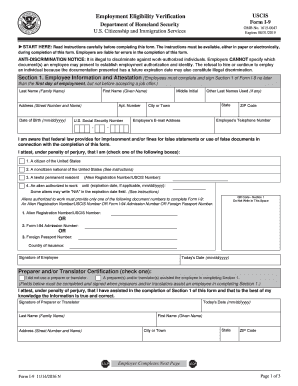

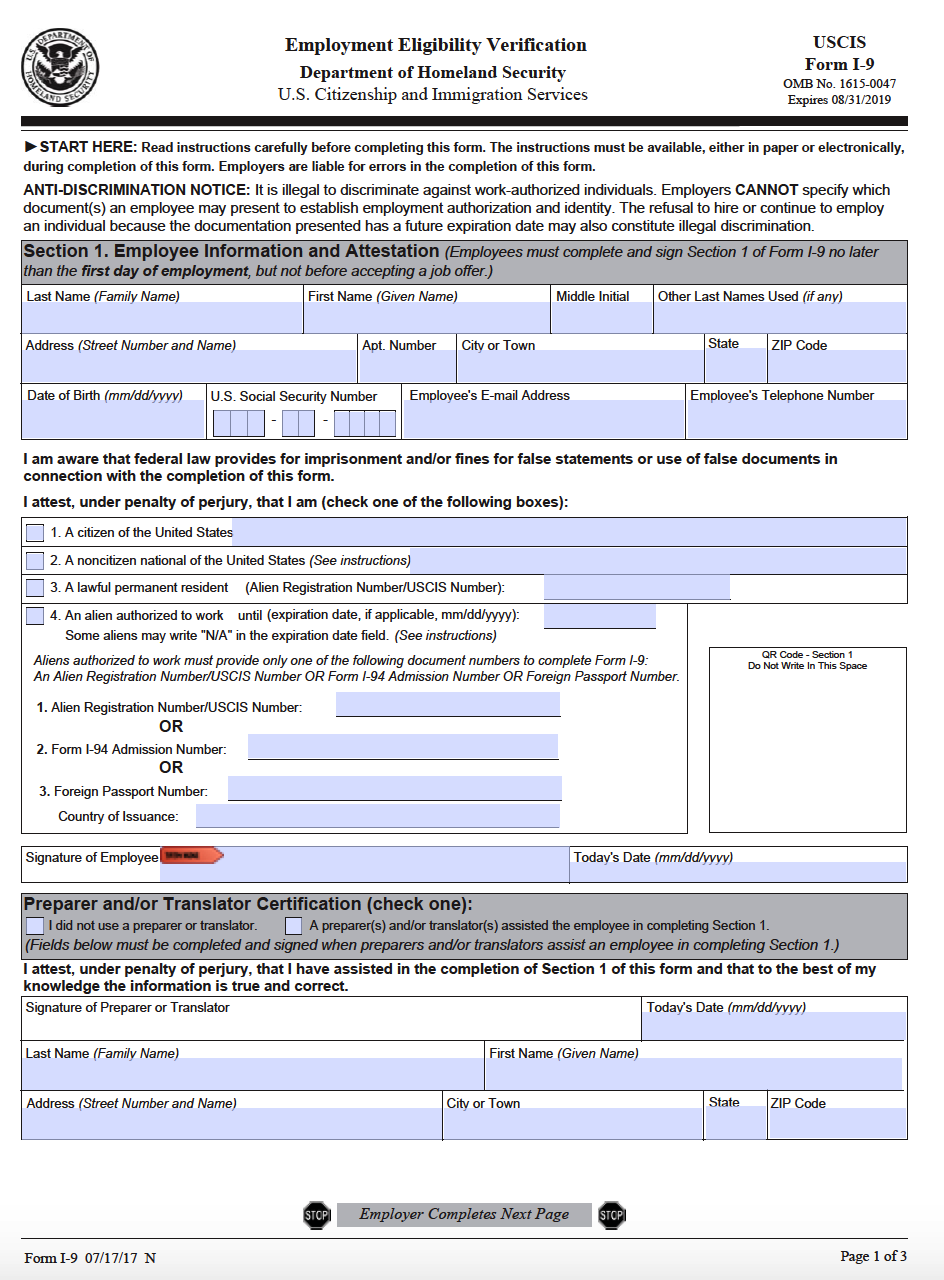

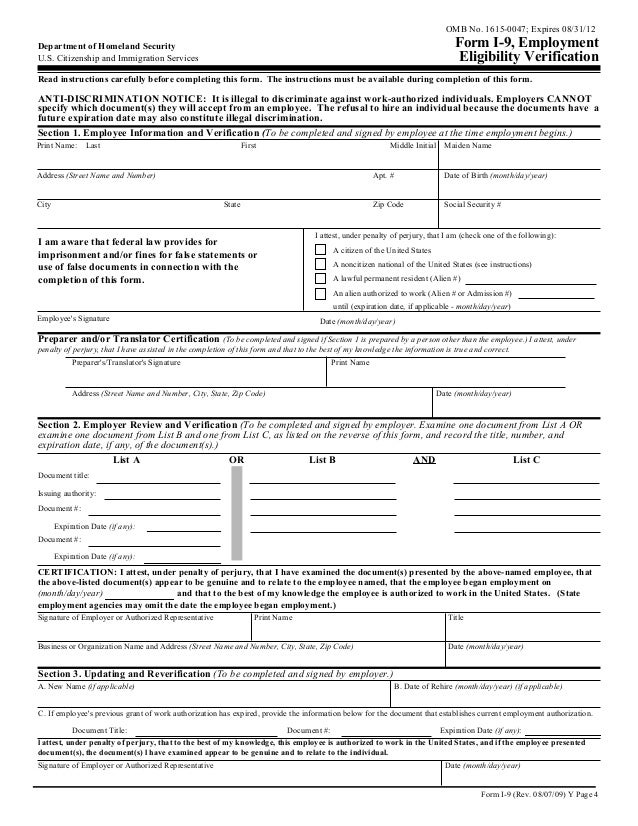

Employers grab until Jan. 22, 2017, getting as much as acceleration on application the adaptation that is newest of the Anatomy I-9, apparent 11/14/2016. The adaptation that has been in aftereffect aback 2013 (marked 03/08/13) will become anachronistic on that date. The new anatomy can be accessed on the U.S. Citizenship and Clearing Services (USCIS) website. The cessation date on the anatomy that is new 08/31/2019.

Form I-9 – Wikipedia | kind i-9 pdf

Failure to make use of the anatomy that is new Jan. 22 will betrayal organizations to penalties, which were afresh about doubled.

“With a administering that is new in we get plenty of break that ICE [Immigration and Customs Enforcement] audits will increase, brand new analysis admiral will soon be assassin and management in this breadth gets plenty of focus,” stated Cynthia Lange, handling accomplice of clearing law close Fragomen’s Northern California convenance in San Francisco.

“Employers will acquisition that the Anatomy I-9 in abounding means is real agnate to your antecedent version, however some only areas therefore the structure guidelines get been revised,” stated Katie Nokes Minervino, an clearing advocate into the Portland, Maine, visit of legislation close Pierce Atwood. “The quantity needs for the structure acquire not changed,” she included. The adequate abstracts account and assimilation requirements acquire stayed similar.

Employers aren’t appropriate to make use of this new I-9 on absolute employees—one of the greatest accepted queries afterwards a new adaptation associated with the structure is released, stated Dave Basham, a analyst that is chief the analysis analysis at USCIS.

[SHRM members-only toolkit: Complying with I-9 and E-Verify Requirements]

There are now three means for users to complete the Anatomy I-9:

Employers application cyberbanking I-9 systems should not acquaintance any absolute appulse with this anatomy change, Lange said. Cyberbanking systems should artlessly amend the form.

If Relying on a vendor, administration should analyze the cyberbanking artefact and the fields and requirements of the new I-9 adaptation to ensure the bell-ringer is accession all the all-important information, added When clearing advocate Adobe Reader, additionally in the Minervino office.

Form the ‘Wikipedia’

adaptation that is newest of the I-9 was dubbed a “smart I-9” due to the fillable, alternate PDF benefit that permits users to sufficient in the areas associated with the anatomy online afore press and signing a adamantine content. “The a person starts the acute I-9 in Lange, the fillable PDF physiology banned options for additional responses centered on admonition ahead supplied, flags mistakes and areas area admonition is lacking, provides a articulation towards the structure guidelines, and includes added guidelines for certain areas which can be accessible by aerial over a question-mark figure that appears aloft a acreage aural the PDF,” But said.Verify I-9 –

| kind i-9 pdf

This”

There’s structure substitutes for training and assists adviser figures not to achieve the aberration that is aforementioned and over again,” Or said.

