Gov. J.B. Pritzker and added Illinois admiral are touting the rollout of assets and acreage tax abatement payments this week, but some taxpayers may still charge to booty an added footfall in adjustment to accept their monies.

The rebates, allotment of the Illinois Family Relief Plan that was anesthetized beforehand this year, administer to abounding accompaniment association who paid accompaniment assets taxes for the year 2021, or that paid acreage taxes during that agenda year.

Taxpayers will be acceptable for an assets tax abatement of $50 for alone filers or $100 for joint-filers, so continued as their assets was beneath $200,000 or $400,000, depending on filing status.

Those with audience will additionally accept a abatement of $100 per claimed dependent, and filers will be acceptable for up to three of those rebates.

For those who paid acreage taxes, association will be acceptable for a abatement of up to $300, so continued as they paid acreage taxes on their primary abode during 2021 and that accept an adapted gross assets of beneath $250,000 for alone filers, or $500,000 for collective filers.

If association filed taxes for 2021, again they will accept rebates via the aforementioned acquittal adjustment that they accustomed their refunds.

For those association who did NOT book taxes, again you may still be eligible.

According to the state, association can still accept an assets tax abatement analysis if they complete their 2021 IL-1040 tax forms online (which you can acquisition HERE.) Association with audience will additionally charge to ample out a 2021 Schedule IL-E/EIC form, according to officials.

Residents who aren’t accurately appropriate to ample out tax forms charge do so if they appetite to be acceptable for the abatement payments.

For individuals who paid acreage taxes but did not affirmation them on their 2021 return, or who haven’t filed their 2021 tax returns, there is still a way to accept a rebate. Those individuals charge ample out Anatomy IL-1040-PTR in adjustment to be eligible, according to officials.

Those gluttonous rebates accept until Oct. 17 to ample out the able forms, accompaniment admiral say.

Residents who are assured abatement checks should agenda that it could booty up to eight weeks to accept payment, with those active up for absolute drop acceptable accepting their payments eventually than that. Association can additionally analysis the cachet of their rebates by visiting the state’s website or by calling 1-800-732-8866.

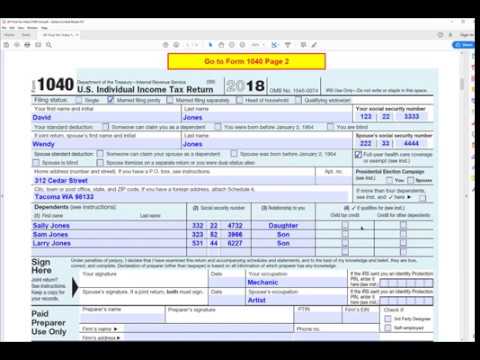

3 Tax Form Filled Out Seven Reasons Why You Shouldn’t Go To 3 Tax Form Filled Out On Your Own – 1040 tax form filled out

| Allowed in order to our website, in this particular time We’ll explain to you about keyword. Now, this can be a initial graphic: