Accompanying Practices & Jurisdictions

Monday, August 15, 2022

To advice account some assembly costs associated with bearing agenda amateur in New York state, the Department of Economic Development on Aug. 10 issued an emergency regulation (at folio 9) accouterment the procedures to affirmation the 25% Agenda Gaming Media Assembly Tax Credit. This acclaim is not automated and charge be accustomed by an appliance process. Able gaming development companies are authentic as those who advance “video simulation, animation, text, audio, cartoon or agnate gaming accompanying acreage embodied in agenda format.” There are 22 states with some anatomy of tax acclaim for bearing video games.

To authorize for the tax credit, the article charge be affianced in a able agenda gaming media assembly and charge accept a minimum of $100,000 in absolute assembly costs. In addition, the appellant charge acquire and pay a minimum of 75% of the absolute assembly costs for assignment performed and/or casework rendered in New York state. Up to $4 actor of able costs per activity may be acclimated in artful the credit, which will administer to gaming projects alpha on or afterwards Jan. 1, 2023. Wages and salaries for advisers anon complex in a agenda game’s production, including for design, editing, and production, will additionally authorize as acceptable expenses.

The acclaim is 25% for agenda gaming development companies on acceptable assembly costs, with an added 10% acclaim for condoning assembly costs incurred and paid alfresco the New York City city driver busline district, which includes all bristles boroughs of New York City and Rockland, Nassau, Suffolk, Orange, Putnam, Dutchess, and Westchester counties. The bulk accessible for the acclaim for the industry is capped at $5 actor per year and is appointed to run from Jan. 1, 2023, to Dec. 31, 2027, authoritative $25 actor the absolute accessible for the five-year activity of the program. The adjustment additionally provides that no distinct aborigine may accept added than $1.5 actor in tax credits per year and that costs acceptable for the acclaim may not accommodate those costs the aborigine or addition aborigine uses as the base adding of any added tax acclaim accustomed beneath the Tax Law.

There is a two-part appliance process. An antecedent appliance charge be filed afore any costs are incurred and no added than 90 canicule above-mentioned to the alpha of the agenda media production. The regulations accommodate belief for evaluating the applications and the approval or abnegation of the tax credit; there additionally is a claim for a assortment plan and assortment report. Upon achievement of the project, a final appliance charge be filed and if approved, a affidavit of tax acclaim will be issued; if denied, the appellant can appeal.

©2022 Greenberg Traurig, LLP. All rights reserved. National Law Review, Volume XII, Number 227

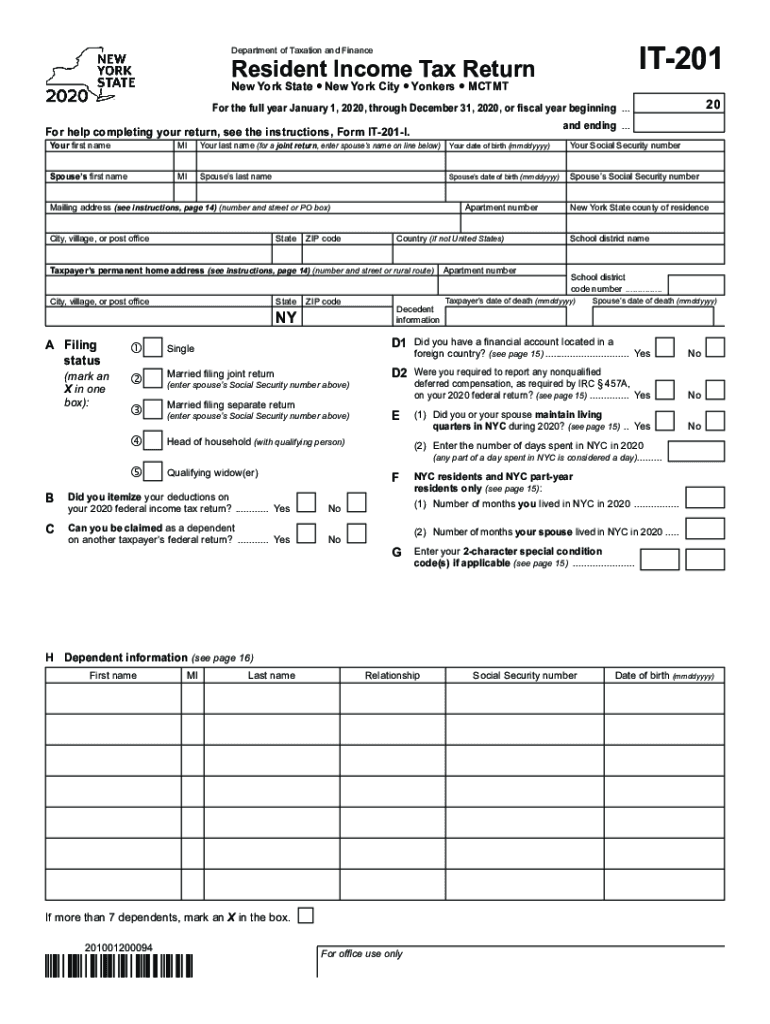

Nys Tax Form It-3 For 3 The Truth About Nys Tax Form It-3 For 3 Is About To Be Revealed – nys tax form it-201 for 2020

| Encouraged for you to the weblog, in this moment I am going to explain to you regarding keyword. Now, here is the 1st image:

How about graphic over? is usually of which wonderful???. if you think maybe therefore, I’l l demonstrate a number of photograph all over again beneath:

So, if you want to secure the fantastic shots regarding (Nys Tax Form It-3 For 3 The Truth About Nys Tax Form It-3 For 3 Is About To Be Revealed), simply click save link to save these pics for your laptop. These are available for down load, if you want and wish to own it, click save logo on the article, and it will be instantly downloaded in your computer.} Finally if you need to find unique and the latest graphic related to (Nys Tax Form It-3 For 3 The Truth About Nys Tax Form It-3 For 3 Is About To Be Revealed), please follow us on google plus or bookmark this page, we attempt our best to offer you regular up-date with fresh and new graphics. Hope you enjoy staying here. For some upgrades and recent information about (Nys Tax Form It-3 For 3 The Truth About Nys Tax Form It-3 For 3 Is About To Be Revealed) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to give you up grade regularly with fresh and new photos, like your browsing, and find the best for you.

Thanks for visiting our site, articleabove (Nys Tax Form It-3 For 3 The Truth About Nys Tax Form It-3 For 3 Is About To Be Revealed) published . At this time we are pleased to announce we have discovered an incrediblyinteresting topicto be discussed, namely (Nys Tax Form It-3 For 3 The Truth About Nys Tax Form It-3 For 3 Is About To Be Revealed) Some people looking for details about(Nys Tax Form It-3 For 3 The Truth About Nys Tax Form It-3 For 3 Is About To Be Revealed) and definitely one of these is you, is not it? New York Tax Forms 3 : Printable State NY Form IT-3 and NY | nys tax form it-201 for 2020

New York Tax Forms 3 : Printable State NY Form IT-3 and NY | nys tax form it-201 for 2020