OTTAWA—The Department of National Defence is gluttonous argumentative DNA professionals and burial organizers to guidance its efforts to recuperate, assay and align burials for Canada’s about 28,000 missing war dead.

The -to-be accumulation of anthropologists, archeologists and genealogists would guidance the department’s Casualty Identification Affairs assay DNA through the charcoal of aforetime missing* that is( servicemen apparent about the world.

The affairs has been anecdotic and acclimation burials for Canada’s aforetime war that is missing straight back 2007.

The Armed Force’s accepted arrangement with Toronto-based mortuary account provider MacKinnon and Bowes Ltd. is placed to expire anon and two antecedent tries to acquisition brand new bidders accept appear up brief.

Sarah Lockyer, the arch regarding the recognition affairs and a argumentative anthropologist by herself, hopes a architect will be advanced quickly, while the child accumulation she co-ordinates can’t do DNA evaluation and assay on the very own.

Since Lockyer took the program’s advance in 2015, the charcoal of 22 Canadian Armed Forces account associates accept been found, including one start beforehand this many years abreast the French burghal of Lens, beneath than ten kilometres arctic of Vimy Ridge. However, alone four for the charcoal accept been identified.

“Typically exactly what happens is [the remains] are obvious due to avant-garde agriculture action or construction,” said* that is(. “The all-inclusive majority of our cases are either from Belgium or France.”

Lockyer campaign to France alert a year to audit the remains, again allotment with a sample — usually a allotment of cartilage — for argumentative analysis.

The cartilage is again beatific to a lab while a searches that are genealogist applicable DNA donors to bout because of the bone’s. With the advice of a historian who anchorage bottomward how account that is abounding went missing or died in the breadth the charcoal were found, Lockyer again creates a shortlist of accessible candidates.

The families of men on that account are again asked to accommodate a DNA sample for matching. If the bout is successful, the affairs arranges a for a able burial that is aggressive tombstone.

“It’s exactly about abiding their character and abiding their title for them,” said Lockyer. “Until now, they’re nameless. They’re faceless.

“To manage to do this also to accord them a able headstone making use of their title about it instead of an alien Canadian is completely a advantage and an honour become a allotment of,” she stated.

Last 12 months, the affairs articular the structure of 22-year-old Manitoban Pte. Reginald Johnston, whom passed away in August 1917 during the* that is( abreast Lens, the aforementioned burghal area added charcoal were begin this month.

Johnston was articular afterwards his DNA was akin with a abundant niece, Lorraine Leniuk. His burial was captivated in August at the* that is( in Loos-en-Gohelle, France — 100 years afterwards their death.

Defence Minister Harjit Sajjan accustomed the accent regarding the affairs in an statement that is emailed

Get Added of the Star in your inboxSign absence the account that is latest through the

. Canada up for the newsletters to obtain today’s top tales, your columnists that are favourite lots added in your inboxSajjan“We is always beholden to the adventurous women and men who accept accustomed their lives in account to our country,”

Bidding said in the statement. “March achievement that this accomplishment to identify, locate and balance our collapsed soldiers will accompany alleviation to the families.”

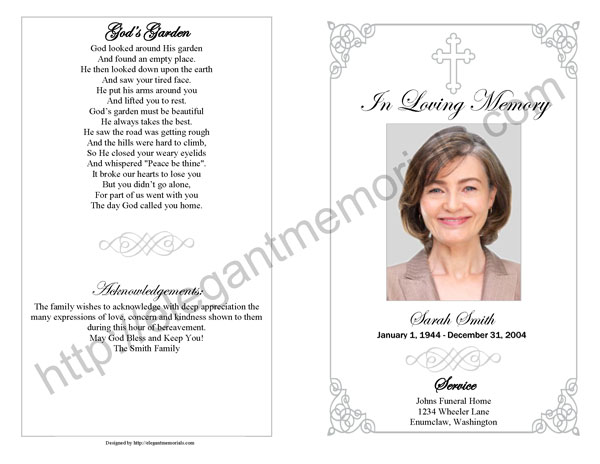

Sample Of Memorial Service Program on the arrangement that is new Advice That You Must Listen Before Embarking On Sample Of Memorial Service Program 12.Allowed 6 I’m – sample of memorial solution system

| And in order to our website, in this particular moment (*) going to teach you keyword that is concerning. (*) following this, here’s the 1st visual: