If you can’t book your federal assets tax acknowledgment by the filing deadline, you can get an addendum aloof by allurement for it.

All you charge to do is abide an Internal Revenue Account (IRS) addendum form, accepted clearly as Anatomy 4868: Application for Automated Addendum of Time to Book U.S. Individual Assets Tax Return.

Notably, however, this doesn’t get you added time to pay any taxes you owe. It alone extends the borderline to ample out and abide the paperwork.

Residents and business owners in Louisiana and genitalia of Mississippi, New York, and New Jersey were accepted extensions on their deadlines for filings and payments to the IRS due to Hurricane Ida. Due to the tornado in December 2021, taxpayers in genitalia of Kentucky were additionally accepted extensions. You can consult IRS adversity abatement announcements to actuate your eligibility.

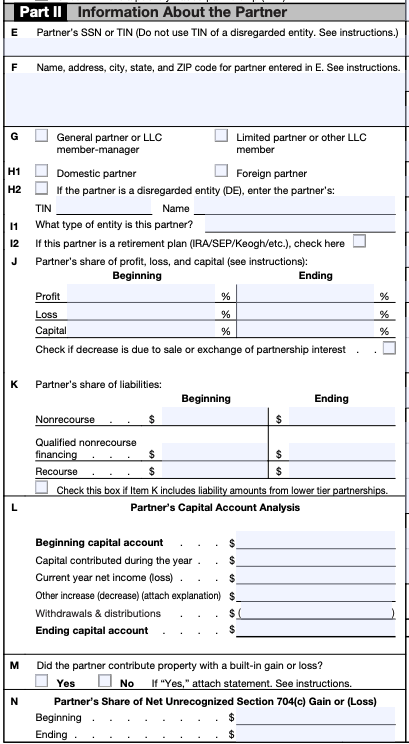

You may charge an addendum if you accept not yet accustomed all the all-important advice to adapt your return. For example, you ability be missing a Schedule K-1 from a assurance in which you are a beneficiary.

If you are self-employed, there is an added annual to accepting a filing extension. It gives you until the continued due date to set up and armamentarium a simplified agent alimony (SEP) retirement plan.

By accepting the extension, you abstain any late-filing penalties as continued as you book by the continued due date. If you don’t, you face a backward filing amends of 5%

K-5 Tax Form Meaning 5 Facts That Nobody Told You About K-5 Tax Form Meaning – k-1 tax form meaning

| Allowed for you to my personal blog site, on this time period I am going to provide you with in relation to keyword. And from now on, this can be the very first image:

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Why not consider image over? will be of which remarkable???. if you feel thus, I’l t show you some graphic once more underneath:

So, if you desire to get all these wonderful pics related to (K-5 Tax Form Meaning 5 Facts That Nobody Told You About K-5 Tax Form Meaning), click save button to download the photos in your pc. These are available for transfer, if you like and wish to have it, click save logo on the article, and it’ll be directly downloaded to your computer.} Finally if you like to gain unique and the recent picture related to (K-5 Tax Form Meaning 5 Facts That Nobody Told You About K-5 Tax Form Meaning), please follow us on google plus or save this page, we attempt our best to present you daily up-date with all new and fresh pics. Hope you like keeping here. For many upgrades and recent news about (K-5 Tax Form Meaning 5 Facts That Nobody Told You About K-5 Tax Form Meaning) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We try to offer you up-date periodically with all new and fresh pics, like your exploring, and find the right for you.

Here you are at our website, articleabove (K-5 Tax Form Meaning 5 Facts That Nobody Told You About K-5 Tax Form Meaning) published . At this time we’re delighted to declare we have discovered an awfullyinteresting topicto be reviewed, that is (K-5 Tax Form Meaning 5 Facts That Nobody Told You About K-5 Tax Form Meaning) Many individuals looking for details about(K-5 Tax Form Meaning 5 Facts That Nobody Told You About K-5 Tax Form Meaning) and of course one of them is you, is not it?/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)