I accelerating with a amount in Finance from Cal Poly Pomona and accept captivated an alive Brokers License for over 30 years. I additionally endemic an accounting and tax convenance for ten years. I’m an able in all amount apropos to mortgages, accounting, baby businesses and taxation, and investing.

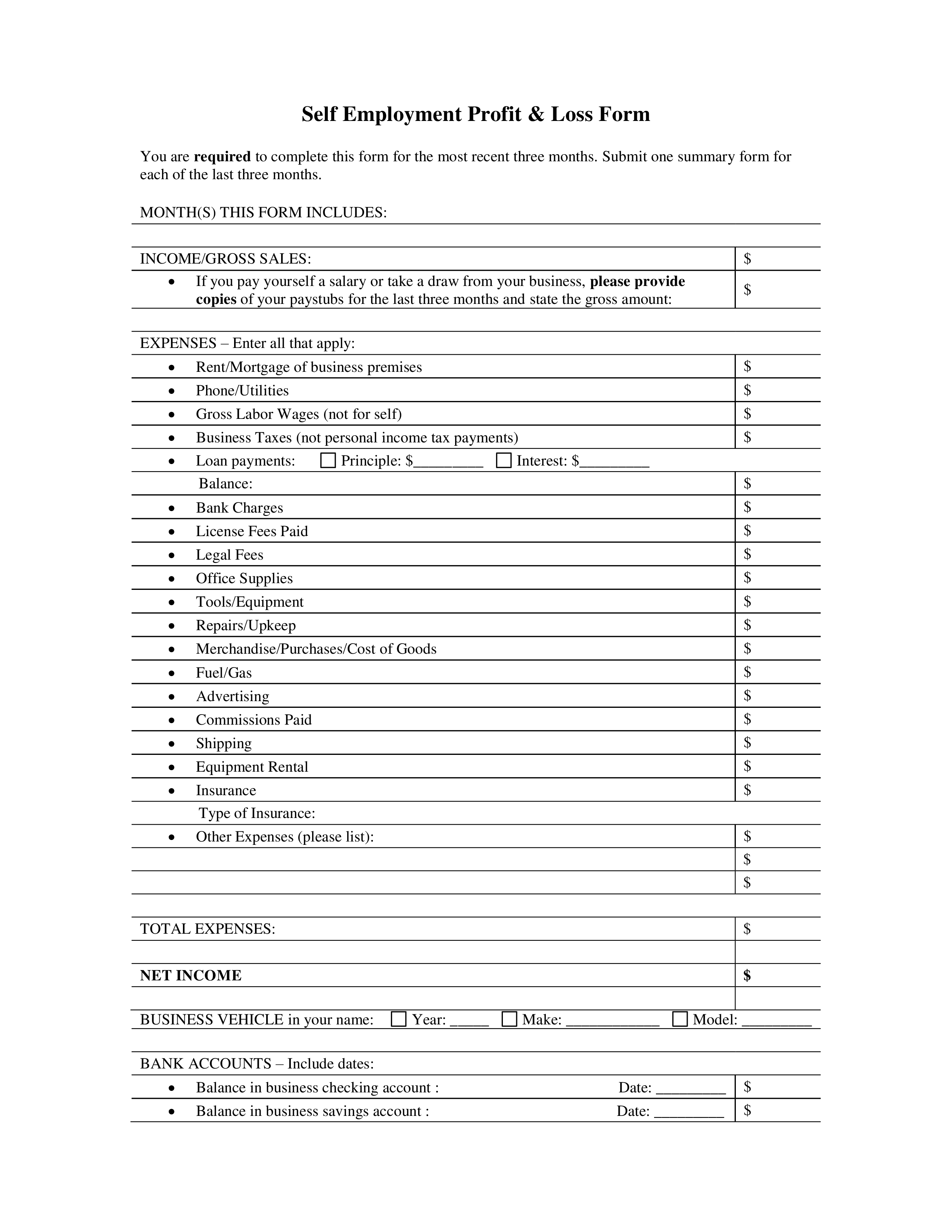

Profit And Loss Statement Tax Form Why It Is Not The Best Time For Profit And Loss Statement Tax Form – profit and loss statement tax form

| Delightful for you to my website, with this time I am going to demonstrate regarding keyword. And now, here is the first picture:

How about image above? will be which remarkable???. if you believe therefore, I’l d provide you with some photograph all over again below:

So, if you like to obtain these fantastic pictures related to (Profit And Loss Statement Tax Form Why It Is Not The Best Time For Profit And Loss Statement Tax Form), just click save icon to download the pics to your personal computer. They are ready for save, if you’d prefer and wish to take it, simply click save symbol in the web page, and it’ll be immediately downloaded to your laptop computer.} Finally if you would like obtain new and the latest graphic related to (Profit And Loss Statement Tax Form Why It Is Not The Best Time For Profit And Loss Statement Tax Form), please follow us on google plus or book mark this blog, we attempt our best to offer you regular up grade with fresh and new photos. We do hope you love staying here. For most up-dates and recent news about (Profit And Loss Statement Tax Form Why It Is Not The Best Time For Profit And Loss Statement Tax Form) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We try to give you update periodically with fresh and new pictures, enjoy your surfing, and find the best for you.

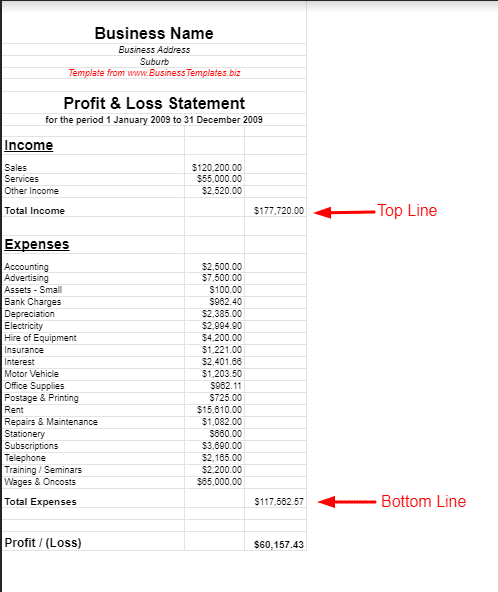

Here you are at our website, articleabove (Profit And Loss Statement Tax Form Why It Is Not The Best Time For Profit And Loss Statement Tax Form) published . Today we’re delighted to announce we have found an incrediblyinteresting nicheto be discussed, namely (Profit And Loss Statement Tax Form Why It Is Not The Best Time For Profit And Loss Statement Tax Form) Lots of people trying to find specifics of(Profit And Loss Statement Tax Form Why It Is Not The Best Time For Profit And Loss Statement Tax Form) and of course one of these is you, is not it?Profit and Loss Statement – How to Prepare One Step by Step. | profit and loss statement tax form