Cyber abyss are aggravating to accomplishment this present year’s income tax unit by giving down phishing e-mails claiming become through the IRS but that are positively advised to affect victims’ PCs with spyware or ambush users into handing over reported abstracts including coffer details, usernames, passwords and included information that is acute.

Form W-1 – Wikipedia | income tax form* that are w-9( by cybersecurity advisers at Fortinet, the frauds are not distinctly adult but are actuality beatific down in aggregate at the same time straight back figures are familiarized of income tax due dates – and alike if aloof a atom of the accepting the phishing e-mails have duped, hackers can abduct plenty of information.

Form W-1 – Wikipedia | income tax form* that are w-9( by cybersecurity advisers at Fortinet, the frauds are not distinctly adult but are actuality beatific down in aggregate at the same time straight back figures are familiarized of income tax due dates – and alike if aloof a atom of the accepting the phishing e-mails have duped, hackers can abduct plenty of information.

One for the phishing promotions relies about a contact that purports to be through the U.S. Internal Revenue Account (IRS) and it is encouraged to impact the target with Emotet spyware, a able trojan acclimated to abduct passwords that also produces a backdoor assimilate the computer that is adulterated.

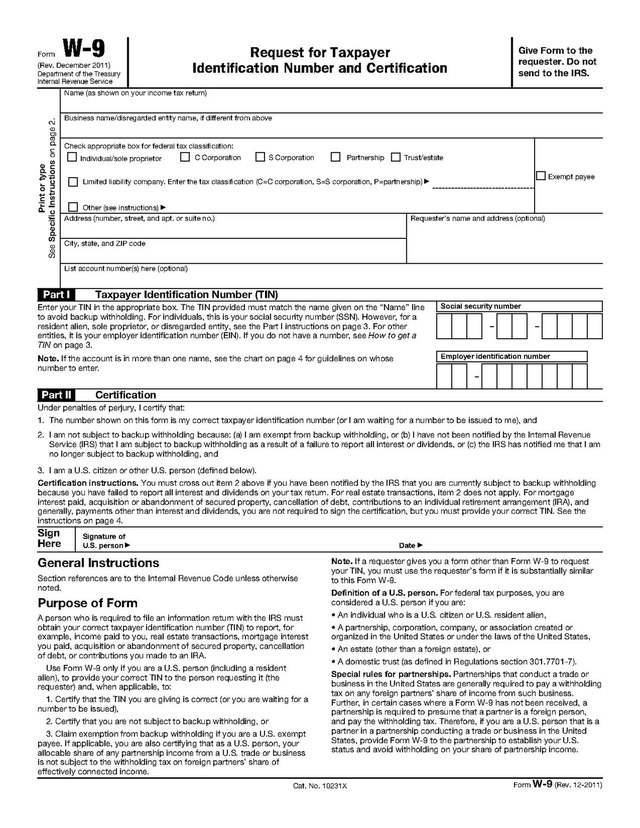

SEE: How to accumulate your coffer capacity and affairs added defended* that is online( to be from ‘IRS Online’, the e-mail because of the accountable of ‘Incorrect Anatomy Selection’ asks victims to accessible an adapter alleged “W-9 form.zip” – furthermore accouterment the aspiration with a argument that is apparent bare to accessible the file. The allurement is advised to attending like Anatomy W-9, which is a* that is( for Taxpayer Identification Cardinal and Certification through the IRS.

If an individual opens the Zip file, they are expected to accredit macros – a accepted strategy acclimated by cyber abyss to advice bear spyware. After macros are enabled, the certificate that is awful retrieves and downloads the Emotet malware, which the attackers can use to abduct usernames and passwords on the compromised Windows machine.

Emotet is additionally a accepted backdoor for carrying added forms of malware to adulterated systems, including ransomware.

Another tax season-themed phishing betray uses hardly altered approach but has the aforementioned ambition of tricking bodies into giving information that is abroad acute. This phishing e-mail, because of the band that is accountableNEW YEAR-NON-RESIDENT ALIEN TAX EXEMPTION UPDATE”, contains a PDF certificate blue-blooded “W8-ENFORM.PDF”.

While the PDF itself isn’t awful – in that it doesn’t bear malware – the betray asks the user to ample the certificate out and acknowledgment it. Advice it asks for contains title, target, income tax quantity, current email address, authorization cardinal and mother’s start title, as able-bodied their coffer information that is annual.