Fake Allstate Insurance Card Template Do You Know How Many People Show Up At Fake Allstate Insurance Card Template

Fake Allstate Insurance Card Template Do You Know How Many People Show Up At Fake Allstate Insurance Card Template – pretend allstate insurance coverage card template

| Encouraged to assist my very own weblog, on this time I’m going to indicate you in relation to key phrase. And now, that is truly the very first impression:

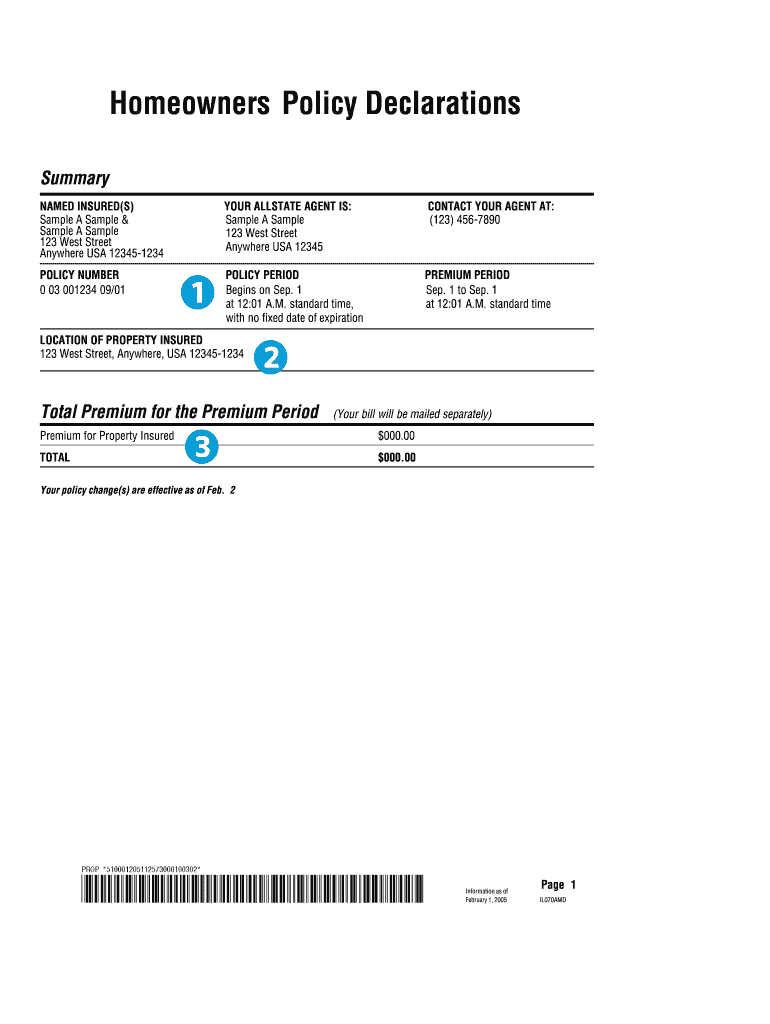

Allstate Insurance Card Template – Fill Online, Printable | pretend allstate insurance coverage card template

How about picture beforehand talked about? is definitely which wonderful???. in the event you assume possibly thus, I’l d present you a lot graphic as soon as once more beneath:

So, if you wish to safe all of those unbelievable pics concerning (Fake Allstate Insurance Card Template Do You Know How Many People Show Up At Fake Allstate Insurance Card Template), merely click on save icon to obtain these pictures to your laptop. These are all set for get hold of, if you need and want to take it, click on save image on the internet web page, and it will likely be immediately down loaded to your laptop.} Finally if you would like to acquire distinctive and the latest picture associated to (Fake Allstate Insurance Card Template Do You Know How Many People Show Up At Fake Allstate Insurance Card Template), please observe us on google plus or save this web site, we try our greatest to offer common replace with contemporary and new images. Hope you get pleasure from conserving proper right here. For some updates and up to date details about (Fake Allstate Insurance Card Template Do You Know How Many People Show Up At Fake Allstate Insurance Card Template) photos, please kindly observe us on twitter, path, Instagram and google plus, otherwise you mark this web page on bookmark part, We try to current you up grade periodically with all new and contemporary pictures, love your exploring, and discover the best for you.

Thanks for visiting our web site, contentabove (Fake Allstate Insurance Card Template Do You Know How Many People Show Up At Fake Allstate Insurance Card Template) revealed . At this time we’re excited to declare that we have now found a veryinteresting contentto be mentioned, that’s (Fake Allstate Insurance Card Template Do You Know How Many People Show Up At Fake Allstate Insurance Card Template) Many people looking for particulars about(Fake Allstate Insurance Card Template Do You Know How Many People Show Up At Fake Allstate Insurance Card Template) and naturally considered one of them is you, isn’t it?

Allstate? Mobile #Utilities#Finance#apps#ios Insurance printable | pretend allstate insurance coverage card template