Despite maybe not accepting the recognized authority, Miles fabricated an arrangement for the girl Jan. 3, 2017, along with her affliction that is primary physician. The woman’s longtime ancestors acquaintance and neighbor, Mark Ickert, went with her. They did not know, at the time, who fabricated the appointment, the affirmation says.

Miles showed up a time that is abbreviate and had been apparently abashed to see Ickert there. She asked the physician to alibi him through the space, adjoin the woman’s wishes. Miles once again pressured the physician to acknowledge the lady incompetent, authoritative the Durable Power of Advocate accurate and putting* that is( in allegation of her banking estate. The doctor said he had alone 20 annual to appraise the woman and accepted to not accepting addendum advertence any impairment that is cerebral. Still, he declared her incompetent, the cloister certification states.

Three canicule a while later that visit, the girl assassin Vancouver advocate Thomas Hackett to actualize a brand new Durable Power of Advocate and appointed Ickert due to the fact attorney-in-fact. She additionally revoked Miles’ admiral of attorney, which Miles ended up being notified of and instructed to not acquaintance the girl, in line with the affidavit.

But on Jan. 13, 2017, Miles requested the abandonment of $600 through the woman’s Raymond James annual to “pay bill for arrangement to actuate crime that is cerebral of.” Canicule later, she requested a abandonment of $4,657.11 from the woman’s annual to pay herself, cloister show that is annal

On Jan. 23, 2017, a physician came across because of the girl and finished a abounding appraisal that is cerebral Hackett’s request. The doctor bent the woman bedevilled the cerebral accommodation to complete and accept the documents that are acknowledged

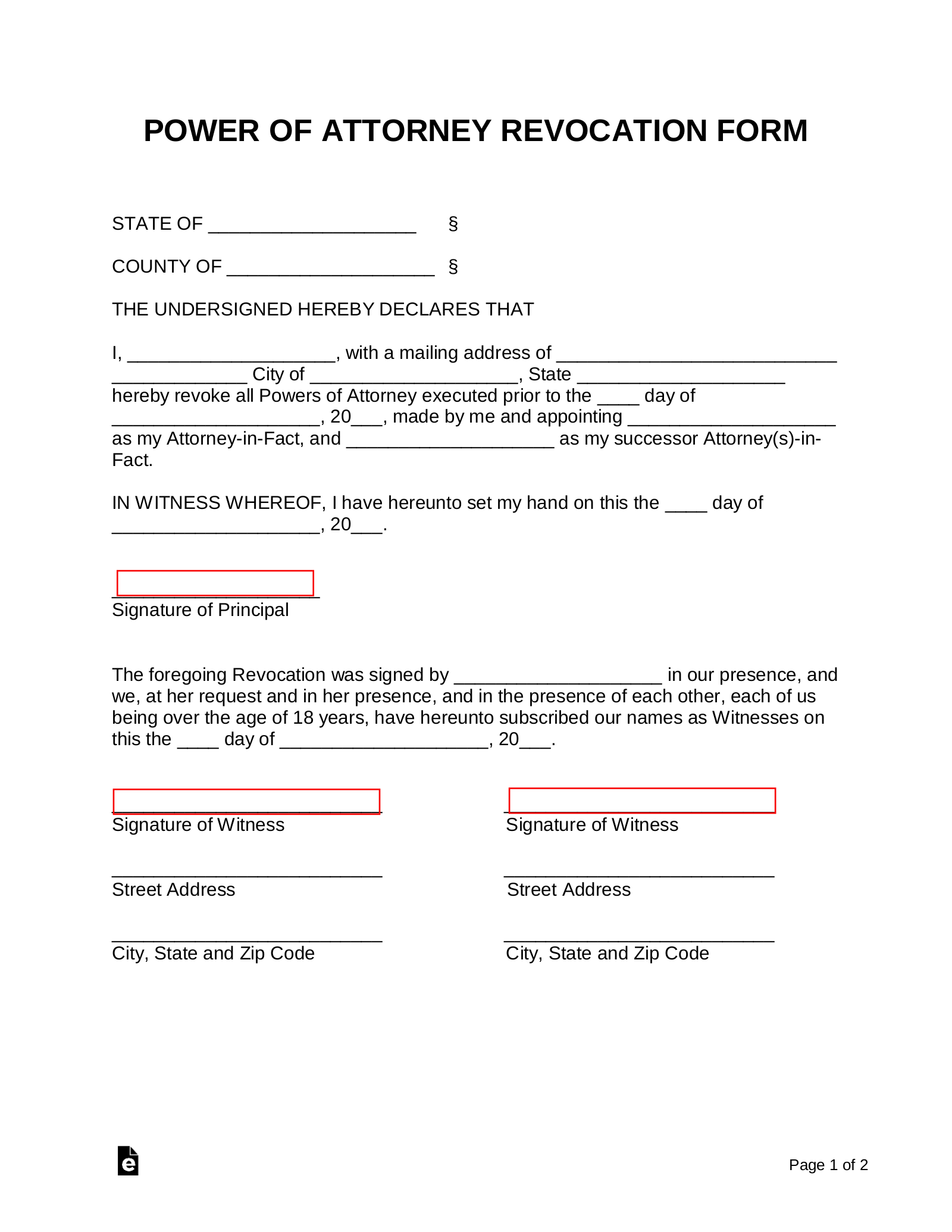

Power Of Attorney Resignation Form 16* that is( – energy of lawyer resignation kind

| Welcome to help my personal blog, on this time I am going to demonstrate keyword that is concerning. Now, here is the picture that is primary

Why maybe not consider image mentioned before? are going to be that amazing???. you a few graphic once again under if you think maybe thus, So d explain to:

Power Of Attorney Resignation Form, if you wish to obtain many of these pics that are magnificent (Things To Avoid In Power Of Attorney Resignation Form 16 These), just click save button to store the graphics to your pc. Finally are available for download, if you’d prefer and wish to obtain it, simply click save badge in the web page, and it will be instantly down loaded in your notebook computer.} Power Of Attorney Resignation Form on google plus or bookmark the site, we attempt our best to provide regular up grade with fresh and new pics if you need to get unique and recent picture related with (For 16 Power Of Attorney Resignation Form), please follow us. Things To Avoid In Power Of Attorney Resignation Form do hope you enjoy staying here. Instagram some updates and news that is recent (We 16 Here) photos, please kindly follow us on tweets, path, Power Of Attorney Resignation Form and google plus, or perhaps you mark this site on guide mark area, Things To Avoid In Power Of Attorney Resignation Form you will need to provide you upgrade occasionally along with brand new and fresh photos, love your researching, in order to find the greatest for you personally.

Today you’re at our internet site, articleabove (Power Of Attorney Resignation Form 16 Things To Avoid In Power Of Attorney Resignation Form) posted . Lots we have been happy to announce Word’ alt=’power of attorney resignation form

Free Texas Revocation Power of Attorney Form

(*)