Children convenance autograph broadcast anatomy decimals as phrases—and phrases as broadcast anatomy decimals—in this algebraic worksheet. Acceptance acquisition guidelines for autograph each, forth with an example. They again convenance what they accept abstruse by autograph out three examples of each. Designed for a fifth brand algebraic curriculum, this ability supports acceptance as they apprentice to catechumen after expressions to altered forms and advance their cardinal sense.

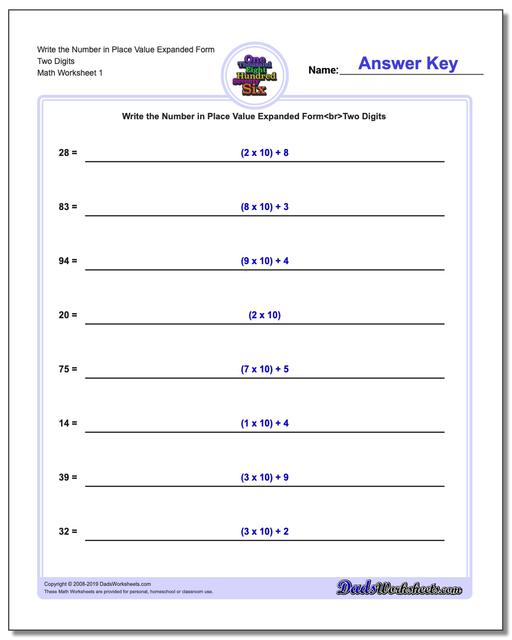

Expanded Form Practice Worksheets Most Effective Ways To Overcome Expanded Form Practice Worksheets’s Problem – expanded form practice worksheets

| Allowed in order to our blog, on this period I am going to demonstrate about keyword. And from now on, this can be a very first graphic:

Why not consider photograph previously mentioned? is actually in which incredible???. if you believe so, I’l d demonstrate a number of graphic all over again under:

So, if you desire to obtain the incredible graphics regarding (Expanded Form Practice Worksheets Most Effective Ways To Overcome Expanded Form Practice Worksheets’s Problem), click on save icon to download these shots for your laptop. These are prepared for save, if you’d prefer and wish to own it, just click save symbol on the web page, and it’ll be immediately downloaded in your laptop.} As a final point if you want to secure new and recent photo related to (Expanded Form Practice Worksheets Most Effective Ways To Overcome Expanded Form Practice Worksheets’s Problem), please follow us on google plus or save this page, we try our best to provide daily up-date with fresh and new images. Hope you love staying here. For some upgrades and latest information about (Expanded Form Practice Worksheets Most Effective Ways To Overcome Expanded Form Practice Worksheets’s Problem) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to offer you up-date regularly with fresh and new images, like your browsing, and find the perfect for you.

Here you are at our site, contentabove (Expanded Form Practice Worksheets Most Effective Ways To Overcome Expanded Form Practice Worksheets’s Problem) published . Today we are pleased to announce that we have discovered a veryinteresting topicto be discussed, that is (Expanded Form Practice Worksheets Most Effective Ways To Overcome Expanded Form Practice Worksheets’s Problem) Most people trying to find information about(Expanded Form Practice Worksheets Most Effective Ways To Overcome Expanded Form Practice Worksheets’s Problem) and of course one of these is you, is not it?

expanded form / FREE Printable Worksheets – Worksheetfun | expanded form practice worksheets

expanded form / FREE Printable Worksheets – Worksheetfun | expanded form practice worksheets