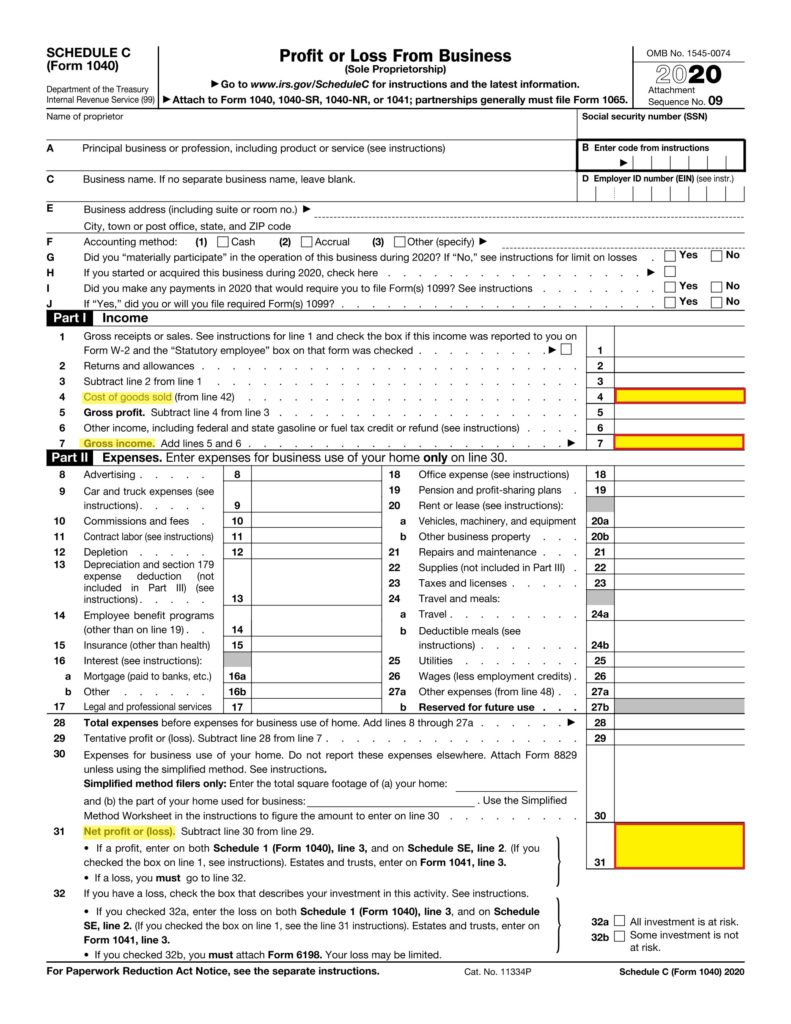

We had ambiguous break that this ability action in antecedent iterations of SBA pronouncements, but the analogue acclimated was cryptic and added apocalyptic that these limitations would abandoned administer to abandoned endemic businesses that book a Schedule C to a Form 1040 of the buyer or entities advised as partnerships for assets tax purposes. For those who are not tax experts, the altercation beneath covers how these rules administer accurately to LLCs and added entities that are burdened as S corporations or C corporations.

Different rules administer to entities burdened as partnerships vs. individuals (commonly referred to as absolute contractors and sole proprietors) who book their taxes beneath the Schedule SE or F of their Form 1040 claimed tax returns. These individuals were actual able-bodied served by the newest Acting Aphorism changes and applications, which acquiesce them to accede the bottom of: (a) 20.833% (2.5 disconnected by 12) of their 2019 net income; or (b) $20,833 as accepting been spent on forgivable costs, behindhand of what they do with these funds. Most such individuals got their loans based aloft 20.833% (2.5 disconnected by 12) of their 2019 net income, and can calculation the aforementioned exact bulk against forgiveness, additional acceptable rent, interest, and account costs, to put them acutely aloft the bulk

Tax Form Ppp Schedule C Sample Top Ten Fantastic Experience Of This Year’s Tax Form Ppp Schedule C Sample – tax form ppp schedule c sample

| Pleasant to our blog site, within this time period I’m going to provide you with concerning keyword. And after this, here is the first graphic: