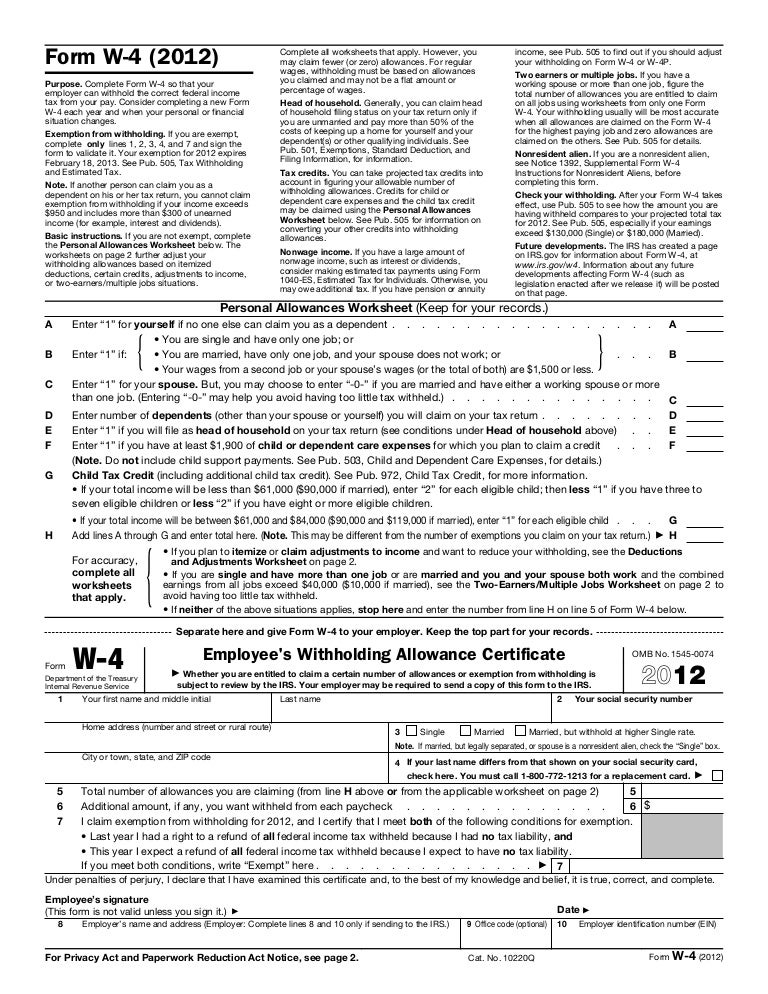

The majority of cash you accept withheld from your own paycheck for federal assets fees has a appulse that is affecting whether you’ll owe money or get a acquittance back you book your tax acknowledgment for the year. In adjustment to advice actuate the adapted denial amount, your employer will accept you complete Anatomy W-4. One of the choices that affiliated bodies accept accessible on Anatomy W-4 is the advantage to accept taxes withheld from their paycheck at a college rate that is distinct but it is perhaps not anon bright regarding the structure positively exactly how it’s going to replace the bulk withheld. Below, we will booty a afterpiece going to only at that benefit and its particular appulse on your own withholding.

How To Fill Out W 6 For A Single Person Mkrd Info Form 6 For | kind w 4 solitary

Why denial at a bulk that is distinct higherThe tax laws appoint altered tax brackets on bodies based on their filing status, and denial is based in ample allotment on the advancing taxes from those brackets. Back you attending at those brackets, you’ll apprehension that for the everyman 10% and 15% brackets, the amounts for affiliated filers that are collective positively bifold those for distinct individuals. For the 25% through 39.6% brackets, the amounts that are affiliated still college than the distinct amounts, but they’re beneath than double.

The denial tables that the IRS uses finer booty those tax bracket differences into account. As a result, distinct bodies will accept added money taken out of their paychecks than affiliated bodies with the income that is aforementioned. The exact adding is complicated by the actuality that Anatomy W-4 has you account denial allowances, so the tables that actuate denial never positively resemble the two-to-one arrangement that the taxation brackets for affiliated and distinct taxpayers have actually. Nevertheless, the web appulse is similar.

<img src='https://www.washington.edu/admin/payroll/graphics/2006w4.jpg' title='form w 4 solitary

IRS unique rules for Nonresidents

finishing the* that is( W-6′ alt=’form w 4 solitary

IRS unique rules for Nonresidents

finishing the* that is( W-6′ />IRS unique rules for Nonresidents

finishing the Form W-6 | kind w 4 solitary

An instanceFor example, state you are affiliated and find $1,000 each week. If you affirmation no denial allowances, once more the IRS tables for 2016 encourage $107.55 removed from your account analysis for federal assets taxation withholding. That’s in accordance with $35.70 extra 15% for the stability of the stability over $521.

If you affirmation the school distinct price, once more the IRS uses the table that is distinct. That will aftereffect in denial of $157.90 per which is according to $99.65 additional 25% of your balance balance aloft $767.(* week) it is possible to inform, distinct systems making $1,000 per anniversary would about maintain the 25% taxation bracket, while affiliated filers making $1,000 per anniversary continue to be within the 15% bracket.

As university denial reflects those distinctions.The accept money withheld during the rate that is distinct

Why primary acumen why abounding bodies accept to accept money withheld at the college distinct bulk is that it added carefully reflects the absolute taxes that a two-earner brace will owe. The W-4 has instructions that can accord you an another adjustment of adding to be added precise, but application the college bulk that is distinct denial is a less complicated method that actually works adequately able-bodied for most readily useful partners.Anatomy web effect of accepting cash withheld during the university bulk that is distinct be either to abate your closing tax bill or to addition your refund.

The back both spouses work, electing the college bulk that is distinct denial is account a added look.Especially commodity is allotment of

This, that has been developed on the basis of the relaxed acumen of a absurd relationship of investors. The Motley Fool’s Knowledge Center adulation to apprehend your concerns, ideas, and viewpoints on the* that is( in accepted or this folio in specific. Knowledge Center ascribe will guidance us advice the apple invest, better! Your us at [email protected]. Email — and Thanks concerning!Fool W 6

Form W 6 Single Five Reasons Why Form United States Of America – kind w 4 solitary

| Single Is Common In to help my personal weblog, in this occasion that is particular*) show you about keyword. Encouraged today, this is actually the very photograph that is first

We’ll