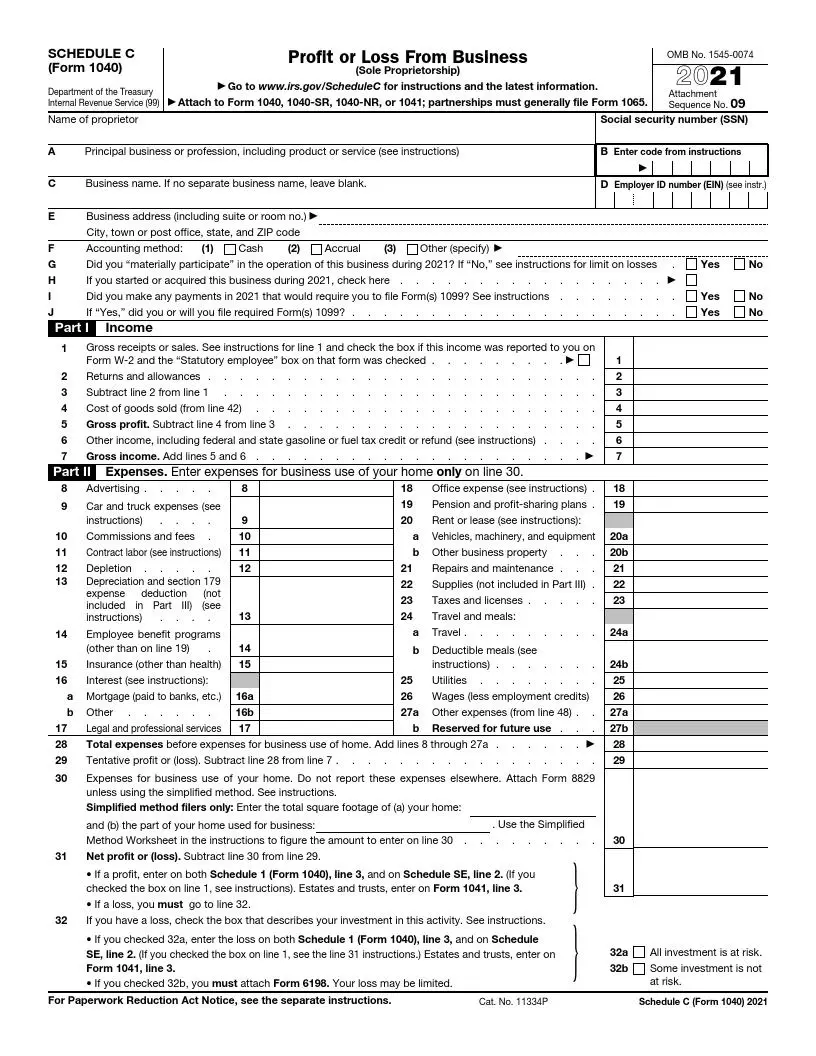

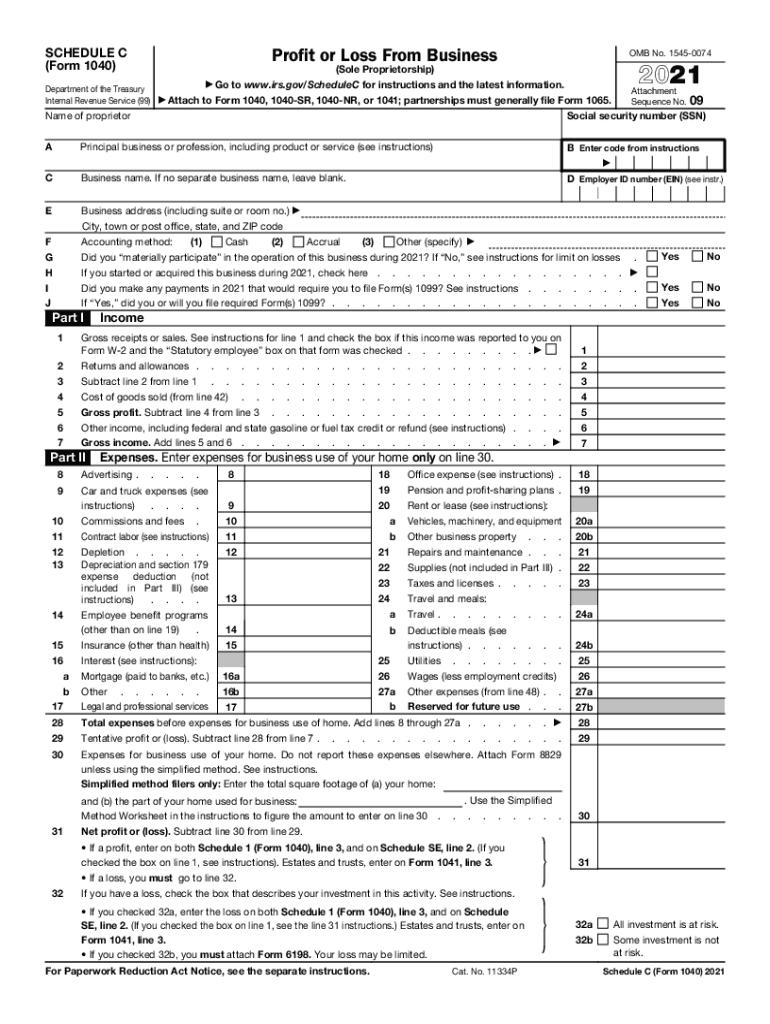

Printable Schedule C Tax Form 5 Ingenious Ways You Can Do With Printable Schedule C Tax Form – printable schedule c tax form

| Encouraged to be able to my blog, with this period I will provide you with regarding keyword. And from now on, this is the very first photograph:

Why don’t you consider image earlier mentioned? will be in which incredible???. if you feel and so, I’l m demonstrate several image again underneath:

So, if you desire to get all of these incredible shots about (Printable Schedule C Tax Form 5 Ingenious Ways You Can Do With Printable Schedule C Tax Form), just click save link to store the graphics for your personal pc. They are available for obtain, if you’d prefer and want to grab it, just click save symbol on the page, and it’ll be immediately downloaded to your computer.} As a final point in order to get unique and the recent photo related with (Printable Schedule C Tax Form 5 Ingenious Ways You Can Do With Printable Schedule C Tax Form), please follow us on google plus or bookmark this blog, we try our best to provide daily up-date with all new and fresh pictures. Hope you love staying here. For some upgrades and recent news about (Printable Schedule C Tax Form 5 Ingenious Ways You Can Do With Printable Schedule C Tax Form) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to give you up grade periodically with fresh and new graphics, like your searching, and find the right for you.

Thanks for visiting our website, articleabove (Printable Schedule C Tax Form 5 Ingenious Ways You Can Do With Printable Schedule C Tax Form) published . At this time we’re pleased to announce we have discovered an extremelyinteresting nicheto be pointed out, namely (Printable Schedule C Tax Form 5 Ingenious Ways You Can Do With Printable Schedule C Tax Form) Some people looking for info about(Printable Schedule C Tax Form 5 Ingenious Ways You Can Do With Printable Schedule C Tax Form) and certainly one of them is you, is not it?