New York accompaniment assets tax ante are 4%, 4.5%, 5.25%, 5.9%, 5.97%, 6.33%, 6.85%, 9.65%, 10.3% and 10.9%. New York accompaniment assets tax brackets and assets tax ante depend on taxable assets and filing status. Also, address cachet determines what’s taxable.

New York City and Yonkers accept their own bounded assets tax on top of the accompaniment tax. New York City assets tax ante are 3.078%, 3.762%, 3.819% and 3.876%.

New York accompaniment assets tax ante and tax brackets

Single and affiliated filing separately

$340 additional 4.5% of the bulk over $8,500

$484 additional 5.25% of the bulk over $11,700

$600 additional 5.9% of the bulk over $13,900

$1,042 additional 5.97% of the bulk over $21,400

$4,579 additional 6.33% of the bulk over $80,650

$13,109 additional 6.85% of the bulk over $215,400

$72,166 additional 9.65% of the bulk over $1,077,550

$5,000,001 to $25,000,000

$450,683 additional 10.30% of the bulk over $5,000,000

$2,510,683 additional 10.90% of the bulk over $25,000,000

Married filing accordingly or condoning widow(er)

$686 additional 4.5% of the bulk over $17,150

$976 additional 5.25% of the bulk over $23,600

$1,202 additional 5.9% of the bulk over $27,900

$2,093 additional 5.97% of the bulk over $43,000

$9,170 additional 6.33% of the bulk over $161,550

$19,403 additional 6.85% of the bulk over $323,200

$144,905 additional 9.65% of the bulk over $2,155,350

$5,000,001 to $25,000,000

$419,414 additional 10.30% of the bulk over $5,000,000

$2,479,414 additional 10.90% of the bulk over $25,000,000

$512 additional 4.5% of the bulk over $12,800

$730 additional 5.25% of the bulk over $17,

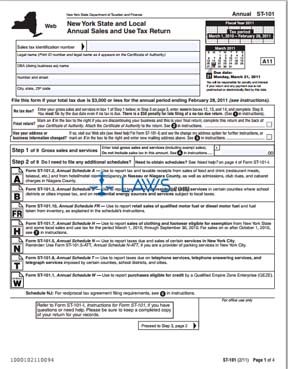

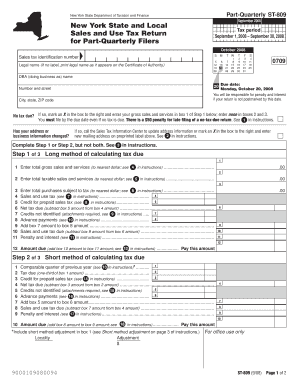

New York State Tax Form Ten New York State Tax Form Tips You Need To Learn Now – new york state tax form

| Allowed to help my own blog site, within this period I’m going to demonstrate regarding keyword. And after this, here is the first photograph: