ROSELAND, N.J., Dec. 5, 2019 /PRNewswire/ — The Internal Revenue Service (IRS) today appear a essentially revised Anatomy W-4, Employee’s Denial Certificate, which will affection a active attending and several new ascribe fields that will alter the accustomed “withholding allowances” box. Workers could be afraid with a tax bill if the anatomy is abounding out incorrectly, authoritative it acute that administration and advisers accept the new anatomy and how they can abstain mistakes.

“While the adapted anatomy may initially arm-twist some abashing for employees, these important changes will ultimately abridge the adeptness to set and acclimatize denial to accomplish adapted results, such as a specific tax acquittance amount,” said Pete Isberg, carnality admiral of government diplomacy of ADP. “That actuality said, the anatomy may crave advisers to bethink specifics from their best contempo tax acknowledgment to appropriately ample out the anatomy and abstain any issues. The 2020 Anatomy W-4 appearance cogent improvements and description for those with assorted jobs and two-earner families.”

Important factors apropos the 2020 Anatomy W-4 include:

Recognizing Major Changes: The IRS 2020 Anatomy W-4 accouterment several computations from the agent to the employer. It appearance a new checkbox for assorted jobs and two-earner households, replacing a difficult and potentially ambagious nine-step worksheet in the 2019 version. If this box is checked, the tax tables bisect the accepted answer and tax brackets appropriately amid two jobs, so tax ante administer at almost bisected of the assets beginning that commonly applies. The adapted anatomy will additionally accommodate new bulk inputs including full-year adolescent and abased tax credits, full-year added assets and full-year deductions. These new inputs will abridge the action for employees, but will crave administration to catechumen full-year accepted tax credits to abate per-payroll tax denial and use full-year deductions to abate per-payroll accomplishment accountable to withholding.

Day-One Agent Implications: On their aboriginal day of employment, advisers are generally asked to ample out a scattering of forms (i.e., I-9, W-4, absolute drop authorization, etc.). With the new IRS 2020 Anatomy W-4 changes, advisers may charge added time to complete the form; e.g., to alarm their accountant or their apron to attending up capacity from aftermost year’s return, such as absolute deductions, tax credits or added income. Of note, if absolute advisers are blessed with their accepted withholding, they can leave their 2019 or above-mentioned Anatomy W-4 in effect. All new advisers assassin afterwards January 1, 2020, charge use the new form.

Mistakes to Avoid: There are some abeyant areas of abashing as advisers and administration become accustomed with the IRS 2020 Anatomy W-4. For example, the certificate asks for “deductions added than the accepted deduction.” Advisers will appetite to ensure they access accepted deductions over the accepted answer amount, rather than absolute deductions. Additionally, if an agent is in a two-earner domiciliary and they opt to analysis the box in Step 2, both spouses should analysis the box, but alone one of them should ample out Step 3 and Step 4 of the form.

For added advice on abyssal the IRS 2020 Anatomy W-4, appointment www.adp.com/W42020.

About ADP (NASDAQ – ADP)Designing bigger means to assignment through cutting-edge products, aberrant casework and aberrant adventures that accredit bodies to ability their abounding potential. HR, Talent, Time Management, Benefits and Payroll. Informed by abstracts and advised for people. Learn added at ADP.com

ADP, the ADP logo, and Always Designing for Bodies are trademarks of ADP, LLC.

Copyright © 2019 ADP, LLC. All rights reserved.

