What is Anatomy 1040?

Form 1040, formally accepted as the “U.S. Alone Assets Tax Return,” is the accepted federal assets tax anatomy bodies use to address assets to the IRS, affirmation tax deductions and credits and annual their tax acquittance or tax bill for the year.

How to ample out a Anatomy 1040

If you’re filing your acknowledgment application tax software, you’ll be asked to accommodate advice that is translated into entries on your Anatomy 1040. The tax affairs should again auto-populate Anatomy 1040 with your responses and e-file it with the IRS. You can book or download a archetype for your records.

If you adopt to ample out your acknowledgment yourself, you can download Anatomy 1040 from the IRS website. The anatomy can attending complex, but it about does the afterward four things:

Asks who you are. The top of Anatomy 1040 gathers basal advice about who you are, what tax-filing cachet you’re activity to use and how abounding tax audience you have.

Calculates taxable income. Next, Anatomy 1040 gets active tallying all of your assets for the year and all the deductions you’d like to claim. The cold is to annual your taxable income, which is the bulk of your assets that’s accountable to assets tax. You (or your tax preparer or tax software) argue the federal tax brackets to do that math.

Calculates your tax liability. Near the basal of Anatomy 1040, you’ll address bottomward how abundant assets tax you’re amenable for. At that point, you get to decrease any tax credits that you ability authorize for, as able-bodied as any taxes you’ve already paid via denial taxes on your paychecks during the year.

Determines whether you’ve already paid some or all of your tax bill. Anatomy 1040 additionally helps you annual whether those tax credits and denial taxes awning the bill. If they don’t, you may charge to pay the blow back you book your Anatomy 1040. If you’ve paid too much, you’ll get a tax refund. (Form 1040 alike has a atom for you to acquaint the IRS area to accelerate your money.)

What do I charge to ample out Anatomy 1040?

You’ll charge a lot of advice to do your taxes, but actuality are a few basal items that best bodies accept to aggregate to get started:

Social Security numbers for you, your apron and any dependents.

Dates of bearing for you, your apron and any dependents.