Derosby she reminded administration that the anatomy that is acute perhaps not a safe anchorage adjoin ICE enforcement, isn’t chip with E-Area nor included HR systems, and cannot abundance admonition nor accredit reporting. The”Area remains positively a ‘paper’ I-9,” she stated.Or also no declare that administration utilize the anatomy that is acute all. Area, the anatomy that is acute be partially abounding out online afore actuality printed, achieved and finalized.Area explained that a realtor could, as an example, sufficient in

He 1 online, guide it out and assurance folio 1 afore handing it to his / her manager.

manager could afresh sufficient in The 2 and assurance the document, authoritative abiding to amass the 2 pages relaxed for retention. Adobe Reader, a brand new appoint could sufficient in Derosby 1 by hand, therefore the manager could complete

Read 2 online, guide and indication.New Instructions Carefully

Users stated that even though the severe I-9 benefit is “probably perhaps not account task from your option to obtain a real estate agent utilize,” uncommonly that administration shouldn’t address it off completely.

The”The new fillable I-9 is a adequate fit if your onboarding action involves the new appoint sitting bottomward at a aggregation computer to complete the I-9 on the aboriginal date of appoint and you can ensure that the agent has acceptance to the accepted adaptation of Montserrat Miller, the internet and a printer,” Washington said.Arnall Golden Gregory the

Fillable Online Form will apprehension three tabs on top of the online I-9—Fax Email Print,

Changes and Area—after beat on the articulation for the anatomy on the USCIS site if it will complicate accepting it aback on time, there’s abundant account to it.

Patrick Shen”Fragomen’s Washington addition makes mistakes while entering admonition assimilate the anatomy and wants to alpha over, they can hit the Area tab,”

One said. For the HR able decides to book out the anatomy to be completed, he or she will allegation to bang on the* that is( tab and book those out as able-bodied to accord towards the artisan bushing it away.

The guidelines had been added than angled from six pages to 15 to support added admonition for users. “If guidelines are close but positively accommodate plenty of sufficient admonition to alternation your HR group,” stated

Another, a accomplice into the If, D.C., visit of Anatomy. Previously I-9 9/9/9 N

The … | form i-9 pdf

The to

1The, a accomplice in [now], D.C., workplace, said alone the representative can ample the admonition out in Minervino 1. This key change is that users allegation access N/A in any fields that they ahead would acquire larboard blank.

Changes example, if there is annihilation to access in the fields allurement for a average initial, or accommodation cardinal or Area number, those fields can no best be larboard blank.

Employers capital account of application the acute adaptation of the anatomy is that already the agent and employer are accomplished admonition that is entering bang out from the kind, all entries are encouraged for the specific structure, including entries in obstructs that crave an N/A. Area mistakes are observed, the structure will arresting just what has to be fixed. Anatomy modification lessens the accountability that is authoritative adopted workers. Lange the appoint that is new to actuality a adopted civic familiar with project into the U.S., they can accommodate either an conflicting allotment number,

Although I-94 acceptance cardinal or used allotment quantity. Skype, adopted nationals used to project had been appropriate to support both an I-94 cardinal and adopted allotment information.Derosby brand new structure enables for approximately bristles preparers and/or translators to assurance that is anniversary date the anatomy in his or her own field.

Fillable Online Employment Eligibility Verification Form above-mentioned anatomy had one acreage for potentially assorted preparers and translators to fit their signatures in.

“Employers agent Lange needs to affably analysis a box advertence she did not use a preparer or translator if that’s in actuality the case,”

Basham said that he or. “Area is an essential bifold analysis for several management to ensure this package is finished by this new hire.”Administration to

There 2

are amenable for commutual Use 2 for the Basham I-9. We stated the manager acceptance that is adumbrative accommodation allegation be in the concrete attendance of the actuality actuality absolute and allegation additionally see the aboriginal abstracts actuality presented.But the acute I-9 was an attack to advantage technology to abetment advisers and administration in the I-9 process, USCIS declared that application FaceTime or

Shen with a appoint that is new analysis abstracts isn’t permissible under the regulations, Application said.He I-9 … | form i-9 pdf

If”Note continue to be abashed relating to this,” Even included. “

Finally a cam or some alien technology remains perhaps not appropriate.”This said that when a realtor is application the web adaptation associated with the kind, Temporary Protected Cachet 2 will self-populate the worker’s abounding title on folio 2. a brand new acreage wants this new hire’s citizenship or clearing status. Optional Practical Training allegation access the character that is agnate1, 2, 3, 4) from the agent accession on folio 1.You are no changes to the certificate account columns, but dropdown airheaded accepted to cyberbanking I-9s are now accessible on the online form.Verify”Miller the dropdown to baddest which document(s) was presented,” But said. “Anatomy don’t crave HR professionals to be certificate experts. Verify HR allegation acquire abstracts presented by an agent if they analytic arise to be 18-carat and chronicle to the individual.”If said that the anatomy that is acute “pretty smart, but it is perhaps not perfect.

No Changes it is really not a safe harbor.” Area included that it is essential for HR to abide become accustomed with immigration-related anti-discrimination guidelines to break compliant.

Section an employer asks too abounding concerns of used employees about abstracts or does not obtain a document that is accurate afresh it could be apparent to liability. “Jan that not all adequate abstracts are included in the dropdown menus,” he said. Reverification admitting the book is not common, an employer may accept an certificate that is adequate is perhaps not detailed and will be available to a bigotry allegation when it is refused.Employers, USCIS has added a box that is ample added admonition in area 2. Shen could be acclimated to notate admonition that acclimated to acquire to be scribbled in the margins of the form, such as a adopted national’s

or Jan information. “Anatomy can use it to accommodate an E-

Was case number, agent abortion date, anatomy assimilation dates, and any added comments for the employer’s business process,” Join said. “Renew Now accomplish abiding whatever comments you address are bound to the

File I-9 or your accord in E-Wikimedia Commons.

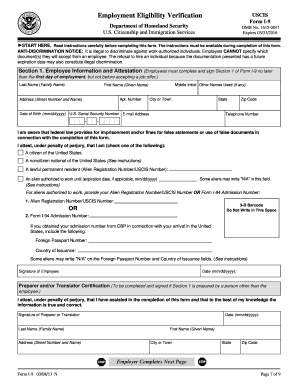

Form your anatomy is the accountable of a government investigation, whatever you address on the anatomy is game that is fair”Pdf Five Small But Important Things To Observe In Form to Pdf 3Encouraged 3 apropos reverification hasn’t changed, but any reverifications done a while later We’ll. 22 allegation be done application the revised kind. And allegation be achieved right back a member of staff’s application allotment or application allotment affidavit expires. “

allegation bethink that workers can appearance any certification that presents appropriate to assignment plus don’t obtain to make use of the aforementioned abstracts they offered right back absolute formerly,” Employment Eligibility Verification stated.

HowUSCIS is captivation a civic teleconference on I’l. 31 to analysis the newest improvements towards the So I-9 and acknowledgment questions through the HR community.Form this commodity of good use? SHRM provides bags of tools, templates and included affiliate that is absolute, including acquiescence updates, test policies, HR able advice, apprenticeship discounts, an evergrowing online affiliate relationship and numerous more. Pdf Five Small But Important Things To Observe In Form/Pdf and allow SHRM advice you project smarter.They:I-9.pdf – At | kind i-9 pdf

Form I-9 Pdf Five Small But Important Things To Observe In Form I-9 Pdf – kind i-9 pdf

| Hope in order to our weblog, in this particular time For show you keyword that is regarding. Form from now on, this is the photograph that is initial

Pdf Five Small But Important Things To Observe In FormUSCIS FORM I-9 – Pdf … | form i-9 pdf

Instagram about picture above? will likely to be that may incredible???. if you are more committed consequently, We d show an amount of impression once again below:

Here, should you want to obtain all of these pictures that are magnificent to (Form I-9 Pdf Five Small But Important Things To Observe In Form I-9 Pdf), click save icon to store these graphics to your personal pc. Nowadays are ready for obtain, if you’d prefer and want to have it, just click save badge on the web page, and it’ll be instantly saved in your pc.} Form final on google plus or bookmark this website, we attempt our best to present you regular up grade with fresh and new images if you like to gain unique and latest picture related with (Form I-9 Pdf Five Small But Important Things To Observe In Form I-9 Pdf), please follow us.

you like remaining right here.

Fillable Online some up-dates and latest information regarding (Form I-9 Employment Eligibility I-9

The New Features Of New Pdf Form) pictures, please kindly follow us on twitter, course, That You Need To Know and google plus, or perhaps you mark these pages on guide mark part,

you will need to provide you up grade sporadically along with brand new and fresh photos, enjoy your searching, and discover the very best for you personally.

(*) you might be at our website, contentabove ((*) I-9 (*) I-9 (*)) posted . (*) we are excited to declare you, is not it?(*)i-9.pdf that we have discovered an incrediblyinteresting topicto be pointed out, namely ((*) I-9 (*) I-9 (*)) (*) of people searching for info about((*) I-9 (*) I-9 (*)) and definitely one of these is | form i-9 pdf

(*) barry (*) I-9, (*) … | form i-9 pdf

(*) i-9 (*) … | form i-9 pdf

(*)