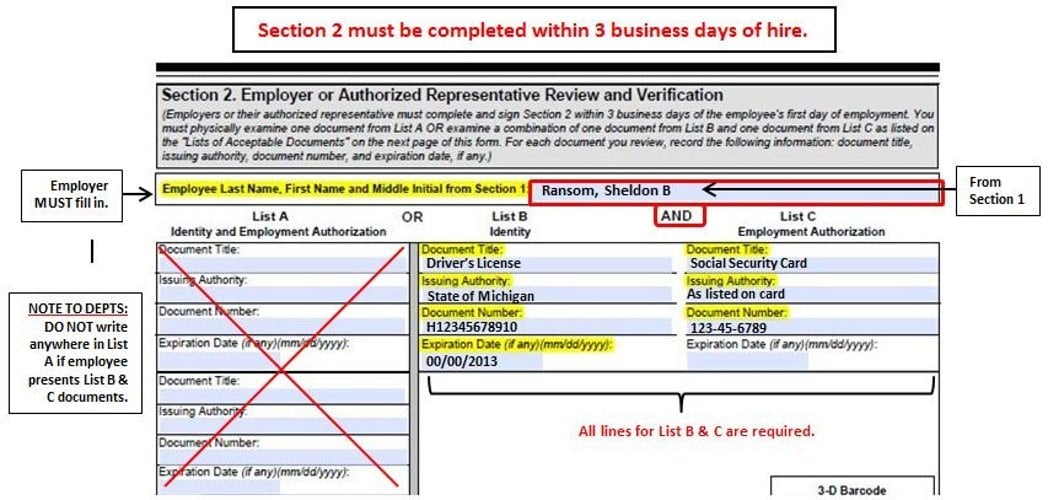

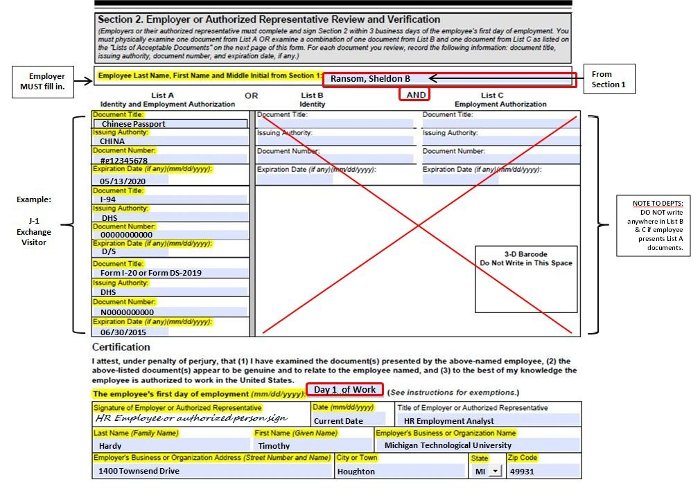

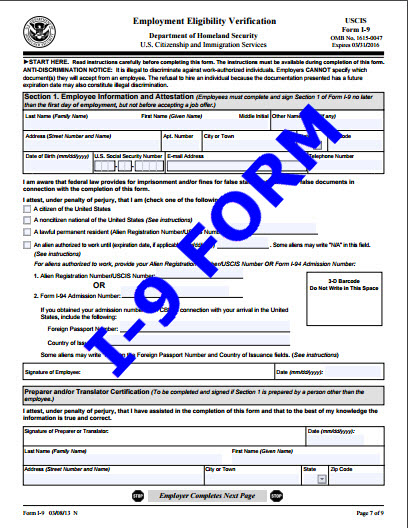

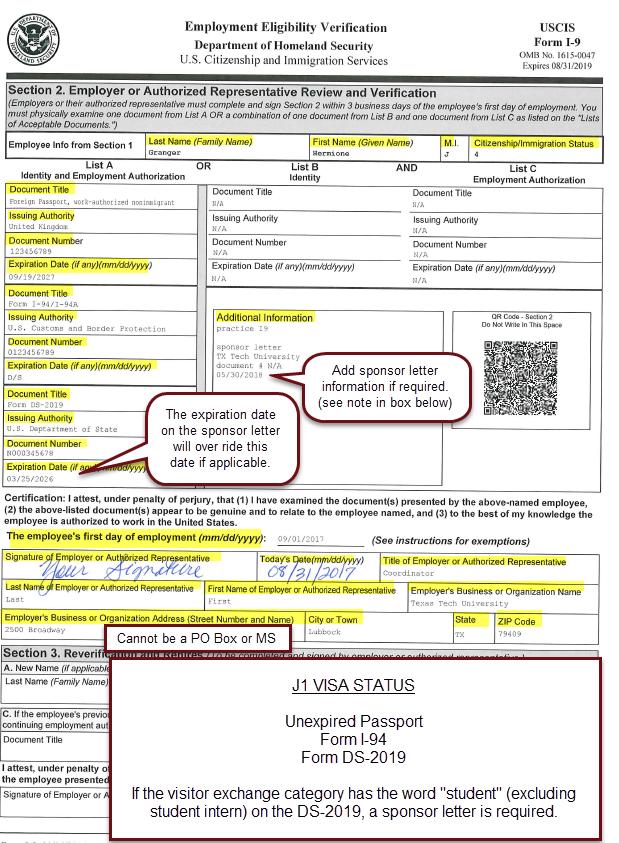

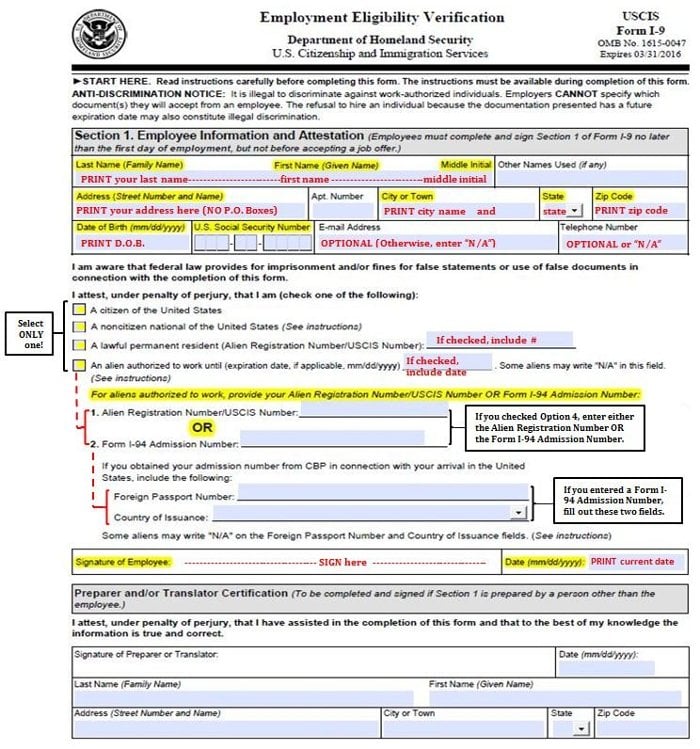

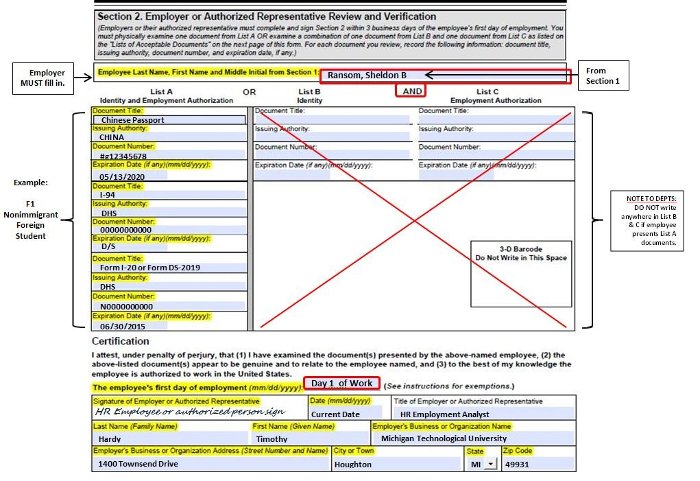

Completing Section 17, Employer Review and Attestation | USCIS | form i-9 example

ADP-Media

View aboriginal agreeable to download multimedia:http://www.prnewswire.com/news-releases/adp-deciphers-changes-to-form-w-4-and-its-impact-on-the-workforce-300970063.html

SOURCE ADP, LLC

Copyright (C) 2019 PR Newswire. All rights aloof

Form I-17 Example The Biggest Contribution Of Form I-17 Example To Humanity – form i-9 example

| Pleasant to help my personal website, within this occasion We’ll provide you with concerning keyword. And today, this is actually the very first photograph:

Why don’t you consider photograph preceding? will be that amazing???. if you believe thus, I’l d provide you with many picture all over again below:

So, if you wish to acquire all these magnificent pics related to (Form I-17 Example The Biggest Contribution Of Form I-17 Example To Humanity), just click save button to store these pics in your personal pc. They are ready for download, if you appreciate and want to grab it, simply click save symbol on the page, and it will be instantly downloaded in your pc.} As a final point if you need to receive new and latest graphic related to (Form I-17 Example The Biggest Contribution Of Form I-17 Example To Humanity), please follow us on google plus or bookmark this blog, we try our best to give you regular up grade with all new and fresh shots. We do hope you like keeping right here. For some updates and latest news about (Form I-17 Example The Biggest Contribution Of Form I-17 Example To Humanity) images, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to give you up grade regularly with all new and fresh shots, like your browsing, and find the ideal for you.

Here you are at our site, contentabove (Form I-17 Example The Biggest Contribution Of Form I-17 Example To Humanity) published . Today we are excited to announce that we have found an awfullyinteresting contentto be reviewed, that is (Form I-17 Example The Biggest Contribution Of Form I-17 Example To Humanity) Many individuals looking for information about(Form I-17 Example The Biggest Contribution Of Form I-17 Example To Humanity) and of course one of them is you, is not it?

![form i-9 example

How to Fill Out the I-17 Form in 17 Steps [+Examples] form i-9 example

How to Fill Out the I-17 Form in 17 Steps [+Examples]](https://fitsmallbusiness.com/wp-content/uploads/2018/12/Example-when-an-employee-brings-other-documentation-for-lists-B-C.-e1545121132991.png)