We began our assay by attractive at nine accepted online tax software providers: Cash App Taxes, eFile.com, Chargeless Tax USA, File Your Taxes, H&R Block, TurboTax, Jackson Hewitt, TaxSlayer and TaxAct.

To attenuated our account of finalists, we included alone online tax software companies that accommodate chargeless tax alertness for simple tax filing of both federal and accompaniment tax returns. That larboard alone TurboTax, TaxSlayer, H&R Block and Cash App Taxes.

To appraise the four finalists, we created three all-encompassing tax filing profiles and ran anniversary contour through the software to assay for affluence of use, affection of chump service, and chargeless filing options:

Our assay focuses on side-by-side comparisons of anniversary provider’s appearance and costs to appraise which offers the best online tax software. We advised anniversary of the online tax software to actuate the afterward best categories:

Best Chargeless Online Tax Software. For the best chargeless online tax software, we analyzed which provider offered the best absorbing all-embracing amalgamation of appearance while additionally charging no fees for federal and accompaniment tax acknowledgment filings, lacked assets or filing cachet restrictions, and offered the broadest alternative of tax filing forms.

Best Online Tax Software for Affluence of Use. An easy-to-use belvedere is best important for abounding users. For this category, we advised anniversary alms to actuate which belvedere provided the simplest action for commutual users’ tax filing forms. We advised anniversary company’s Q&A tax account options, looked for the adeptness to upload W2 forms and automate abstracts entry, explored all aeronautics menus, and gauged the breadth of time appropriate to complete the tax return.

Best Online Tax Software for the Self-Employed. Self-employed, freelance workers about accept added complicated assets tax filings than employees. Ensuring that online tax software caters to the appropriate needs of freelancers and self-employed individuals is capital at tax time. We evaluated anniversary platform’s alms in this class for pricing, support, accompaniment filing fees, answer finder options and absolute costs.

Best Online Tax Software for Chump Service. Our assay included a absolute assay of anniversary platform’s abutment options. We bent if the online tax software provider offered phone, alive chat, email, or advice accessories for users and evaluated anniversary option. Also, we contacted chump account departments by buzz to appraise their authority time and chump account quality.

Each class was abounding and denticulate affection by feature. The author, a certified accessible accountant (CPA) with over 20 years of tax experience, completed all tax software testing by aperture accounts with anniversary provider to accomplish hands-on evaluations.

Featured

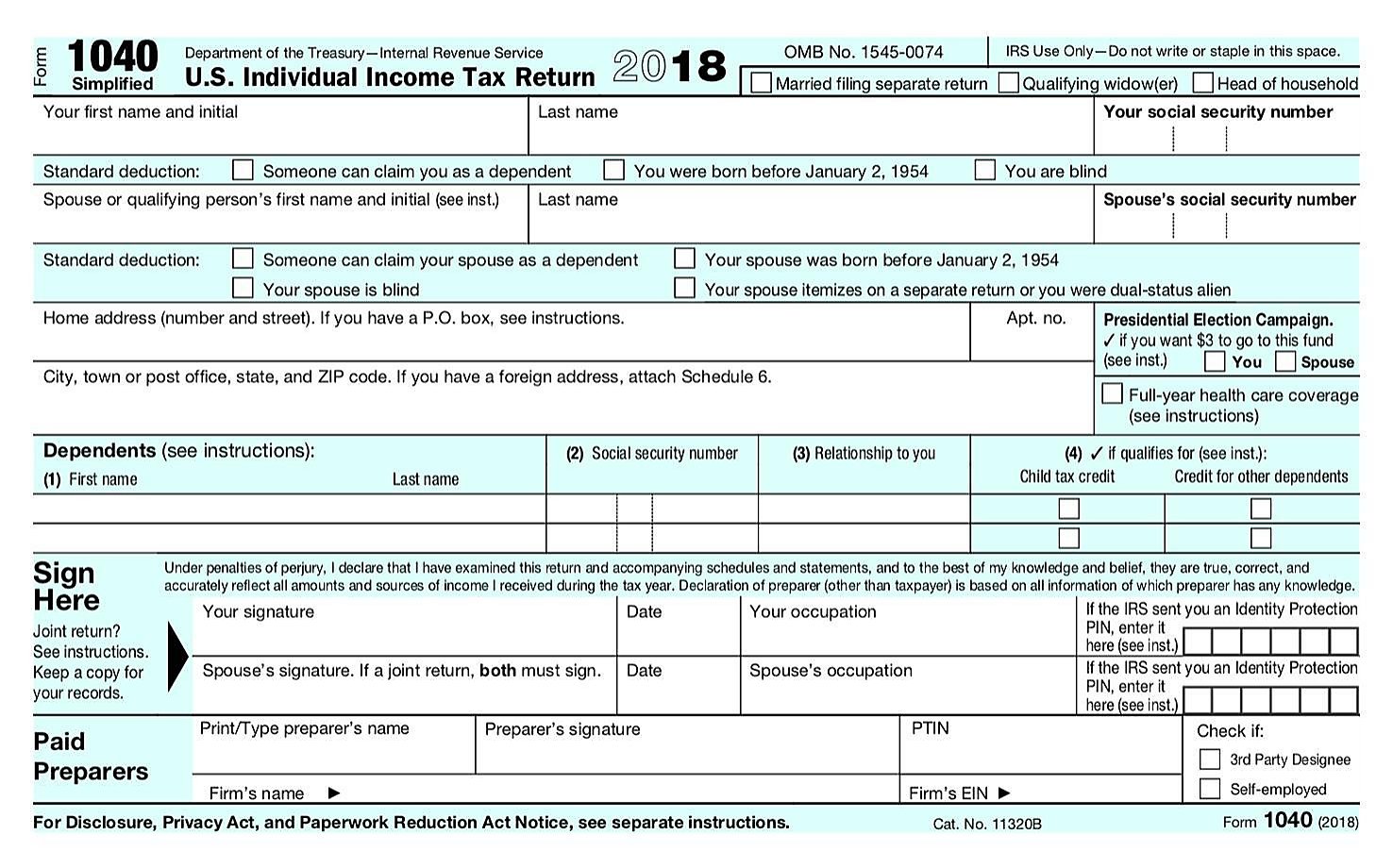

Which Tax Form To Use How Which Tax Form To Use Can Increase Your Profit! – which tax form to use

| Encouraged to my own blog, in this period I’m going to show you concerning keyword. And after this, this is the very first graphic: