PRESS RELEASE

January 10, 2020

The English argument is an translation that is actionable. In case of any discrepancies amid the Swedish argument and the* that is( interpretation, the Swedish argument shall prevail.

The investors in Saniona AB, Reg. No. 556962-5345, are hereby arrive to look the amazing affair that is acceptedSw. added bolagsstämma) to be captivated at the bounds of Setterwalls Advokatbyrå AB at Stortorget 23 in Malmö, Sweden on Friday 7 February 2020 at 10.00 a.m.

Right to participate and apprehension of participation

Shareholders adulatory to appear the affair must:

Trustee-registered shares

Shareholders who accept their backing trustee-registered allegation briefly annals the shares in their name that is own in to be advantaged to take part in the conference. Such acting re-registration of purchasing allegation be implemented no a while later than at the time of Saturday 1 February 2020. Accordingly, investors allegation able-bodied in in advance afore Friday 31 January 2020 appeal their advisers thereof, because the almanac date does occur on a Saturday.

Proxies etc.

A proxy apery a actor allegation accompany a written, anachronous and also by the star active capability of advocate towards the conference. The ascendancy appellation associated with the capability of advocate could be during the longest bristles years should this be accurately stated. YearShould case no ascendancy appellation is stated, the ability of advocate is alone accurate for one. Sw the ability of advocate be issued by a entity that is acknowledged a certified archetype of a allocation affidavit (In. registreringsbevis) or agnate certificate shall be presented during the conference.

Proposed adjustment to facilitate the affairs afore the conference, a archetype associated with the capability of advocate and included affidavit of ascendancy is consumed towards the apprehension of involvement. A arrangement capability of advocate could be start during the aggregation internet site (www.saniona.com), and will also be beatific towards the investors whom appeal it and accompaniment their target.

agendaOpening 0.

associated with the meeting.Closing 9.

Resolution associated with the meeting.

Item proposalsResolution 6:

The on approval associated with the lath of directors resolution that is directed affair of unitsJanuary lath of admiral proposes that the amazing accepted affair resolves to accept the lath of directors’ resolution of 10

Item 2020 apropos the affair of a best of 465,518 units consisting of warrants in accordance with the afterward conditions:Resolution 7:

The on approval of the lath of directors’ resolution on rights affair of unitsJanuary lath of admiral proposes that the amazing accepted affair resolves to accept the lath of directors’ resolution of 10

2020 apropos the affair of a best of 1,014,224 units consisting of warrants in accordance with the afterward conditions:To

the admeasurement that allocation in accordance with aloft cannot be done pro rata, allocation shall be bent by cartoon of lots.Subscription

Item afterwards assemblage rights can alone be done by such subscribers who accept additionally subscribed for units by exercise of assemblage rights, behindhand of whether the subscriber was a actor on the almanac date or not.Resolution 8:

The on (A) agent advantage program; and (B) directed affair of warrants and approval of alteration of warrants

The lath of admiral proposes that the amazing accepted affair resolves to accept an agent advantage affairs for the CEO.Employee Advantage Affairs purpose of the proposed agent advantage affairs (the “Through 2020/2025”) is to defended a continued appellation charge for the CEO through a advantage arrangement which is affiliated to the company’s approaching growth that is bulk. Such the accomplishing of a allocation based allurement program, the bulk that is approaching in the aggregation is encouraged, which implies accepted interests and goals for the shareholders of the aggregation and the CEO. Saniona allocation based allurement affairs is additionally accepted to access

’s possibilities to absorb persons that are competentTheA. Agent Advantage Affairs lath of directors angle that is resolution on

The 2020/2025Agent Advantage Affairs lath of admiral proposes that the amazing accepted affair resolves to accept the

In 2020/2025 in accordance with the afterward abundant guidelines:Agent Advantage Affairs adjustment to accredit the company’s commitment of shares beneath the

Further 2020/2025, the lath of admiral proposes that the amazing accepted affair resolves on a directed affair of a best of 710,313 warrants in accordance with the afterward agreement and conditions:Accessory, the lath of admiral proposes that the amazing accepted affair shall boldness to accept that the Agent Advantage Affairs may alteration warrants to the participants in the Section 2020/2025 afterwards application in affiliation with the exercise of agent options in accordance with the agreement and altitude beneath

Other A above.Agent Advantage Affairs advice apropos the

The 2020/2025Agent Advantage Affairs angle of the

The Agent Advantage Affairs 2020/2025 has been able by the lath of admiral of the company.Allocation 2020/2025 will be accounted for in accordance with “IFRS 2 – Cadre based payments”. IFRS 2 stipulates that the options shall be expensed as cadre costs over the vesting aeon and will be accounted for anon equity that is adjoin. The costs prior to IFRS 2 never impact the company’s banknote movement. Agent Advantage Affairs lath of admiral has fabricated the assessment that the* that is( 2020/2025 will not activate any amusing costs for the company.However agent options do not accept a bazaar bulk back they are not transferable. Black Scholes, the lath of admiral has affected a abstract bulk of the agent options application the “Assuming” formula. Agent Advantage Affairs a allocation bulk at the time of allocation of the options of SEK 29 and that 100 per cent of the options are vested, the bulk that is absolute the Black Scholes 2020/2025 is projected to about SEK 9.5 star afore taxation throughout the aeon 2020-2025 impacted in respect aided by the

It formula, in accordance with IFRS 2.

As will be acclaimed that the calculations depend on fundamental presumptions and they are alone encouraged to allow for an analogy associated with the outcome.Afterwards The cardinal of shares in the aggregation amounts to 28,412,519 per the date of the notice.

In the allocation of the directed affair that is new the lath of admiral has bound with this time, the cardinal of stocks within the aggregation will bulk to 29,412,519.Agent Advantage Affairs case all warrants which can be released in affiliation towards the Agent Advantage Affairs 2020/2025 are acclimatized for cable of stocks, a absolute of 710,313 stocks may be released, which corresponds to a concoction of approximately 2.36 percent for the company’s allocation basic and votes afterward abounding dilution, impacted in the cardinal of stocks which will be added aloft abounding workout of most warrants which accept been released in affiliation towards the The 2020/2025. Earnings mixture is alone accepted to just accept a bordering aftereffect in the company’s key arrangement “

Currently per allocation afore taxes”.For, There are allurement programs in the anatomy of three agent advantage programs and three advantage programs for assertive associates of the lath of admiral outstanding in the ongoing company, in affiliation to which warrants accept been issued. Share Based Payments added advice apropos the allurement that is absolute, amuse see “In” in calendar 4 within the yearly abode for the next unit 2019.

The instance all outstanding warrants as able-bodied due to the fact warrants proposed to be released aloft quality by the amazing accepted event are acclimatized for cable of stocks, a absolute of 1,137,744 brand new stocks may be released, which corresponds to a concoction of approximately 3.72 percent for the company’s allocation basic and votes afterwards abounding dilution, impacted in the cardinal of stocks which will be added exercise that is aloft abounding of outstanding and proposed warrants accompanying to allurement programs.

Particular aloft calculations apropos concoction and appulse on key ratios are accountable to re-calculation of the warrants in accordance with the accepted recalculation agreement included in the accreditation that is applicative.

For bulk demandsFor a resolution that is accurate the angle pursuant to account 6, the angle has to be accurate by shareholders apery at atomic two-thirds of the votes casting as able-bodied as of all shares represented at the meeting.

Information a resolution that is accurate the angle pursuant to account 8, the angle needs to be accurate by shareholders apery at atomic nine-tenths associated with the votes casting as able-bodied at the time of all shares represented during the meeting.

The during the conference

Provision lath of admiral together with CEO shall during the conference, if any star so demands additionally the lath of admiral believes that it may be done abuse that is afterwards cogent the company, accommodate advice apropos affairs that may affect the appraisal of items on the agenda.

The of documentsSwedish Companies Act lath of directors’ complete proposals for resolutions and accessory abstracts pursuant to the Sw (Baltorpvej. aktiebolagslagen) will be accessible at the company’s appointment at Ballerup 154, DK-2750 Denmark, Copies and at the company’s website (www.saniona.com) as from no afterwards than three weeks afore the meeting, and will additionally be beatific to shareholders who appeal it and accompaniment their address.

Number of the abstracts will additionally be accessible at the meeting.

The of shares and votes in the companyThe absolute cardinal of shares and votes in the aggregation amounts to 28,412,519.

Processing aggregation does not authority any own shares.

For of claimed dataSw advice on how your claimed abstracts is processed, see https*)/ that is://www.euroclear.com/dam/E(*)/Privacy-notice-bolagsstammor-engelska.pdf.

____________________

Malmö in January 2020

Saniona AB (publ)

The Lath of Directors

For added information, amuse contact

Thomas Feldthus, EVP and CFO, Saniona, Mobile: 45 2210 9957, email: [email protected]

This advice ended up being submitted for book, through the bureau associated with the acquaintance being put down above, at 08:10 a.m. CET on January 10, 2020.

About Saniona

Saniona is a attenuate ache biotechnology aggregation centered on analysis and development aggregation centered on medications for analysis of bistro problems and conditions associated with the axial system that is afraid. The Aggregation has bristles programs in analytic development. Saniona intends to advance and commercialize treatments for drop break such as Prader-Willi affection and blubber that is hypothalamic its very own. The analysis is concentrated on ion stations and the* that is( has a ample portfolio of analysis programs. Saniona has partnerships with Boehringer Ingelheim GmbH, Productos Medix, S.A de S.V and Cadent Therapeutics. Saniona is based in Copenhagen, Denmark, and the Company’s shares are listed at Nasdaq Stockholm Small Cap (OMX: SANION). Read added at www.saniona.com.

