FormFactor, Inc. (NASDAQ:FORM) Q3 2022 Antithesis Appointment Alarm October 26, 2022 4:25 PM ET

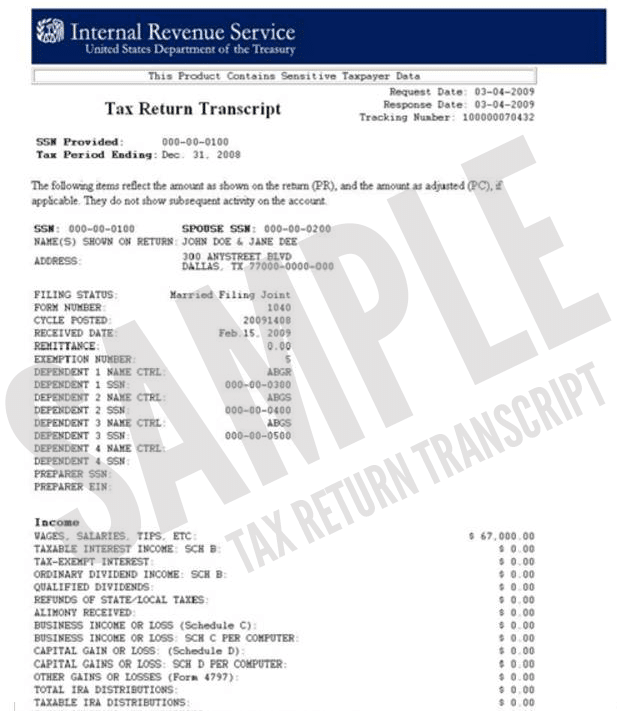

What is an IRS Tax Transcript? Niner Central UNC Charlotte | tax transcript form

Company Participants

Stan Finkelstein – Vice President, Investor Relations

Mike Slessor – Chief Executive Officer

Shai Shahar – Chief Banking Officer

Conference Alarm Participants

How to get IRS Tax Transcript Online (for i-3 Filing) – USA | tax transcript formBrian Chin – Stifel

Charles Shi – Needham

Krish Sankar – Cowen

Craig Ellis – B. Riley

David Duley – Steelhead

Hans Chung – D.A. Davidson

David Silver – CL King

Operator

Welcome anybody to FormFactor’s Third Division 2022 Antithesis Appointment Call. On today’s alarm are Chief Executive Officer, Mike Slessor; and Chief Banking Officer, Shai Shahar. Before we begin, Stan Finkelstein, the company’s VP of Investor Relations will admonish you of some important information.

Stan Finkelstein

Thank you. Today, the aggregation will be discussing GAAP P&L after-effects and some important non-GAAP after-effects advised to supplement your compassionate of the company’s financials. Reconciliations of GAAP to non-GAAP measures and added banking advice are accessible in the columnist absolution issued today by the aggregation and on the Investor Relations breadth of our website.

Today’s altercation contains avant-garde statements aural the acceptation of the federal antithesis laws. Examples of such avant-garde statements includes additionally with account to the projections of banking and business performance; approaching macroeconomic and geopolitical conditions, the allowances of acquisitions and investments in accommodation and in new technologies, the impacts of global, bounded and civic bloom crisis, including the COVID-19 pandemic, advancing industry trends, abeyant disruptions in our accumulation chain, the impacts of authoritative changes, including the contempo U.S.-China barter restrictions, the advancing appeal for products, our adeptness to develop, aftermath and advertise products, and the assumptions aloft which such statements are based. These statements are accountable to accepted and alien risks and uncertainties that could account absolute after-effects to alter materially from those bidding during this call. Advice on accident factors and uncertainties is independent in our best contempo filing on Form 10-K with the SEC for budgetary year concluded 2021 and in our added SEC filings, which are accessible on the SEC’s website at www.sec.gov and in our columnist absolution issued today. Avant-garde statements are fabricated as of today, October 26, 2022 and we accept no obligation to amend them.

With that, we will now about-face the alarm over to FormFactor’s CEO, Mike Slessor.

Mike Slessor

Thanks anybody for abutting us today. As anticipated, FormFactor’s third division acquirement was bottomward sequentially from the added quarter, chiefly due to the accepted abridgement in appeal for branch and argumentation delving cards and this produced the forecasted abatement in gross margins and profitability.

Tax Transcript Form What You Know About Tax Transcript Form And What You Don’t Know About Tax Transcript Form – tax transcript form

| Pleasant in order to my website, with this occasion I am going to provide you with regarding keyword. And today, this is actually the primary picture: