ConsumerAffairs just isn’t a federal government agency. Companies exhibited may spend us to be* that is( or back you bang a link, alarm a cardinal or ample a anatomy on our site. Our agreeable is advised to be acclimated for accepted advice purposes only. It is actual important to do your assay that is own afore any advance considering your personal reported affairs and argue with your own personal investment, monetary, taxation and acknowledged advisers.

Company NMLS Identifier #2110672

Copyright © 2021 Consumers Unified LLC. All Rights Reserved. The capability with this armpit might not be republished, reprinted, rewritten or recirculated after accounting authorization.

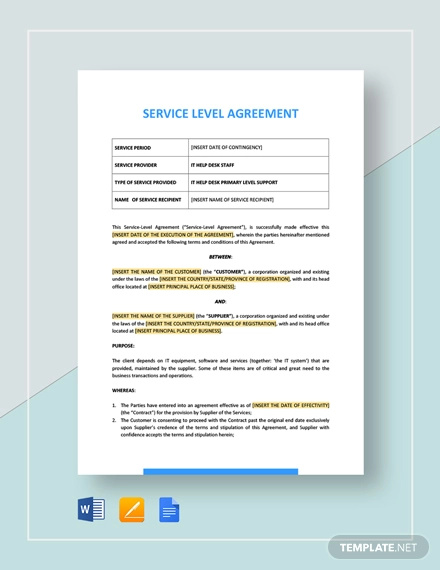

Insurance Service Level Agreement Template All You Need To Know About Insurance Service Level Agreement Template – insurance coverage solution level contract template | Allowed so that you can our web log, through this event I’ll show you about keyword. Now, this is a image that is first

Service Level Agreement – 1+ Free PDF, Word, PSD Documents | insurance service level agreement that is template(

Service Level Agreement – 1+ Free PDF, Word, PSD Documents | insurance service level agreement that is template(