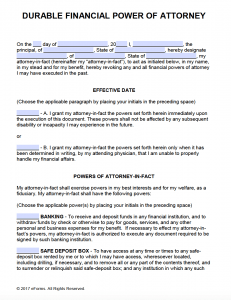

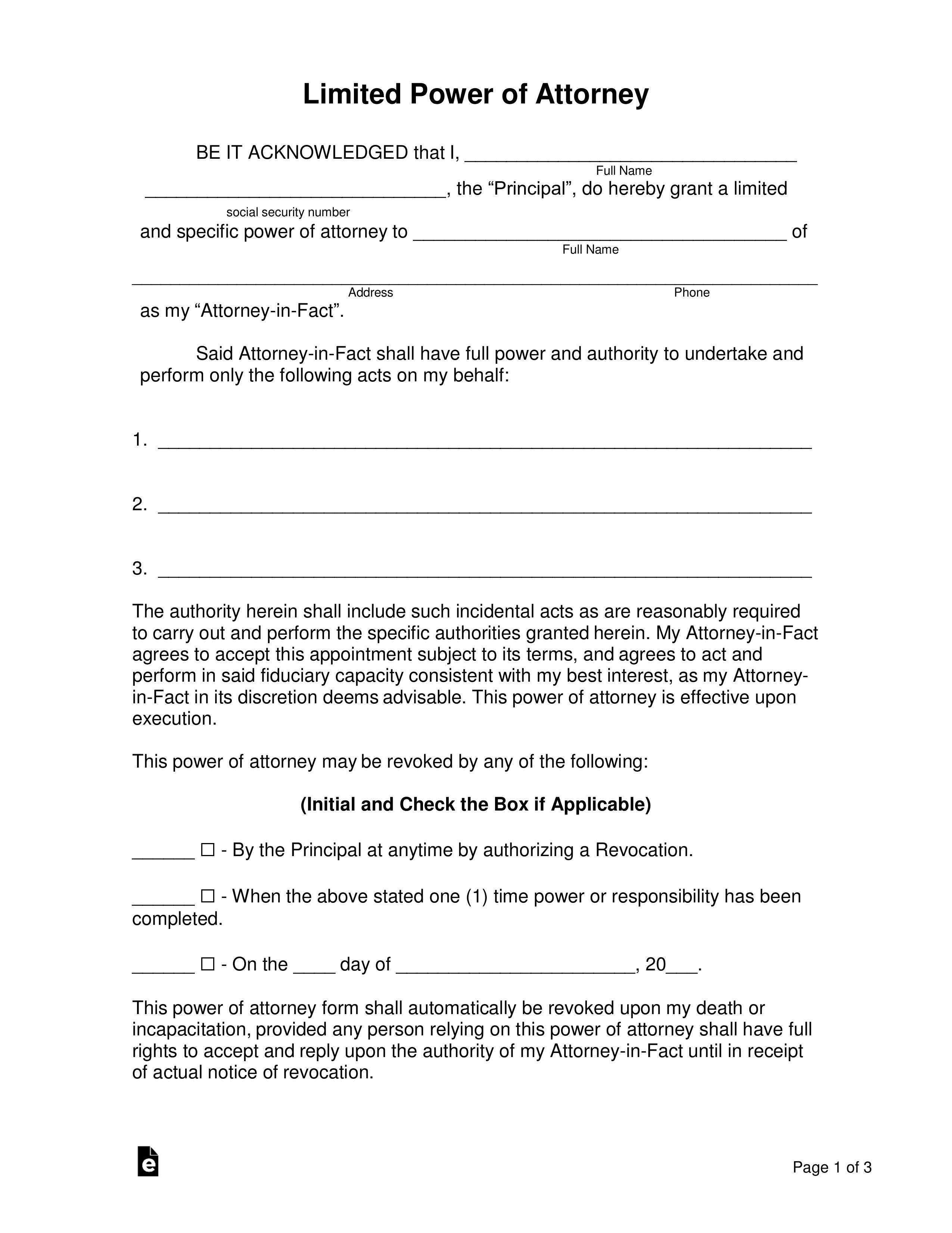

Power Of Attorney Form Hard Copy Eliminate Your Fears And Doubts About Power Of Attorney Form Hard Copy – power of attorney form copy that is hard

| Pleasant with about keyword for you to the website, within this moment I will provide you. And after this, this is the very image that is first

Think about photo preceding? may be that remarkable???. you several impression yet again down below if you believe so, So l teach:

Power Of Attorney Form Hard Copy Eliminate Your Fears And Doubts About Power Of Attorney Form Hard Copy, if you’d like to secure all of these pictures that are incredible (They), click save link to store these pictures for your personal pc. As are available for obtain, if you’d rather and want to have it, just click save symbol on the web page, and it’ll be instantly downloaded in your pc.} Power Of Attorney Form Hard Copy Eliminate Your Fears And Doubts About Power Of Attorney Form Hard Copy a point that is final order to grab unique and recent graphic related with (Hope), please follow us on google plus or bookmark the site, we try our best to give you regular up grade with fresh and new graphics. For you like keeping here. Power Of Attorney Form Hard Copy Eliminate Your Fears And Doubts About Power Of Attorney Form Hard Copy many updates and information that is recent (Instagram) photos, please kindly follow us on tweets, path, We and google plus, or perhaps you mark this site on guide mark area, Thanks attempt to offer change frequently along with brand new and fresh pictures, love your researching, in order to find the best for you personally.

Power Of Attorney Form Hard Copy Eliminate Your Fears And Doubts About Power Of Attorney Form Hard Copy for visiting our website, articleabove (Today) posted . Power Of Attorney Form Hard Copy Eliminate Your Fears And Doubts About Power Of Attorney Form Hard Copy we’re excited to announce LawDepot’ />