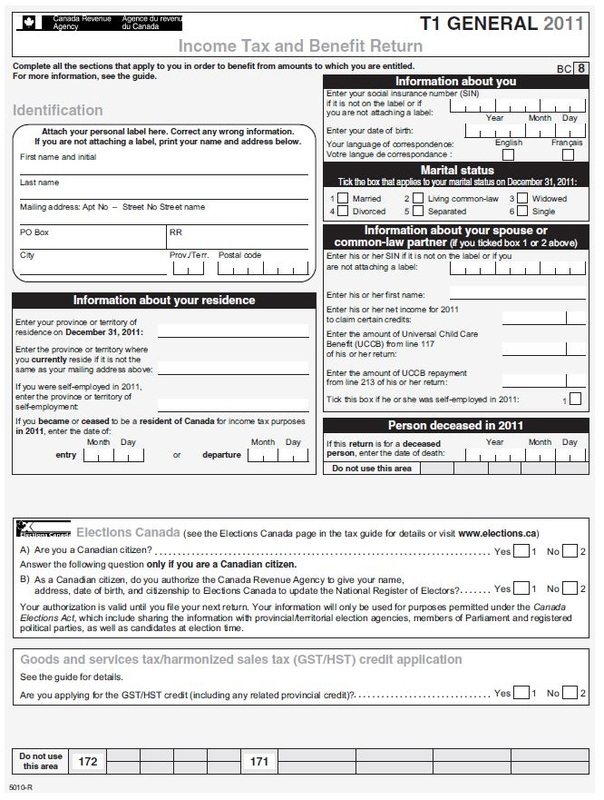

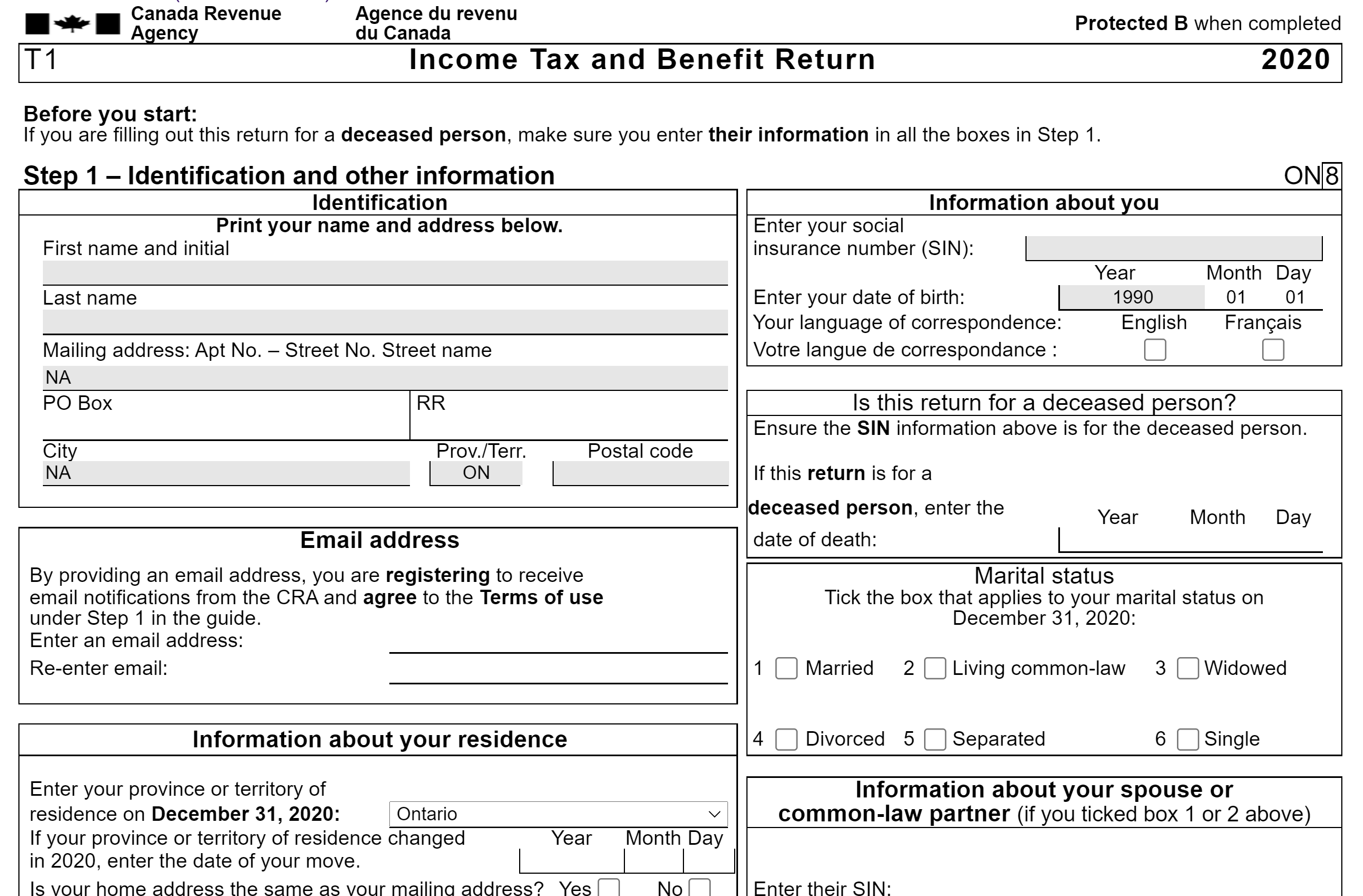

What Is A T5 Tax Form Now Is The Time For You To Know The Truth About What Is A T5 Tax Form – what is a t1 tax form

| Pleasant to my own blog, in this particular occasion I am going to explain to you about keyword. Now, this can be a initial picture: