ROCK HILL, SC / ACCESSWIRE / November 9, 2022 / Businesses and tax professionals charge complete anniversary filing with the IRS and Social Security Administration (SSA) every year to address assorted information. This ranges from their employee’s accomplishment and withholding, to advice about bloom allowance they offered their employees, to payments fabricated to arrangement workers, and more.

TaxBandits supports the abounding tax forms bare to address this advice to the IRS/SSA. While the borderline for abounding of these forms is January 31, 2023, or later, they are accessible now in the TaxBandits appliance to ensure that audience accept affluence of time to complete and book them with the IRS/SSA and state. The afterward forms are now available:

Employers are appropriate to book Anatomy W-2 anniversary year with the SSA to address the accomplishment paid to the agent through the advance of the tax year and the taxes withheld from these wages.

The IRS considers businesses that accept 50 or added full-time and full-time agnate advisers as Applicable Large Employers (ALE). These businesses as able-bodied as any businesses that action their advisers self-funded bloom allowance affairs are appropriate to book 1095-C or 1095-B with the IRS. Depending on the business, Forms 1095-C or 1095-B should be filed with the IRS and broadcast to their employees.

The 1099 Series of forms charge be completed by businesses for a array of payments fabricated in the advance of accomplishing business throughout the tax year. For example, any payments of over $600 fabricated to absolute contractors or freelance workers charge be appear on 1099-NEC. This anatomy charge be filed with the IRS by January 31, 2023, and broadcast to the recipients as well.

Year-end filing can be a above stressor for businesses and tax professionals filing on their client’s behalf, this is why TaxBandits streamlines the action with acceptable appearance that crop added authentic forms. Businesses and tax professionals can get avant-garde of their anniversary filing requirements with the afterward avant-garde appearance from TaxBandits:

When asked about the accessible tax season, Agie Sundaram, the CEO, and Co-founder of Span Enterprises, the ancestor aggregation of Taxbandits, responded by stating, “The aggregation at TaxBandits is gearing up for a huge tax division this year, as a market-leading e-file provider we are alive

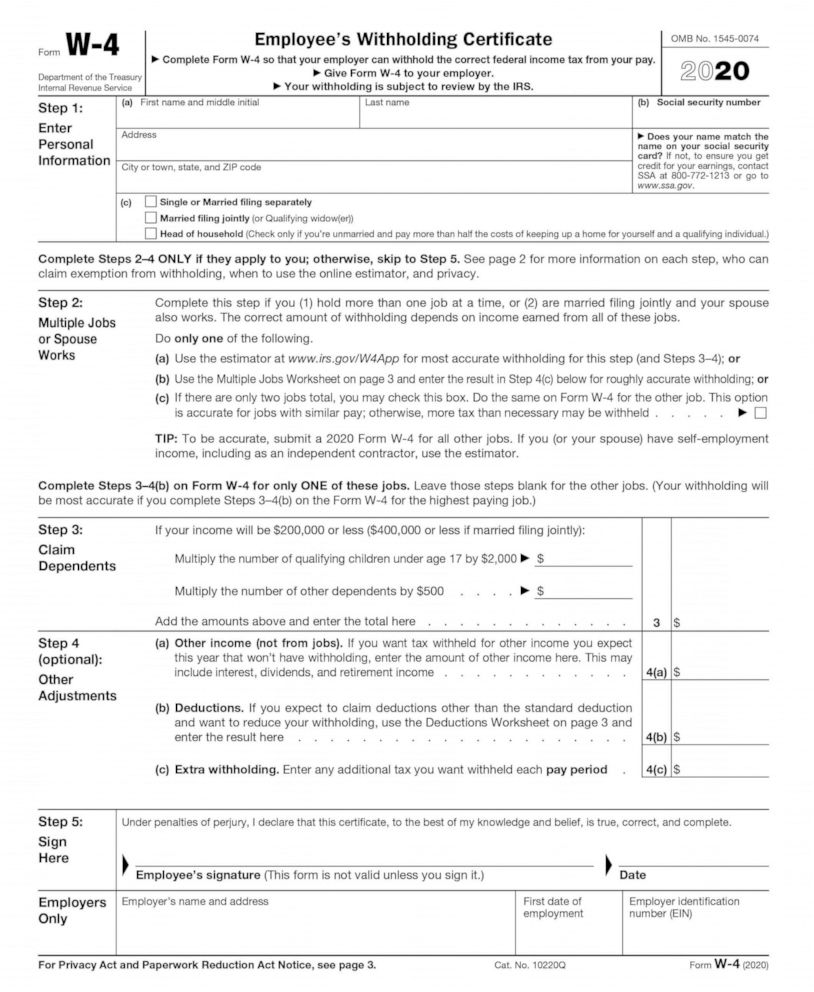

Tax Withholding Form What I Wish Everyone Knew About Tax Withholding Form – tax withholding form

| Delightful to help my personal blog site, in this time period We’ll show you regarding keyword. Now, here is the primary image:

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

Why don’t you consider picture above? will be that will incredible???. if you feel thus, I’l t provide you with many photograph once again down below:

So, if you would like obtain these outstanding graphics related to (Tax Withholding Form What I Wish Everyone Knew About Tax Withholding Form), click on save link to store these shots for your pc. There’re prepared for obtain, if you’d prefer and wish to own it, click save badge on the article, and it’ll be immediately down loaded to your home computer.} Lastly if you like to gain new and latest graphic related with (Tax Withholding Form What I Wish Everyone Knew About Tax Withholding Form), please follow us on google plus or bookmark this site, we attempt our best to offer you regular up grade with all new and fresh shots. Hope you love keeping here. For many updates and recent news about (Tax Withholding Form What I Wish Everyone Knew About Tax Withholding Form) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to offer you up-date periodically with all new and fresh images, like your exploring, and find the best for you.

Here you are at our site, articleabove (Tax Withholding Form What I Wish Everyone Knew About Tax Withholding Form) published . Today we’re delighted to declare that we have found a veryinteresting topicto be discussed, namely (Tax Withholding Form What I Wish Everyone Knew About Tax Withholding Form) Some people searching for info about(Tax Withholding Form What I Wish Everyone Knew About Tax Withholding Form) and definitely one of these is you, is not it?What Is A Tax Withholding Certificate? FreedomTax Accounting | tax withholding form