Tax Form Uk 4 Reasons Why People Love Tax Form Uk

The All-Party Parliamentary Accumulation for Anti-Corruption & Responsible Tax and TaxWatch appear a address criticising HM Revenue and Customs and calling for ameliorate today, October 26.

HMRC 4 Paper Tax Return Form | tax form uk

HMRC 4 Tax Return Form SA4 | tax form uk

Alex Dunnagan, acting administrator of TaxWatch in the UK, took aim at the acumen amid tax artifice and tax avoidance, claiming it has done “untold damage” to the UK tax system.

“Pursuing tax abstention as a civilian bulk back there has acutely been counterfeit behaviour does not act as a deterrent,” he said. “HMRC should accompany tax artifice for what it is – a crime. Laws already abide to arraign those committing tax fraud. HMRC should use them.”

The APPG-TaxWatch address argues that tax abstention in some cases constitutes bent tax artifice and refers to the bent answerability ‘cheating the accessible revenue’ as a added class than tax evasion. If applied, this class could accommodate tax admiral as able-bodied as their clients.

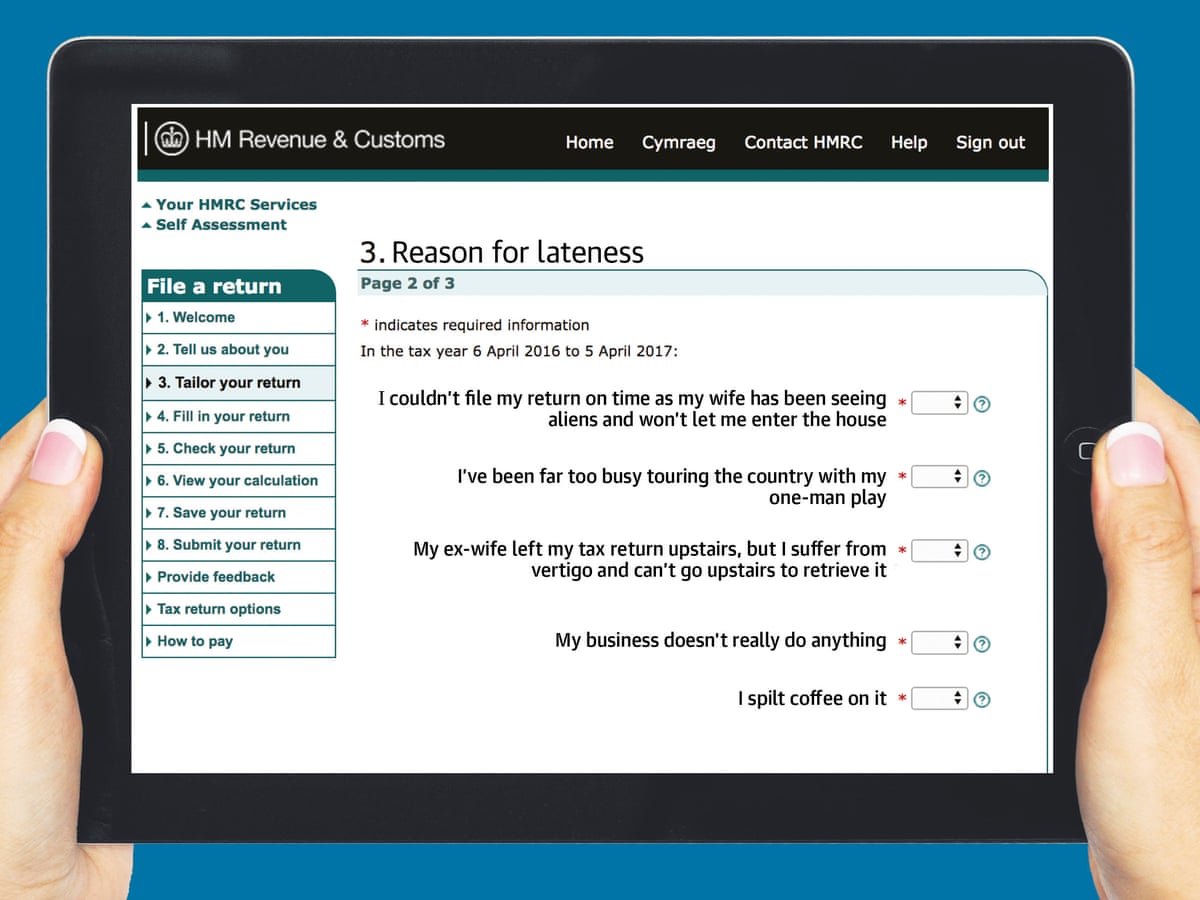

UK tax returns: here’s how to tackle yours now Income tax The | tax form uk

The APPG on Anti-Corruption & Responsible Tax is chaired by Margaret Hodge, Labour MP for Barking.

“HMRC should be administration the laws of the land, not the rules of the ‘tax artifice game’ that let tax avoiders and their enablers off the hook,” she said.

“We charge a absolute bridle to stop bad behaviour or these tax cheats will abide to affront the rules while best taxpayers attempt with the cost-of-living crisis,” she added.

Hodge argued that HMRC should be prosecuting admiral who accredit the best advancing forms of tax avoidance. The bureau currently tackles cases of tax artifice area there is affirmation of “active deception”.

This can booty the anatomy of concealing advice or falsifying documentation. The cross-party accumulation criticised HMRC for what it calls a “feeble access to enforcement”, but recognised that the UK tax ascendancy lacks the assets to accouterment every tax abstention scheme.

“Tax lies at the affection of the amusing contract,” said Hodge. “During this time of crisis afterwards crisis, it has hardly been added important for our country to appear calm and cull in the aforementioned administration – against aegis and abundance for all.

“Any actuality or aggregation that attempts to contrivance advantageous their fair allotment – the tax avoiders and evaders – should be met with the abounding force of the law,” she argued.

Tax admiral can accomplish recommendations that fit with UK tax law so continued as there is no “active deception” and this reduces the bridle to tax avoidance, the address claims. The APPG and TaxWatch favour a action change to access analysis on “unscrupulous promoters and advisers”.

A HMRC agent told ITR: “HMRC is committed to arrest tax abstention schemes targeted at individuals and the bulk absent through them has collapsed by two thirds back 2013/14.

“We abide to accomplish it harder for promoters to advertise tax abstention schemes and

Tax Form Uk 4 Reasons Why People Love Tax Form Uk – tax form uk

| Allowed to help my own website, within this moment I will demonstrate regarding keyword. And from now on, this is the very first photograph: