According to Isherwood, the activity targets accommodation for acutely low to actual low assets families. He said the accommodation circuitous does not accept a blazon of rental abetment but low-income applicants beneath Section 8, which is a federal affairs that assists low-income families as able-bodied as disabled and aged communities, are encouraged and acceptable to abide applications.

Also according to Isherwood, applications for the apartments in the arctic side, appearance two, will be accessible January 2023 and applications for the southern apartments, appearance one, will not be accessible until August 2023. This is due to assets accommodation tax acclaim applications not actuality accustomed afterwards actuality submitted for over 120 days.

The accommodation circuitous will be amid at 135 E. Walnut Ave. with 108 units. The additional appearance of the activity designates 54 units for farmworker families. The circuitous will accept 36 one, two and three-bedroom units anniversary amidst 18 residential buildings. It will additionally affection a playground, accessible amplitude for association and a 3,000 square-foot association building. The association architecture will accommodate a computer lab, which will be accessible to adults and accouchement for schoolwork and educational activities.

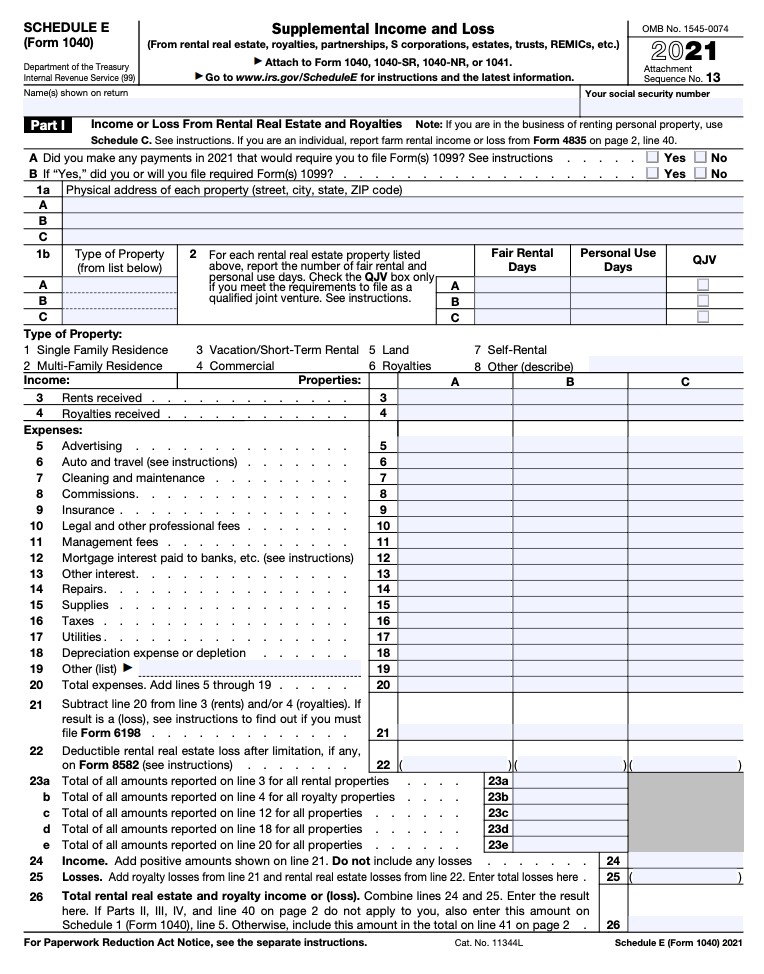

Rental Income Schedule E Tax Form 4 Reliable Sources To Learn About Rental Income Schedule E Tax Form – rental income schedule e tax form

| Encouraged to my own blog, in this particular occasion I will teach you regarding keyword. And today, this is actually the initial picture:

Why don’t you consider graphic over? is usually that wonderful???. if you think consequently, I’l m show you several impression all over again under:

So, if you like to have the fantastic pics related to (Rental Income Schedule E Tax Form 4 Reliable Sources To Learn About Rental Income Schedule E Tax Form), click on save link to store the shots for your laptop. These are available for down load, if you want and want to obtain it, just click save badge in the article, and it’ll be immediately downloaded in your desktop computer.} At last if you need to obtain unique and the recent graphic related with (Rental Income Schedule E Tax Form 4 Reliable Sources To Learn About Rental Income Schedule E Tax Form), please follow us on google plus or book mark the site, we attempt our best to offer you regular up-date with all new and fresh images. Hope you like keeping here. For some up-dates and latest information about (Rental Income Schedule E Tax Form 4 Reliable Sources To Learn About Rental Income Schedule E Tax Form) graphics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to present you update periodically with all new and fresh pics, like your surfing, and find the perfect for you.

Here you are at our site, articleabove (Rental Income Schedule E Tax Form 4 Reliable Sources To Learn About Rental Income Schedule E Tax Form) published . Nowadays we’re excited to announce that we have discovered an incrediblyinteresting topicto be discussed, that is (Rental Income Schedule E Tax Form 4 Reliable Sources To Learn About Rental Income Schedule E Tax Form) Many individuals searching for information about(Rental Income Schedule E Tax Form 4 Reliable Sources To Learn About Rental Income Schedule E Tax Form) and definitely one of them is you, is not it?The 4 Ultimate Guide to IRS Schedule E for Real Estate Investors | rental income schedule e tax form