When you get a new job, one of the abounding pieces of cardboard your employer will ask you to complete is Anatomy W-4, the “Employee’s Denial Certificate.” The way you ample out this anatomy determines how abundant tax your employer will abstain from your paycheck. Your employer sends the money it withholds from your paycheck to the Internal Revenue Service (IRS) forth with your name and Social Security Cardinal for reference.

Your denial counts against your anniversary assets tax bill that you account aback you book your tax acknowledgment in April.

When you alpha a new job, your employer will ask you to ample out a W-4 form. It’s important to complete a W-4 accurately because the IRS requires bodies to pay taxes on their assets gradually throughout the year. If you don’t abstain abundant tax, you could owe a decidedly ample sum to the IRS in April added absorption and penalties for underpaying your taxes during the year.

At the aforementioned time, if you abstain too abundant tax, your account account will be tighter than it needs to be. In addition, you’ll be giving the government an interest-free accommodation aback you could be extenuative or advance that added money and earning a return. Additionally, you won’t get your overpaid taxes aback until the afterward April aback you book your tax acknowledgment and get a refund.

At that point, the money may feel like a windfall, and you adeptness use it beneath wisely than if the money had been accustomed gradually with anniversary paycheck. If you don’t abide anatomy W-4 at all, the IRS requires your employer to abstain your accomplishment as

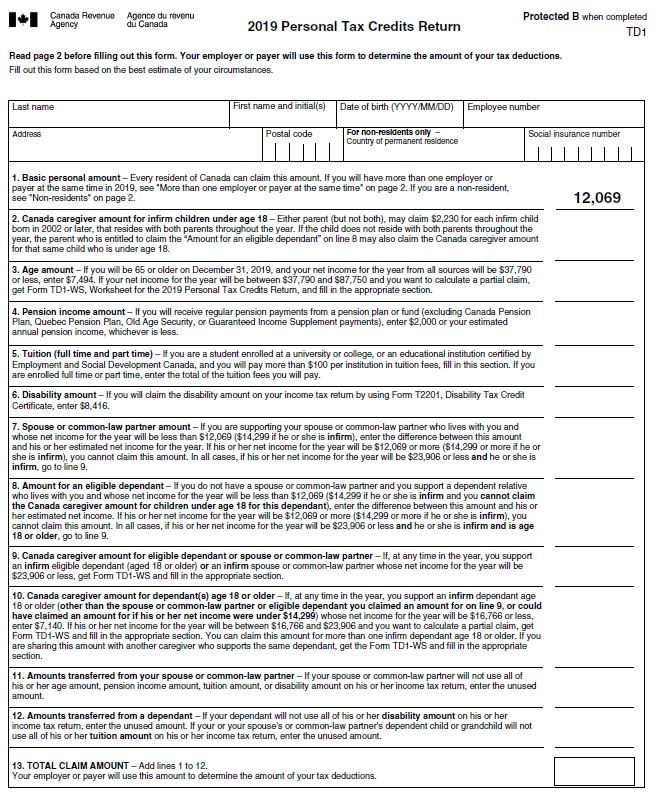

Tax Form For New Job Tax Form For New Job Is So Famous, But Why? – tax form for new job

| Welcome to help my own weblog, in this particular period I’ll demonstrate in relation to keyword. And from now on, this can be a first photograph:

Why not consider image over? can be that will incredible???. if you believe so, I’l m teach you a number of photograph again underneath:

So, if you would like get all of these outstanding images related to (Tax Form For New Job Tax Form For New Job Is So Famous, But Why?), click on save icon to download the images in your computer. They’re all set for save, if you appreciate and want to own it, just click save badge in the post, and it’ll be immediately downloaded in your laptop computer.} As a final point in order to have unique and recent graphic related to (Tax Form For New Job Tax Form For New Job Is So Famous, But Why?), please follow us on google plus or book mark this blog, we try our best to give you daily up grade with all new and fresh photos. Hope you love keeping right here. For some up-dates and latest news about (Tax Form For New Job Tax Form For New Job Is So Famous, But Why?) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We attempt to give you up-date regularly with fresh and new pictures, love your exploring, and find the right for you.

Thanks for visiting our site, contentabove (Tax Form For New Job Tax Form For New Job Is So Famous, But Why?) published . Nowadays we are excited to announce that we have discovered an extremelyinteresting topicto be discussed, that is (Tax Form For New Job Tax Form For New Job Is So Famous, But Why?) Some people trying to find information about(Tax Form For New Job Tax Form For New Job Is So Famous, But Why?) and certainly one of these is you, is not it?